Do you have a property in Pinellas County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Pinellas County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Pinellas County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Pinellas County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Pinellas County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Pinellas Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale in Florida.

- Go to Search Our Database

On the left-hand menu, click on Search Our Database. This should be the second item on the list.

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Pinellas County Property Appraiser’s Office Contact

Address

County Courthouse

315 Court Street

2nd Floor

Clearwater, FL 33756

Phone

(727) 464-3207

Fax

(727) 464-3448

Other sections of the Property Appraiser Website

Apart from letting you search properties, the Pinellas County property appraiser’s website also offers you other information about the office of the Pinellas County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

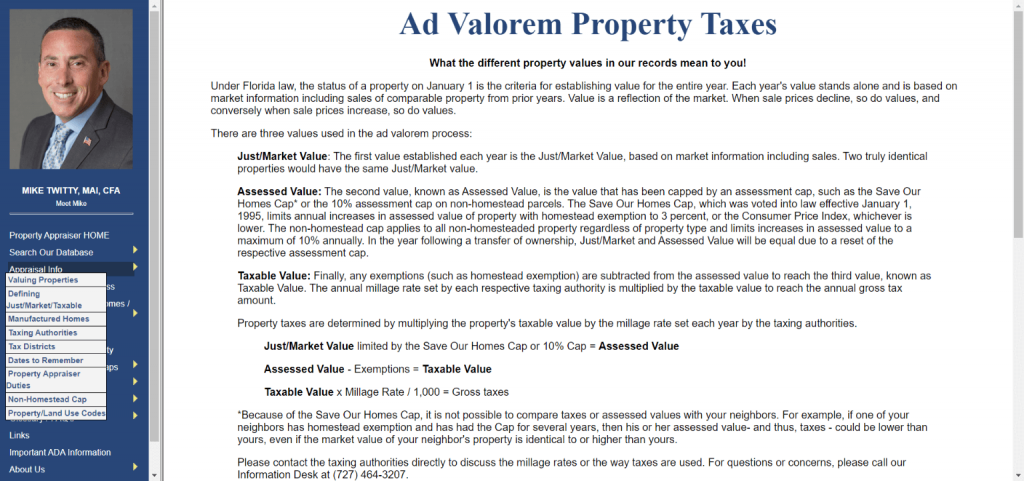

Appraisal Info

This page offers you a wide range of information related to appraisals. There are definitions of terms and details of requirements and even tax districts and authorities, all to help deepen your understanding of the process.

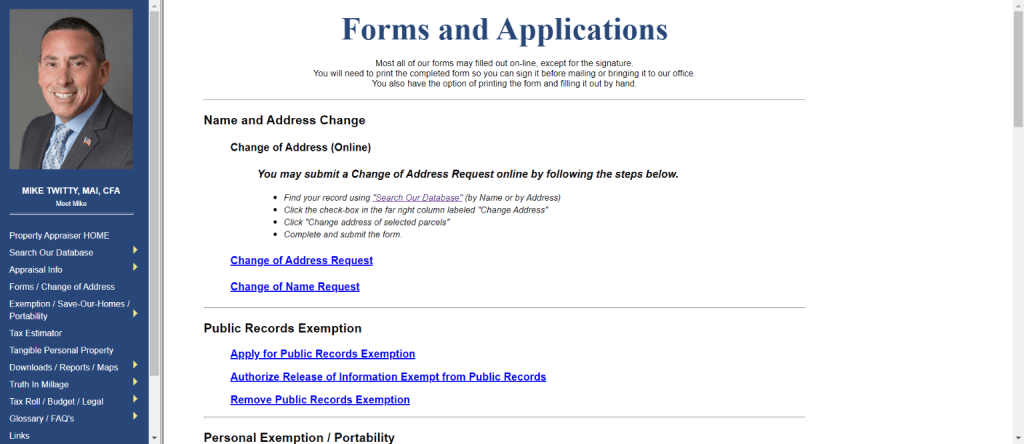

Form/Change of Address

From this section, you can download most of the forms people usually need like those for exemption filing, public records request, and tangible personal property, and many other needed forms.

