Do you have a property in Pasco County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Pasco County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Pasco County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Pasco County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Pasco County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Pasco Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Records Search

Click Records Search on the top menu, and you will be directed to a search form.

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Pasco County Property Appraiser’s Office Contact

Address

East Pasco Government Center

14236 6th St., Ste. 101

Dade City, FL 33523-3408

Phone

(352) 521-4433

Fax

(352) 521-4411

Other sections of the Property Appraiser Website

Apart from letting you search properties, the Pasco County property appraiser’s website also offers you other information about the office of the Pasco County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

Record Search

Apart from a search form for a property appraisal, you can also search recent sales, mineral rights, and tangible personal property. You can also view maps and download forms. There’s also a link to video guides and a civic association listing.

Exemption

If you want to know the exemptions available in Pasco County, then this section has you covered. It gives you data on exemptions involving the following: homestead, agriculture, and disability among others. You can also calculate your tax here.

Information and Tools

This section gives you a long list of useful information and tools. You can report suspected homestead fraud while you can also download forms. You can access a guide to understanding the appraisal process and other information. This is basically a long FAQ.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Pasco County Property Appraiser’s Office, Website, Map, Search Content

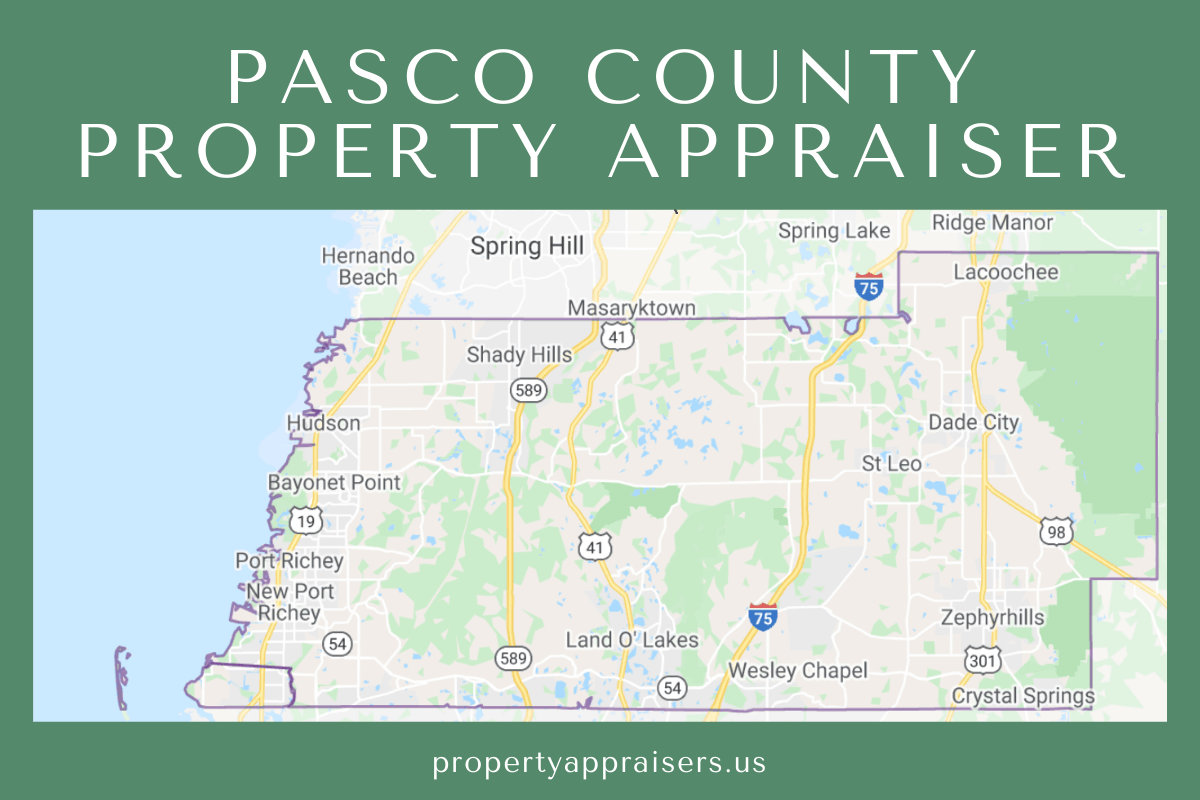

Pasco County Property Appraiser was created on June 2, 1887, and now has over 260,000 parcels of real property. Its vision is to excel in Property Appraiser administration and continue education through innovative technology while achieving quality service through teamwork. Visit the Property Appraiser’s website for more information.

