Do you have a property in Polk County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Polk County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties, like Paulding County, visit Property Appraiser where you can find their offices and websites.

Check Polk County Property Value with Online Tools

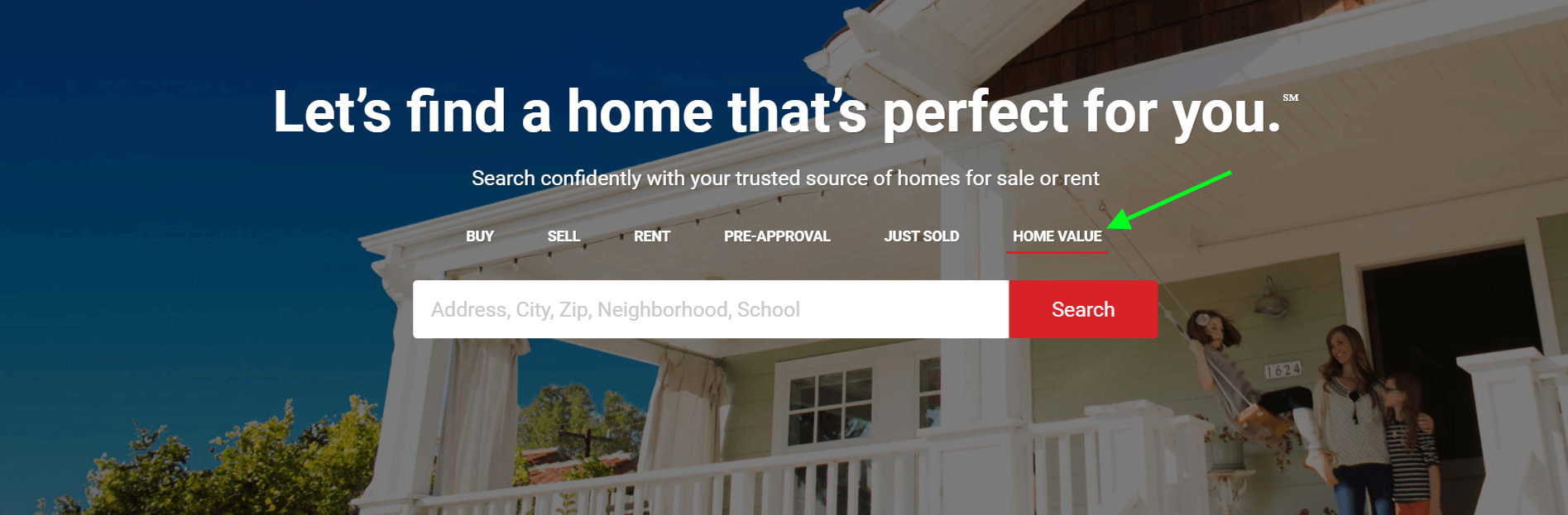

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Polk County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Polk County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Polk Property Appraiser’s Website

This website gives you an option to check your property’s value and find out the properties of another person for sale.

- Go to Property Search

There will be a drop-down menu once you click or hover over this category. From the drop-down menu, choose Property Searches.

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Polk County Property Appraiser’s Office Contact

Address

255 N Wilson Avenue Bartow,

FL 33830

Phone

(863) 534-4777

Fax

(863) 534-4753

Other sections of the Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Polk County property appraiser office would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