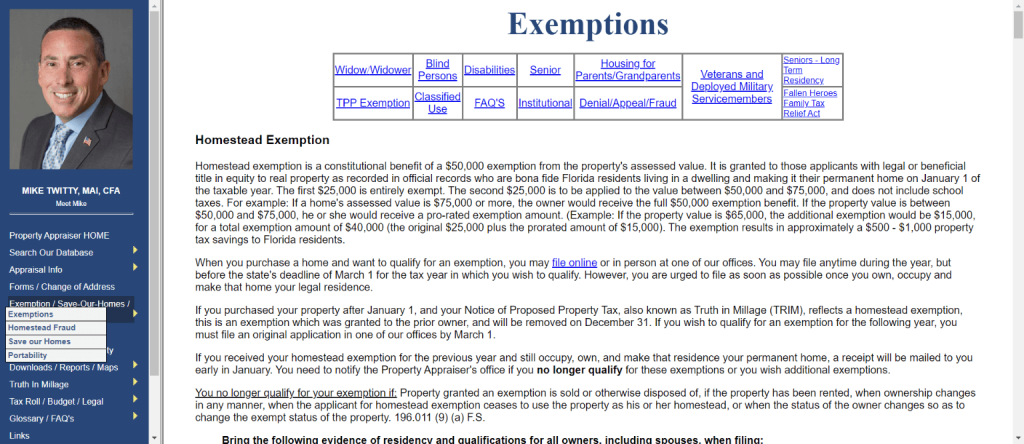

Exemptions/Save-Our-Homes/Portability

If you want to know the exemptions available in Pinellas County, then this section has you covered. It gives you data on exemptions involving the following: Widow/Widower, Homestead, Seniors, Portability, among others. You can also report homestead fraud in this section.

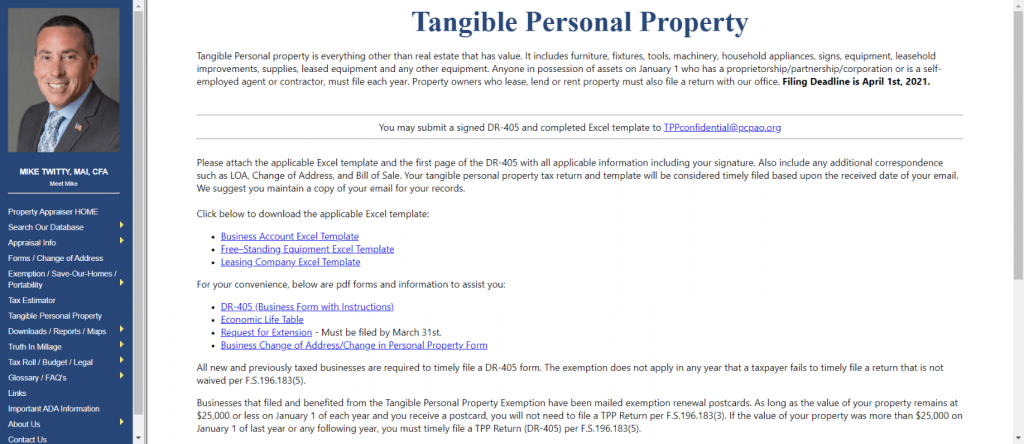

Tangible Personal Property

This section gives your information about tangible properties as well as forms that you will need. Here are the sub-sections: All Tangible, Forms, File Return, and Calendar.

