Do you have a property in Charlotte County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Charlotte County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Charlotte County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

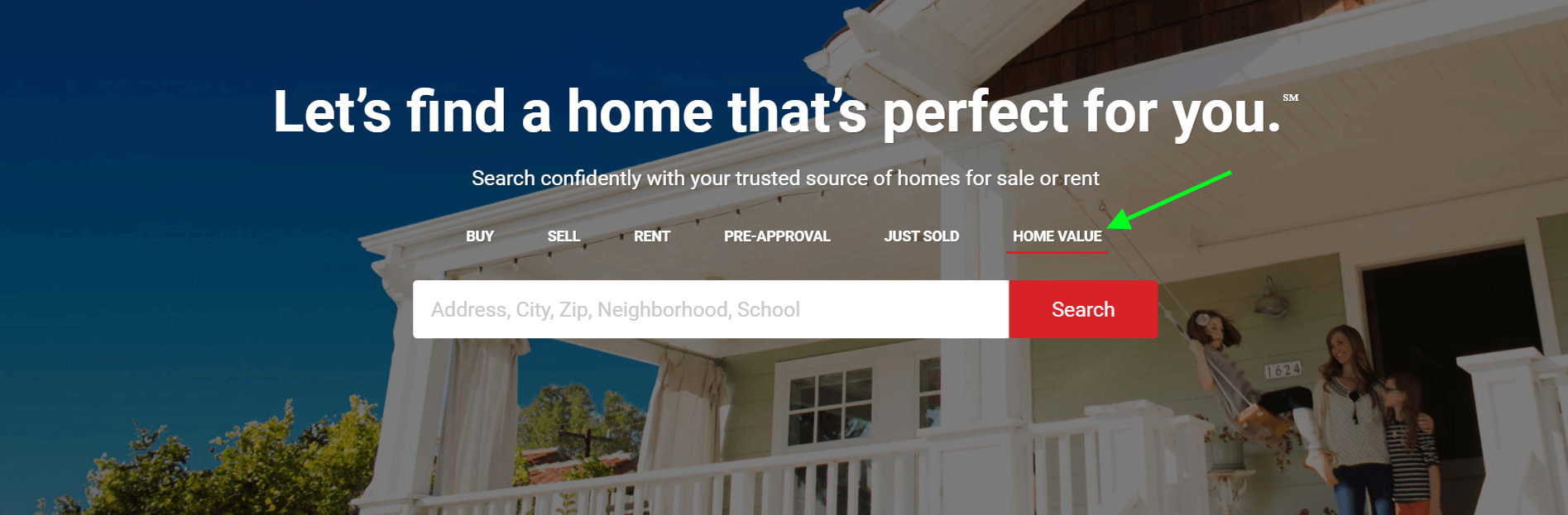

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Charlotte Property Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Charlotte County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Charlotte Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Fill out the form

Fill out the form that appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Other information from the Property Appraiser

Apart from letting you search properties, the Charlotte County property appraiser’s website also offers you other information about the office of the Charlotte County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

Exemption

If you want to know the exemptions available in Charlotte County, then the property appraiser office has a guideline for this. You can get data on exemptions involving the following: Widow/Widower, Homestead Fraud, Homestead, Non-Profit, veterans, Conservation, Seniors, and Portability.

Tangible Personal Property

You can gather information and apply the process of tangible personal property-related papers at the appraiser’s office as well.

Tax Roll

Apart from details about tax roll, the office could also provide you tax information related to properties in this county. You can get Millage Rates, Alachua Annual Report, DOR Tax Roll Data, Tax Roll Certifications, and even Download CAMA data.

Homestead

All can file for homestead exceptions and even report any homestead fraud.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Charlotte County Property Appraiser’s Office, Website, Map, Search Content

Determining the worth of a property is a matter of discovering the most likely price people can spend on it, in good shape, which is what the Charlotte County Property Appraiser majors on. Florida’s evaluation date is on January 1 of every year, a requirement of Florida Law. The Supreme Court of Florida declares it as “simply value” to be legally associated with “complete money value” and “fair market value.” Meanwhile, take an also peek at other appraisers at Property Appraisers.

Nevertheless, it is no small job, given that determining worth for each piece of property in Charlotte County happens each year. The Charlotte Property Appraiser establishes a value for over 210,000 private tax rolls for thousands of acres of citrus, pasture, and farmland.

All About Charlotte County Property Appraiser Duties

The property appraiser also determines a home’s entitlement to the agricultural category. To identify the just value of any property, a Property Appraiser should initially understand the importance of similar homes. They also must know what other features are selling for, the cost to make any enhancements, how much it takes to run, and keep them in repair.

It is also upon them to find out the income it might make. And lots of other realities are impacting its value. Also, the appraiser researches the current rate of interest charged, for obtaining money to own a comparable home, either through purchase or building.

The initial move is to identify properties like yours, which are on offer for sale. Nevertheless, their market price should be analyzed thoroughly to get the actual image. Utilize the technique of comparing property prices. The Property Appraiser needs to always think about such factors as over or underrating of value. The conclusion boils down to how much money it would take. The current product value an exact property and labor costs to replace your property with one just like it.

Another way is by considering the property income depending on how they make earnings, such as an apartment building, store area, or office complex. In that case, the Property Appraiser must think about such realities as income and running expenditure.

Learn other related articles like Miami Dade Property Appraiser, Monroe County Property Appraiser, and Nassau County Property Appraiser

FAQ

What notices being mailed by the charlotte property appraiser?

After the County property appraiser puts together a certified tax roll, then presents it to the county tax collector, who mails the tax notices to property owners and later collects the money.

What is the duty of Charlotte’s County Property Appraiser?

The Charlotte County PA determines a property’s value according to the current market value of similar properties.

Conclusion

Real Estate Appraisal and Closing services are in every County in Florida. Utilize the County’s online purchasing and tracking system to track your files. The determination of value for homes in Florida takes place every year, according to the law. If you have questions about Charlotte County Property Appraiser, write them in the comment box below.