Their mission is to provide courteous and prompt quality service and compile accurate information that will ensure the fair appraisals of the assessment purposes while making the government accessible to the property owners through technology. Check out Property Appraisers if you want to learn more about other appraisers like Orange County Property Appraiser, Nassau County Property Appraiser, and Monroe County Property Appraiser.

Access Pasco County PA’s Website

Pasco County has an online database that provides up-to-date property details; like, assessment, legal descriptions, ownership, and other information. This information can be accessed through parcel numbers, address, owner’s name, and subdivision criteria on the County’s record search page and by using the variety of approaches on the new sales page. GIS data and Source Appraisal with the supporting metadata can be accessed on the downloads page. But it is not possible to have technical support concerning these downloads.

The information about the properties shown on Pasco County’s site is identically the same as what was restored in their physical office unless noted on the page.

The change of name and address has a required processing time. That is why the most current information may not vary.

Access Search

There are six methods to search Pasco County’s parcel database on their official website. Those are through parcel name, ID, recent sales, page & official record book, physical address, and interactive maps. The physical address is provided by the city and County growth management offices. The search toolbar’s information is based on the review of the existing public records, information, and documents provided to the Pasco County PA office.

Location and Contact Information

- Pasco County PA- Dade City, FL 33526 Dade City East

- Pasco Government Center- 14236 6th St., Ste. 101 Dade City, FL 33523-3408, (352) 521-4433 Phone, (352) 521-4411 Fax

- Land O’Lakes- Central Pasco Professional Center, 4111 Land O’Lakes Blvd., Ste. 106, Land O’Lakes, FL 34639-4402, (813) 929-2780 Phone, (813) 929-2784 Fax

- New Port Richey- West Pasco Government Center, 8731 Citizens Drive, Suite 130, New Port Richey, FL 34654-5572, (727) 847-8151 Phone, (727) 847-8013 Fax

Review Homestead Exemption

When applying for Homestead exemption, the property you will file for an application must be your principal residence place in January of the year. The Pasco County PA office is currently accepting applications for the Homestead exemption online. The approved exceptions annually renew unless there is a change in your status, like relocating after the property is sold and other valid reasons. You can only receive a Homestead exemption to your permanent place of residence. Read the following requirements carefully. These documents are required for each applicant applying for the Homestead Exemption if applicable. The lists of requirements are mandatory for the online filing:

- Valid driver’s license issued in Florida or Identification Card. (necessary during the online application)

- Social security number of the applicant and his/her spouse. (essential during the online application)

- Florida vehicle registration if you own a vehicle.

- Voter’s registration if you are a U.S. citizen and registered in Florida.

- If not a U.S. citizen, permanent visa, and declaration of domicile. The statement of residence may obtain from the Clerk of the circuit court.

- Name and address of any of the owners that do not reside on the property.

- Tax bill or record of deed verified ownership of the property on or before January 1 of the year when the application was filed.

- If previously owned a home in Florida, the parcel of identification number or physical address. (these can be found on a prior tax bill)

Note: The following are also required to your spouse if you are married or married but separated, regardless if he/she is or not listed as an owner in the record of Pasco County.

Read more about other related appraisers: Flagler County Property Appraiser, Citrus County Property Appraiser, Osceola County Property Appraiser

FAQ

What is the duty of Pasco County PA?

Pasco County PA was created on June 2, 1887, and now has over 260,000 parcels of real property. Its vision is to excel in Pasco County PA administration and continue education through innovative technology while achieving quality service through teamwork. Their mission is to provide courteous and prompt quality service and compile accurate information that will ensure the fair appraisals of the assessment purposes while making the government accessible to the property owners through technology.

How to contact Pasco County PA?

Pasco County PA- Dade City, FL 33526 Dade City East

Pasco Government Center- 14236 6th St., Ste. 101 Dade City, FL 33523-3408, (352) 521-4433 Phone, (352) 521-4411 Fax

Land O’Lakes- Central Pasco Professional Center, 4111 Land O’Lakes Blvd., Ste. 106, Land O’Lakes, FL 34639-4402, (813) 929-2780 Phone, (813) 929-2784 Fax

New Port Richey- West Pasco Government Center, 8731 Citizens Drive, Suite 130, New Port Richey, FL 34654-5572, (727) 847-8151 Phone, (727) 847-8013 Fax

How to search for property in Pasco County, PA?

There are six methods to search Pasco County’s parcel database. Those are through parcel name, ID, recent sales, page & official record book, physical address, and interactive maps. The physical address is provided by the city and County growth management offices.