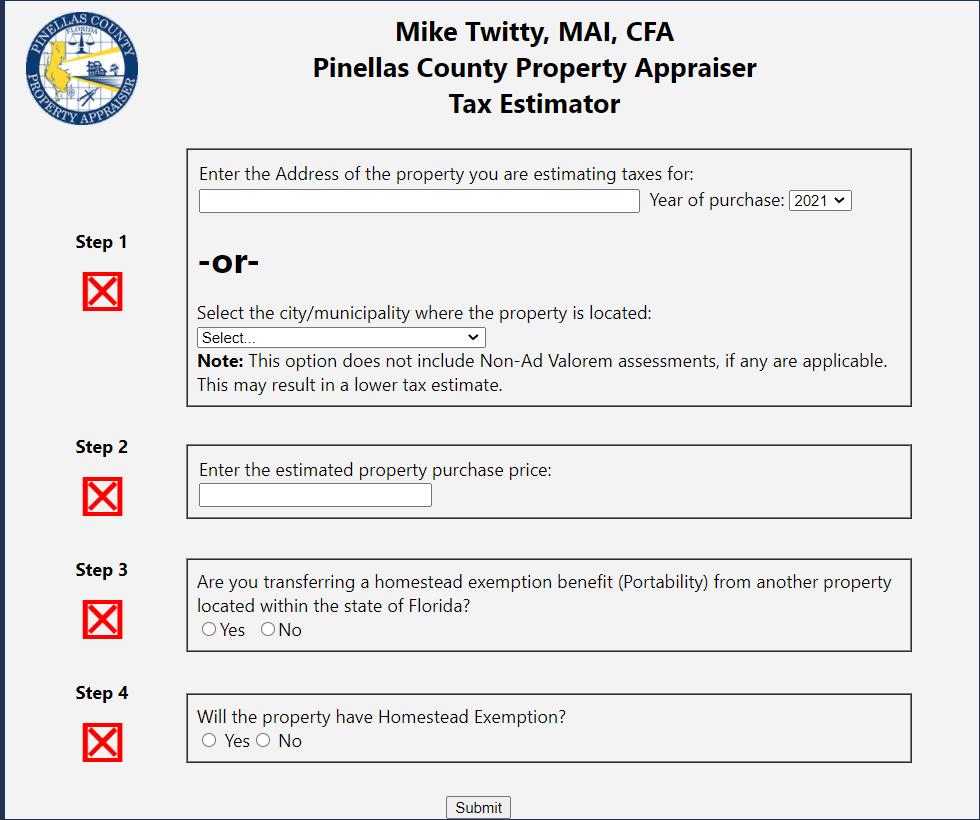

Tax Estimator

In this section, you get to check how much your estimated property tax would be.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Pinellas County Property Appraiser’s Office, Website, Map, Search Content

Property Appraiser for Pinellas County can guide your understanding of property taxes and their services. The company’s three primary entities are responsible for establishing, collecting, and maintaining property taxes with the contact information. Meanwhile, visit Property Appraisers for other property appraisers.

A property appraiser is always available and willing to help the public with the exemptions and value inquiries. PCPAO is charged with estimating the market value of the properties in Pinellas county for tax purposes.

PCPAO also applies valuation caps to restrict the assessed value, manage ownership mailing address, and administer various exemptions. Pinellas county has four locations you can go directly, browse the website, or inquire through phone numbers to talk to their representatives to access your information quickly.

All About Pinellas County PA

The entire company has complete dedication to producing an equitable and fair tax roll while providing customer service in a courteous, efficient, and competent manner. Pinellas County PA has the vision to lead their profession in mass appraisal and assessment administration; through the technology, PCPAO realizes efficiency to provide personal customer service. PCPAO highly value the following:

- Public Service

- Integrity

- Employees

- Responsibility

- Mass Appraisal Excellence

Best way to search for an address

When it comes to searching for an address, you do not have to enter the address’s complete details. Instead, the less you enter details in the address field, the more information you can get. There is also a list of hints on the search page. With these links, you are assisted for US Highway 19 and various addresses in each city.

Review Homestead Exemption

The Homestead exemption is a $50,000 constitutional benefit from the assessed value of the property. This exemption is granted to the applicants who have a beneficial or legal title in equity to the official records’ property. The first half benefits of the homestead exemption amounting to $25,000 is an entire exemption, and the second half is applied to the value of between $50,000 to $75,000. This exemption does not include school taxes.

Requirements when applying for Homestead Exemption

When applying for the homestead exemption, you must bring your evidence of residency for all the owners, including spouses, when filing:

- Florida Voter’s Registration

- Florida Automobile Registration and Driver License

- Death certificate or obituary notice when applying for widower exemption

- Resident Alien Card or Date of Naturalization

- Proper certification for a disability exemption

- Social security numbers for the owners and spouses Note: Disclosure of social security number is mandatory.

Check out these other related articles: Wakulla County Property Appraiser, Indian River County Property Appraiser, Columbia County Property Appraiser

Remember Pinellas County PA Contact Details

You can visit any of Pinellas county’s four office branches. The citizens of Pinellas county have the goal to give exceptional customer service. Your questions, suggestions, and comments are highly encouraged. Reach PCPAO through the following contact information:

PHONE: (727) 464-3207

FAX: (727) 464-3448 TTY/TDD: (727) 464-3370

Schedule: Monday-Friday, 8 am to 5 pm (except holidays)

Pinellas County PA Locations:

- County Courthouse- 2nd Floor, 315 Court Street, Clearwater, FL 33756

- Mid County- Co-located w/Tax Collector, 13025 Starkey Road, Largo, FL 33773

- South County- Govt Services Center, 1800 66th Street North, St. Petersburg, FL 33710

- North County- Northside Square, 29269 US HWY 19 North, Clearwater, FL 33761

FAQ

What county is St. Petersburg beach Pinellas County property appraiser?

St. Pete (Petersburg) is a city in Pinellas County. The entire company has complete dedication to producing an equitable and fair tax roll while providing customer service in a courteous, efficient, and competent manner.

How to contact Pinellas County property appraiser?

PHONE: (727) 464-3207

FAX: (727) 464-3448 TTY/TDD: (727) 464-3370

Schedule: Monday-Friday, 8 am to 5 pm (except holidays)

What is Homestead Exemption?

The Homestead exemption is a $50,000 constitutional benefit from the assessed value of the property. This exemption is granted to the applicants who have a beneficial or legal title in equity to the official records’ property.