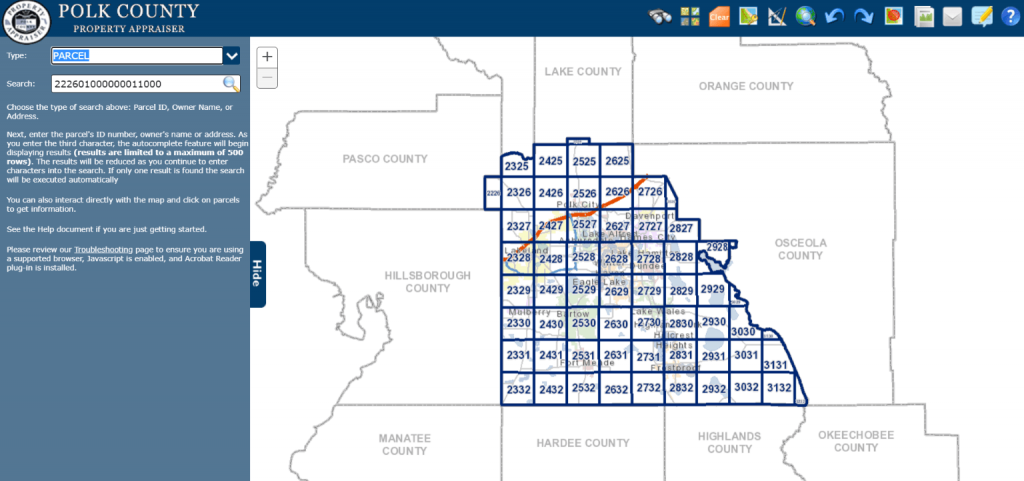

Map Search

This page offers you an interactive map where you can click on locations and get reports of location details, like customers’ locations or your location

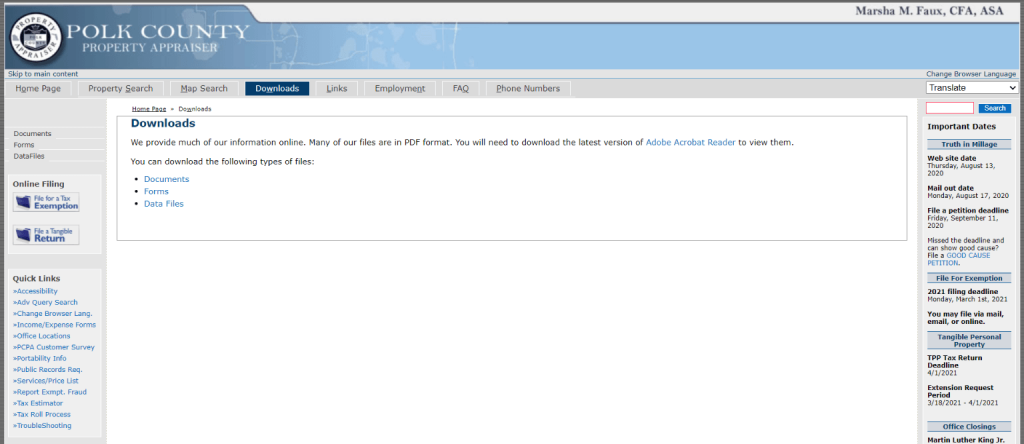

Downloads

From this section, you can download most of the forms you need for filing exemptions among others. You can also download public records data and documents.

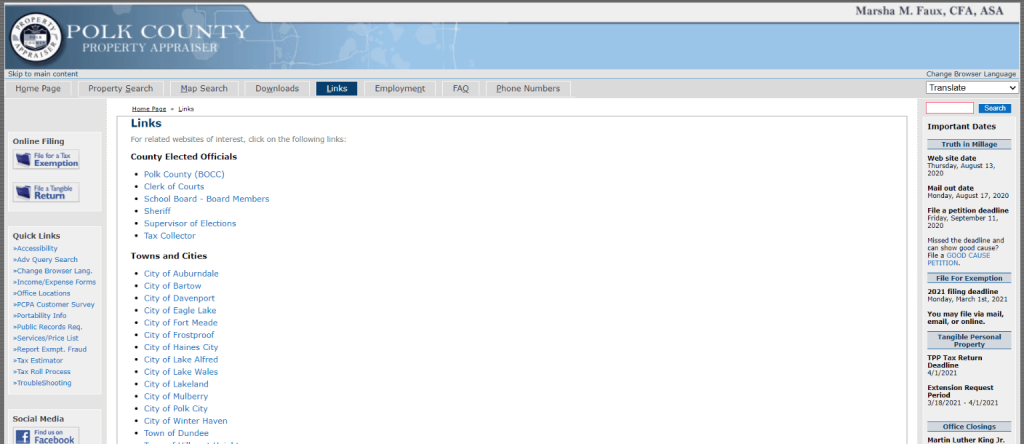

Links

This section gives you a list of links to pertinent government offices and agencies, as well as business links.

