Do you have a property in St Johns County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the St Johns County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check St Johns County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit St Johns County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the St Johns County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to St Johns Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Property Records

On the top menu, click Property Records. A new window will open.

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

St Johns County Property Appraiser’s Office Contact

Email

[email protected]

Address

4030 Lewis Speedway,

St. Augustine,

FL 32084

Phone

(904) 827-5500

Other sections of the Property Appraiser Website

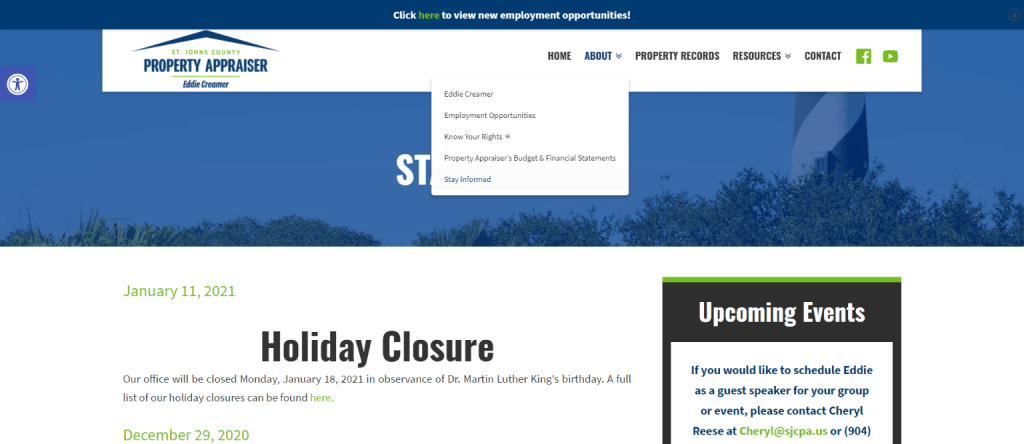

Apart from letting you search properties, the St Johns County property appraiser’s website also offers you other information about the office of the St Johns County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

Resources

This section gives you information about the property appraiser’s office plus updates.

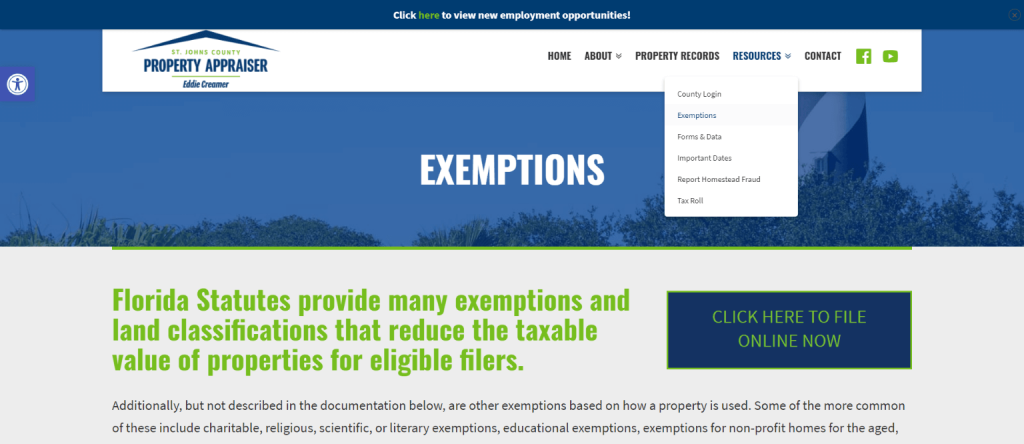

Resources

This page brings you to the login section for when you want to request documents. This section is also where you get access to information about exemptions and a link to online filing of exemptions and many others. There is also information on the tax roll in this section, and a means for you to report homestead fraud.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

