Do you have a property in Miami Dade County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Miami Dade County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Miami Dade County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Miami Dade Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Miami Dade County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Miami Dade Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Click Property Search on the homepage

Click the Property Search button on the homepage, and you will be directed to a page of an interactive map.

- Navigate the map

You may encode an address or click on a part of a map. You will be shown all pertinent information about the property you selected.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Miami Dade County Property Appraiser’s Office Contact

Email

[email protected]

Address

Miami-Dade County Property Appraiser

Stephen P. Clark Center

111 N.W. 1st Street

Suite 710

Miami, Florida 33128-1984

Phone

305-375-4712

Other sections of the Property Appraiser Website

Apart from letting you search properties, the Miami Dade County property appraiser’s website also offers you other information about the office of the Miami Dade County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

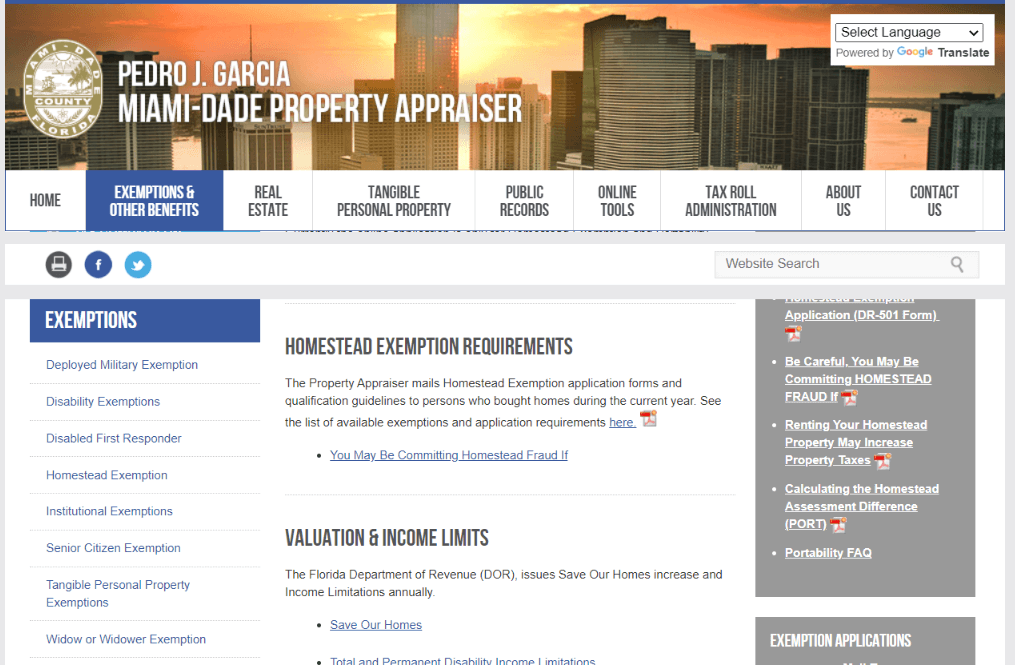

Exemption & Other Benefits

If you want to know the exemptions available in Miami Dade County, then this section has you covered. It gives you data on exemptions involving the following: Widow/Widower, Homestead Fraud, Homestead, Non-Profit, veterans, Conservation, Seniors, and Portability.