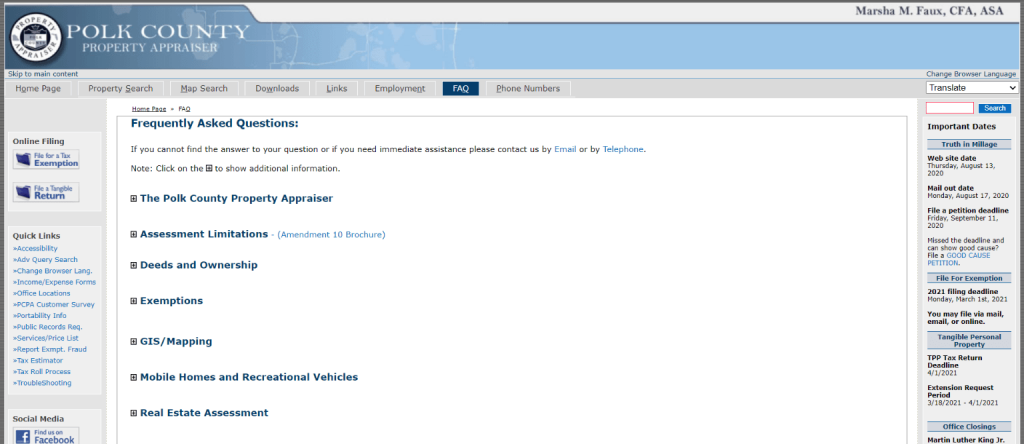

FAQ

This section contains their questions and answers everything you need to know about property appraisal, taxation, and even exemption among many other details available.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Polk County Property Appraiser’s Office, Website, Map, Search Content

Polk County property appraiser works with the Florida Department of revenue to reassure the assessment’s accuracy through the property tax oversight program. PCPA administers 131,000 homestead exemption, 84,000 business accounts, 358,000 parcels of real estate, and must identify the property entitled to the agricultural classification. Meanwhile, you can visit Property Appraiser to find out more about other property appraisers.

Their office and staff are responsible for service to the public and glad to assist with exemptions and appraisals. Polk County Property Appraiser must be aware of what properties are selling for, rent and operating expenses, cost to replace the improvements, and numerous factors that impact the value.

See more of the appraisers that can help you with your property. You can read the reference we provided for Charlotte County Property Appraiser, Flagler County Property Appraiser, or Gulf County Property Appraiser.

All About Property Appraiser for Polk County

PCPA’s office wants to ensure that the services provided are accessible for every individual, even those who have disabilities such as hearing, visual, cognitive, and motor disabilities.

PCPA is working diligently to ensure that the website and its content meet the WCAG 2.0 level AA accessibility standard. The PCPA website is available to help people through:

Review Communication Trail

Free visual, hearing and other assistance can be arranged. You can look for their web’s ADA notice for additional information or contact the Polk County property appraiser’s ADA coordinator to give the proper assistance that you need.

Read more about other related appraisers: Escambia County Property Appraiser, Sarasota County Property Appraiser, Sumter County Property Appraiser.

Remember: Polk County Property Appraiser Grievance Procedure

To meet the requirements of the ADA of 1990, that’s why the Grievance procedure is established. Anyone who wants to file a protest against discrimination based on the disability in the provision of activities, programs, services, or benefits by the Polk County PA office can use this procedure.

Do you want to read about Pasco County Property Appraiser, Nassau County Property Appraiser, or Leon County Property Appraiser? We have references for their appraiser.