St Johns County Property Appraiser’s Office, Website, Map, Search Content

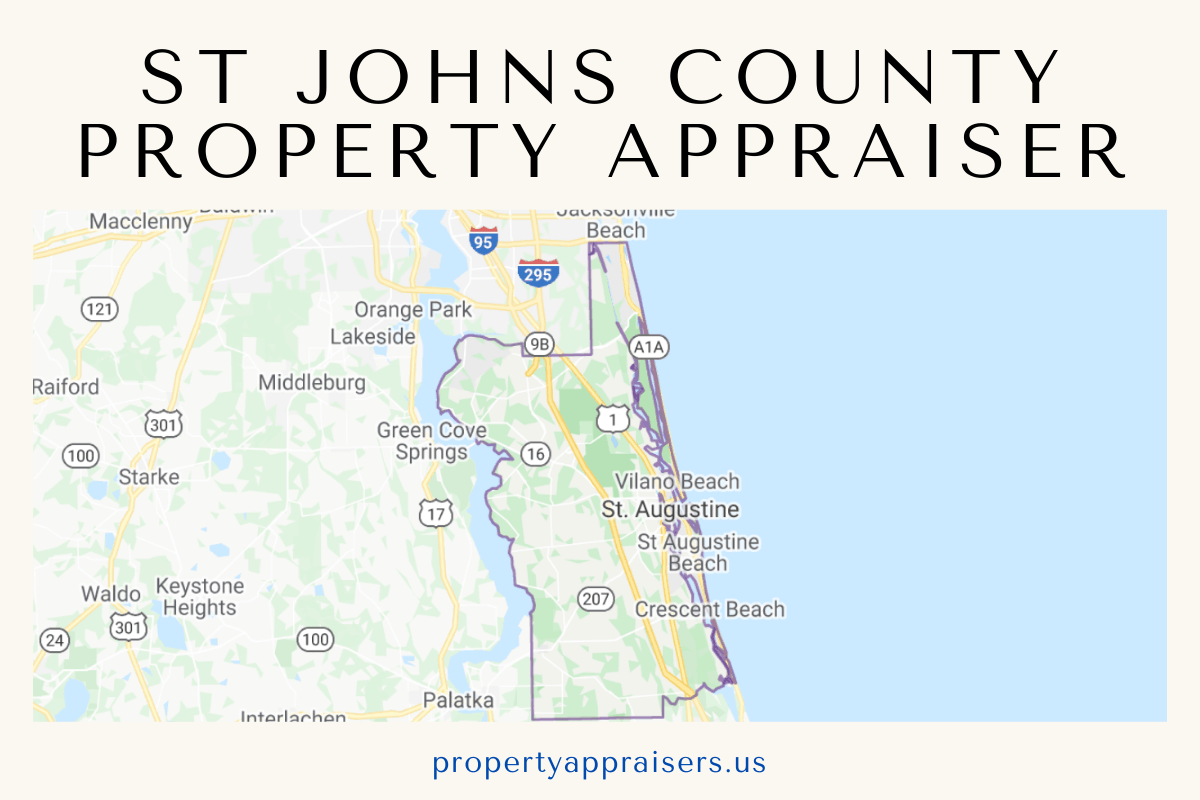

Property Appraiser for St Johns County is constitutionally mandated to assess the real and tangible personal properties and administer exemptions. The property appraiser team consists of experts in appraisal, deed and property ownership, GIS mapping, information technology, and database administration to achieve these goals.

A combination of on-site property inspections, aerial photography, recorded sales, construction cost data, and mapping technologies are used by the Property Appraiser’s Office to determine property values. If you are interested in more property appraisers, visit Property Appraisers.

You can also check out related Property Appraisals from Volusia County, Seminole County, Polk County, Pinellas County, and Pasco County.

Former Regional President of Ameris Bank and CEO of Prosperity Bank, current Property Appraiser Eddie Creamer made countless contributions to the community over the last 19 years. He spearheaded the consumer and business real estate financing, small business administration, municipal, agricultural, construction, personal, educational, and home equity line of credit lending, as well as investments, financial planning, and traditional banking services in St. Johns County. He also led his team to elevate customer service and quality, drive technological advancements, increase profitability, and expand products.

Access St Johns County PA Website

Visit the official website of St Johns County, PA, and see all the details you need to know about Florida real estate and properties. You may apply for an exemption on this website, search property records and maps, search by map, estimate your taxes, and stay informed with property appraisal.

St Johns County has 124,300 residential properties, 8,800 commercial properties, 2,100 agricultural properties, and a $30.2 billion taxable county value. Users can view the property information, zoom and pan the map, turn map layers on and off, and print maps.

Review Property Search

If you are looking for a particular property, you may click on the first tab to load another page. Here, you may search by owner, location address, parcel number, and legal information. Once the search results show, you may choose to share the page, print, and email the search results for easier recording.

Review SJCPA Contact Information

If you want to reach St. Johns County, PA, to have your property appraised, or to inquire about other services, here are the details to reach them quickly.

Contact Number

For any inquiry, you may reach St. Johns County PA at (904) 827-5500. For general inquiries, you may also send an email to [email protected].

Location

St Johns County PA is located at 4030 Lewis Speedway, Ste 203 St Augustine, Florida 32084. It is open from Monday to Friday from 8:30 a.m. to 5 p.m.

Review Homestead Exemption

The real estate appraisal and closing services are available in every county in Florida, 67 counties. With our sophisticated computer technology, you can view your files online 24 hours a day.

FAQ

What is Property Appraisal?

Real estate appraisal, property valuation, or land valuation is the process of developing an opinion or a ballpark figure of the market value of real estate properties. Real estate transactions often require appraisals because they occur infrequently, and every property is unique, specifically its current condition, which is a key factor in property valuation.

Why do you need a Property Appraisal?

Property Appraisal is used as the basis for mortgage loans, settling estates and divorces, taxation, and other legal matters. Sometimes an appraisal report is used to establish a sale price for a property.

Who is the St. Johns County, PA?

The St Johns County PA helps determine the value of a property through examination and research. The office comes up with a detailed report about the property that indicates its value and the reason(s) why it was given such value.

Who is the St. Johns Country Property Appraiser?

The current St. Johns Country Property Appraiser is Eddie Creamer. He is a former Regional President of Ameris Bank and was also the CEO of Prosperity Bank.

What is a Homestead Exemption?

Homestead exemption is a law that protects the value of the homes of residents from property taxes, creditors, and circumstances caused by the death of the homeowner’s spouse. These laws are found in many of the states in the US.

Conclusion

We have provided you with the necessary information about the responsibilities of St. Johns County, PA. We hope that this has been helpful to you. If you have any questions, you may leave a comment below.st johns county property appraiser