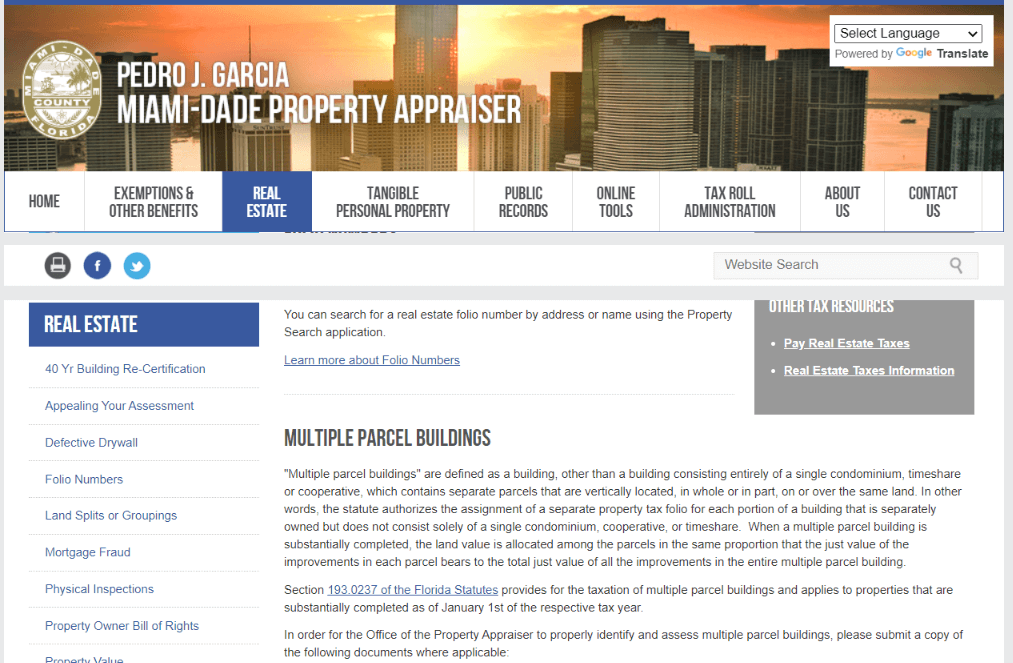

Real Estate

This page offers you various information about real estate including building re-certification, how to appeal your assessment, folio numbers, TRIM notices, and many others.

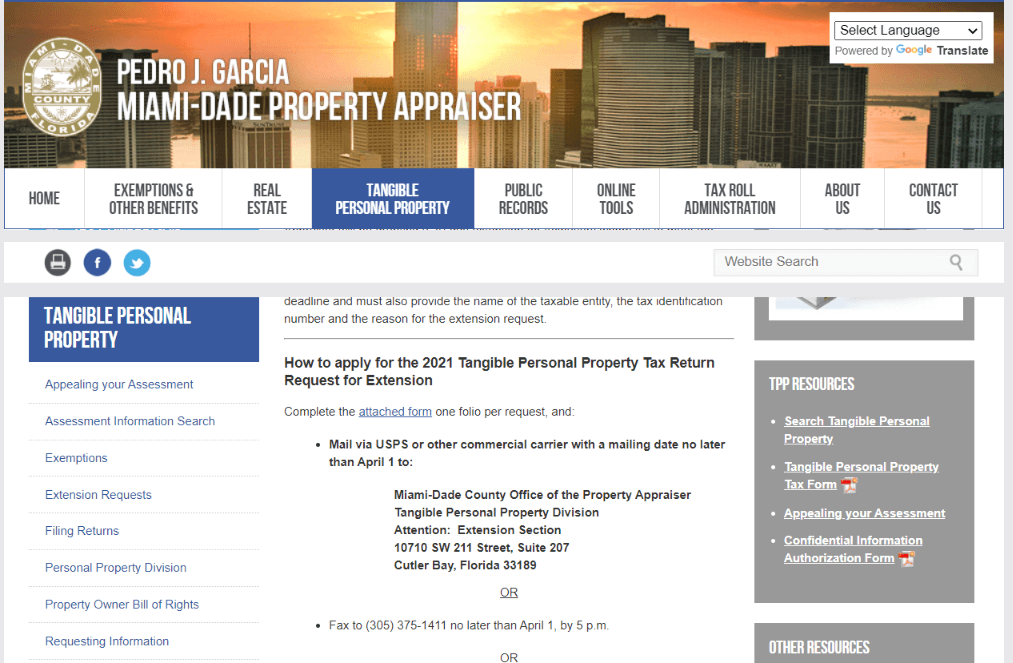

Tangible Personal Property

This section gives your information about tangible properties as well as forms that you will need. Among the forms, you can download that of a request an extension of the tangible personal property tax return.

Public Records

This section gives you an opportunity to request public records. You can also file for a change of name, address, and ownership.

Online Tools

This section gives you interactive tools. Among these tools are tax estimator, tax visualizer, tax comparison, compatible sales, and many others.

Tax Roll

This section gives information about tax roll per year. There are other reports that you can check on this page as well.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Miami Dade County Property Appraiser’s Office, Website, Map, Search Content

Property Appraiser for Miami Dade County does not send bills of fees, and it also does not collect taxes. When you buy a real estate property, you must not assume that the property taxes will be the same. Change in the ownership may reset the assessed value of a property to the full market value. This change could result in higher property taxes. You may continue to read till the end and checkout Property Appraiser’s website.