Access Location and Contact Information

All comments, compliments, and questions about the transactions, information, or the PCPA can be directed through phone calls, or you may visit the Polk County property appraiser’s office in person with the help of the given information below:

- Bartow/ Main Office- 255 N Wilson Ave. Bartow, FL 33830 Phone: (863) 534-4777

- Lakeland Office- 930 E Parker St., Suite 272 Lakeland, FL 33801 Phone: (863) 802-6150 FAX: (863) 802-6163

- Winter Haven Office- 3425 Lake Alfred Rd. 3 Gill Jones Plaza, Winter Haven, FL 33881 Phone: (863) 401-2424 Fax: (863) 401-2428

Access Search Information

Here are the ways to find a real and tangible property on the Polk County PA’s website:

- Through the property search page, including by address, parcel ID, and name. You can search for the property appraiser’s database to find the property you are looking for.

- You can use the advanced query search page to create your query.

Third-party links on the PCPA website

PCPA offers links to other third-party websites that could be an interest to the visitors of their website. These links are provided solely for the visitor’s convenience and help them locate other information on the internet.

Clicking the links will automatically leave the Polk County PA’s website and redirect it to another website.

The sites are not under the management of PCPA. The content of the linked third-party websites is not under the liability of PCPA.

The privacy policies and security on the linked sites may differ from what the PCPA policies have, so you must be aware and read the third party’s security policies and privacy.

Access Homestead Exemption

Each person who has the equitable or legal right to a property and maintains it as his permanent residence or another legally dependent owner is entitled to the homestead exemption.

A person and his spouse(if married) must bring proof of legal residency established by the following:

- Florida Driver License (with current address)

- Florida vehicle registration (with current address)

- Local employment

- Voter Registration (with current address)

- School Name of Dependent Children

- Current Utility Bill

- Bank Statement mailing address

Additional homestead exemption documents

Property owners qualified for the initial $25,000 homestead exemption will also be eligible to receive an additional $25,000 homestead under Amendment 1 beginning in the 2008 tax year. The additional homestead exemption is applied to the assessed value of between $50,000-$75,000. The school board portion of the account rate is not exempted, unlike in the initial homestead exemption.

Changes that may affect the homestead

Any of the following applied situations are not reported. You may call the PCPA exemptions department-(863)534-4777 for the proper action to be implied:

- You and your spouse have a second home in/out of the state, and you both receive a residency tax credit or homestead exemptions.

- Still, receiver widow exemption even if you have remarried.

- Your salary exceeds the legal limit for the qualification of senior exemption.

- You moved from your homestead property.

- The owner of the homestead property was deceased.

- You are renting your homestead property.

- You and your spouse own different/separate properties, and both receive the homestead exemption.

FAQ

What is the duty of Polk County PA?

Polk County PA works with the Florida Department of revenue to reassure the assessment’s accuracy through the property tax oversight program. PCPA administers 131,000 homestead exemption, 84,000 business accounts, 358,000 parcels of real estate, and must identify the property entitled to the agricultural classification.

What are the contact details of Polk County, PA?

> Bartow/ Main Office- 255 N Wilson Ave. Bartow, FL 33830 Phone: (863) 534-4777

>Lakeland Office- 930 E Parker St., Suite 272 Lakeland, FL 33801 Phone: (863) 802-6150 FAX: (863) 802-6163

>Winter Haven Office- 3425 Lake Alfred Rd. 3 Gill Jones Plaza, Winter Haven, FL 33881 Phone: (863) 401-2424 Fax: (863) 401-2428

How to find a real and tangible property on the Polk County property appraiser’s website?

1. Through the property search page, including by address, parcel ID, and name.

2. You can search for the property appraiser’s database to find the property you are looking for. You can use the advanced query search page to create your query.

Conclusion

Property Appraiser is a big help to all aspiring people. You’ll get to know all the documents, fees, and processes you need to own and maintain your future home; if you have any questions, feel free to contact us.

I am trying to find the location of my property at River Ranch in Polk County, Fla. My name is David Stanford Sr and I live at 1225 Popash Road, Wauchula, Florida 33874-4356. My tax Folio Number is 1378020.0000. Please let me know what cost is involved. You can contact me at 863 222 1533 and speak to my wife Donna Stanford as it is hard to hear on the phone. I also need a copy of the deed. Thanks.