The homestead exemption helps the property owner save thousands of dollars every year. Visit Property Appraisers to explore other property appraisers like St. Lucie County Property Appraiser, Putnam County Property Appraiser, and Santa Rosa County Property Appraiser.

All About Miami Dade PA

Miami Dade Property Appraiser’s office has the primary responsibility to appraise and identify all the county’s real and tangible personal property. The office certifies the annual tax roll with the Florida Department of Revenue accordingly to the State law. The property appraiser includes the maintenance of all the associated possession records, the annual notification, and the administration of all the exemptions to all property owners in Miami Dade County to assess the value of their property.

Their office performs statutory functions related to the assessment of the property for the ad valorem taxes. These are vital to the financial health of the local tax-supported government. Some of these tax-supported governments are the County, support water management, police, fire, libraries, public schools, districts, municipalities, and voter-approved debt services and obligations.

Miami Dade PA office fulfills its responsibilities by communicating regularly with the County’s property owners, agencies, Florida Department of Revenue, tax collectors, and other taxing authorities. They are established by the Florida constitutions and regulated by the Florida Statutes and DOR rules and regulations.

Where do you live? Are you near Volusia County, St. Johns County, or Seminole County? Check out our site for the details of their property appraiser.

Access Website and Search Option

The Miami Dade PA website was created with the valuable input of its citizens and the business community. Their office has incorporated various recommendations, and they encourage their visitors to take the opportunity of giving their comments and suggestions.

The property ‘Search’ help page has essential information that may answer your questions. Miami Dade PA continually edits and updates the tax roll. The website could not reflect the most current information on their record. For the discrepancies that you will encounter, you can report them at their office, report discrepancies.

Miami Dade Property Appraiser aims to make their company the most accessible appraiser they could be in the County. That is why their website has a search option to find the information you want to gather. Here are what the application can provide:

- Search by Name, Address, Folio, and Subdivision name

- Key property ownership, characteristics, and sales information

- Assessment, taxable value information, and exemption benefits

- Prior and current year aerial imagery.

- Building sketch (if available)

- Detach the aerial map to its window to allow a larger viewing window

- Double click on a condominium complex to list the individual property owners on the map

- Allows you to print the matching results of partial search

- Copy matching results from the print page to a spreadsheet

- Links to other Property Appraiser applications

- Zoom in/out map features

- Allows you to apply layers to the map

Check out these other related articles: Broward County Property Appraiser, Pinellas County Property Appraiser, Hillsborough County Property Appraiser

Review Location and Contact Information

Miami Dade, PA, has two offices you can visit for your homestead application. You may also direct your inquiries to their office for a clear and transparent verification of the information you want to get.

- Main Office- Miami-Dade County Property Appraiser, Stephen P. Clark Center, 111 N.W. 1st Street, Suite 710, Miami, Florida 33128-1984 Phone: 305-375-4712

- South Dade Office- Miami-Dade County, Property Appraiser, South Dade Government Center, 10710 SW 211 Street, Suite 207, Cutler Bay, FL 33189 Phone: 305-232-3810

Do you want to know how to contact Sarasota County Property Appraiser, Polk County Property appraiser, or Pinellas County Property Appraiser? Read our pages about those appraisers to see what you are looking for.

Review Main Phone Numbers

For a more convenient way, you can call any of the following contact numbers depending on your inquiry category. You can dial and call personnel to assist you with your needs regarding Miami Dade, PA’s services.

- Public Service- 305-375-4712

- Public Service (South Dade)- 305-375-4712

- Exemptions (Residential)- 305-375-4091

- Residential- 305-375-4050

- Exemptions (Institutional)- 305-375-3414

- Commercial (Real Estate)- 305-375-4580

- Lan Splits or Groupings- 305-375-4060

- Agriculture- 305-234-1454

- Working Waterfronts- 305-375-4580

- Tangible Personal Property- 305-375-4070

- TYY- 305-375-3607

- Media Relations- 305-375-4789

Fax Numbers

You can also email the Miami Dade Property appraiser’s office through the given fax numbers below. Through this, you can exchange relevant documents if you are required to submit a file to their office.

- Public Service- 305-679-7940

- Exemptions-305-375-4491

- Real Estate (Downtown)- 305-375-4533

- Agriculture- 305-232-7909

- Tangible Personal Property- 305-375-1411

Accommodations for persons with disabilities

Anyone who wants to ask for assistance for their disabilities to participate in the services, activities, or Miami Dade County PA programs may inquire to Eileen Hernandez at 305-375-4089.

Access Public Records Custodian

Angel Rey- Public Records Custodian, Property Appraiser, 111 NW 1St. S.T. STE.710 MIAMI FL 33128 Contact Number: 305-375-2480 Fax: 305-679-7940

Want to explore other counties ‘ appraisers? Why not read about Pasco County Property Appraiser, Palm Beach County Property Appraiser, and Osceola County Property Appraiser? Surely, you will find the best appraiser for your property.

Review Homestead Exemption

The first-time applicants of a homestead exemption can file their application online. You can use this service to apply for a homestead exemption and transfer of the portability. Before you proceed, you must provide the following for your application:

- Date of birth

- Marital status

- Social Security Number

- Property Folio Number

- U.S. permanent resident immigration number of you are a non-U.S. citizen

- Automobile registration of Florida that reflects the address of the property

- Florida driver’s license number that indicates the address of the property

Review Penalties for Unreported Change in Status

Any changes in the situation of the owners failed to notify the office of the Miami Dade PA. The owner can be penalized back taxed for ten years of the exempted taxes, plus a 15% interest per annum and penalty of 50% of the exempted fees.

Change in Status

- Rental property- this is not qualified for the homestead exemption, but other exemptions might qualify you to apply.

- Duplex- only the part of your primary residence may receive the homestead exemption, and it does not include the part of the property where you are earning income.

- Granny Flat exemption- this is for a separate exemption form.

- Partial Rental- you can only get a prorated exemption if you rent a part of your primary residence that you also occupy.

- Refinance- changes in the title may need a new application. Refinancing is not required to file an exemption application again. If you are not sure if you are required to submit a request, you can file an application listing all the residing owners, and the office of Miami Dade Property Appraisal will keep a record of the application. It can help to determine if a new form is required. The original homestead exemption will apply to a property if all the requirements are met.

Other change in status

- Title Changes- if the property title changed into a trust, you must attach a copy of the faith and send it as mail to the property appraiser if you apply for an exemption.

- Probate- waiting to receive an order that will determine the homestead from the courts must not doubt you on filing your homestead exemption application to continue on the process. The order of establishing the homestead might be retroactive, but the exemption is not if you still submit by the 1st of March.

- Inheritance- the exemption can be inherited the same year when the owner passes away after the 1st of January. In these circumstances, the decedent should permanently reside on that property as of the 1st of January. This exemption will be applicable only until the next 1st of January. The new owner of the property must apply to receive their homestead exemption. In some cases, if the property owner passed away, you–the decedent must notify the property appraisal department to cancel the homestead exemption.

- Military Personnel- renewing the homestead exemption that you already have will require you to get a copy of the military orders to the Miami Dade Property Appraiser’s office and fax it to 305-375-3024.

FAQ

How to change the mailing address?

You can also email the Miami Dade Property appraiser’s office through the given fax numbers below. Through this, you can exchange relevant documents if you are required to submit a file to their office.

How do you get assessed value on your home in Miami Dade, PA?

The office certifies the annual tax roll with the Florida Department of Revenue accordingly to the State law. The property appraiser includes the maintenance of all the associated property records, the annual notification, and the administration of all the exemptions to all property owners in Miami Dade County that assessed the value of their property.

What is the responsibility of Miami Dade, PA?

Miami Dade County property appraiser’s office has the primary responsibility to appraise and identify all the county’s real and tangible personal property. The office certifies the annual tax roll with the Florida Department of Revenue accordingly to the State law.

How to contact the Miami Dade PA?

For a more convenient way, you can call any of the following contact numbers depending on your inquiry category. You can dial and call personnel to assist you with your needs regarding Miami Dade, PA’s services.

Conclusion

Miami Dade Property Appraiser’s office aims to appraise and identify all real and tangible personal property within the County. They have two offices you can visit to apply for the exemptions you will be qualified for. For a clear and transparent verification, you can go directly to their office, which is located at Miami-Dade County Property Appraiser, Stephen P. Clark Center, 111 N.W. 1st Street, Suite 710, Miami, Florida 33128-1984 (Main Office) and at Miami-Dade County, Property Appraiser, South Dade Government Center, 10710 SW 211 Street, Suite 207, Cutler Bay, FL 33189 (South Dade Office).