Do you have a property in Citrus County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Citrus County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Citrus County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Citrus County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Citrus County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Citrus Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

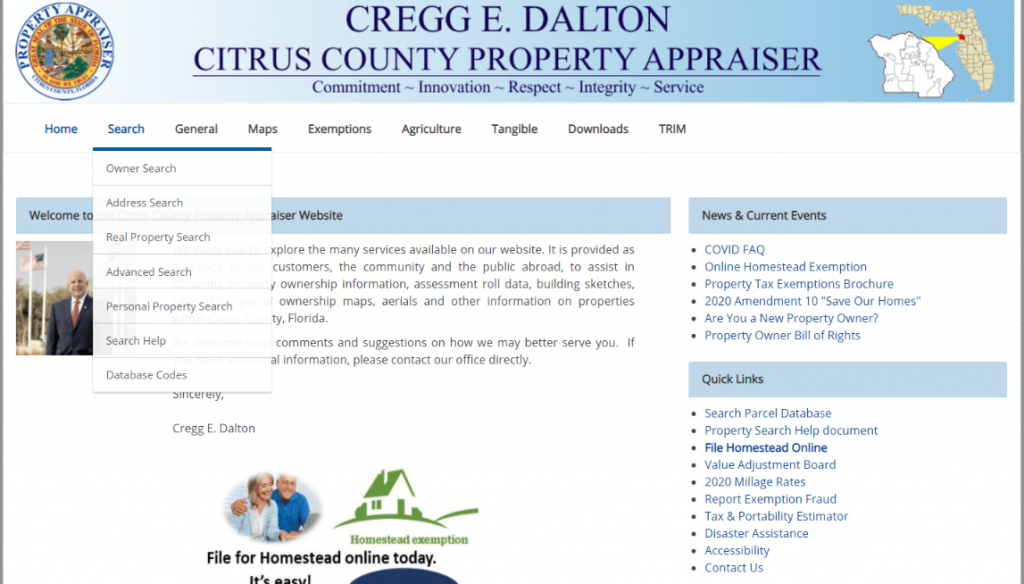

- Go to Search

From the top menu, click on Search Records, and from the drop-down menu, choose Real Property Search. On the next page, click on “Agree” after reading the statement.

- Fill out the form

Fill out the form that appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Citrus County Property Appraiser’s Office Contact

Email

[email protected]

Address

210 N. Apopka Ave., Suite 200

Inverness, FL 34450

Phone

(352) 341-6600

Fax

(352) 341-6660

Other sections of the Property Appraiser Website

Apart from letting you search properties, the Citrus County property appraiser’s website also offers you other information about the office of the Citrus County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

Search

This menu gives you different options for doing a search. You may search by owner’s name or address. You can even do an advanced search.

General

This section gives you a wide range of information, answering every question related to real property. You’ll find details about tax roll, value adjustment board, and even links or important dates.

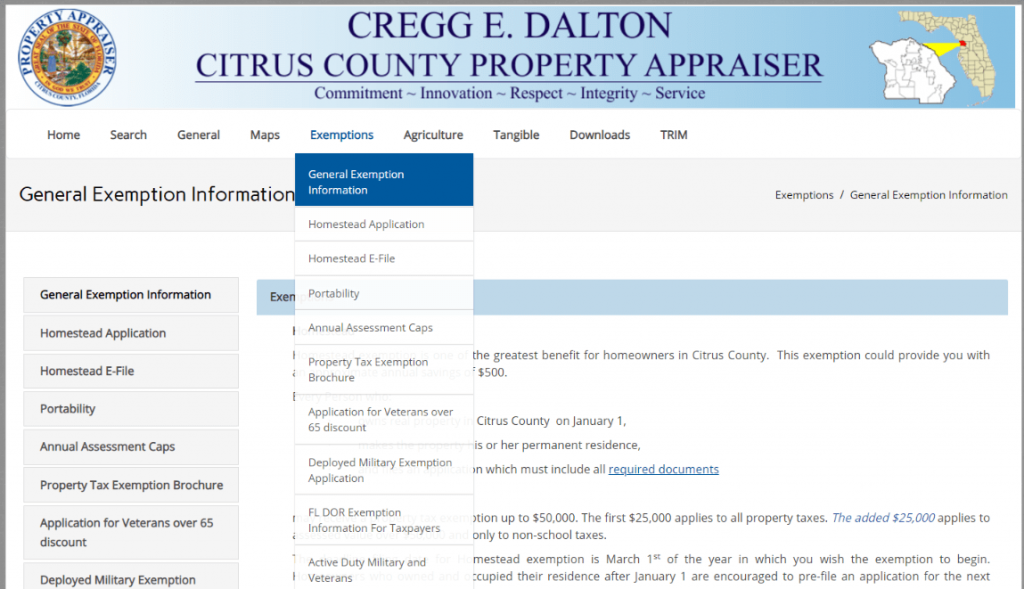

Exemption

If you want to know the exemptions available in Flagler County, then this section has you covered. It gives you data on exemptions involving the following: Widow/Widower, Homestead, Veterans, among others.

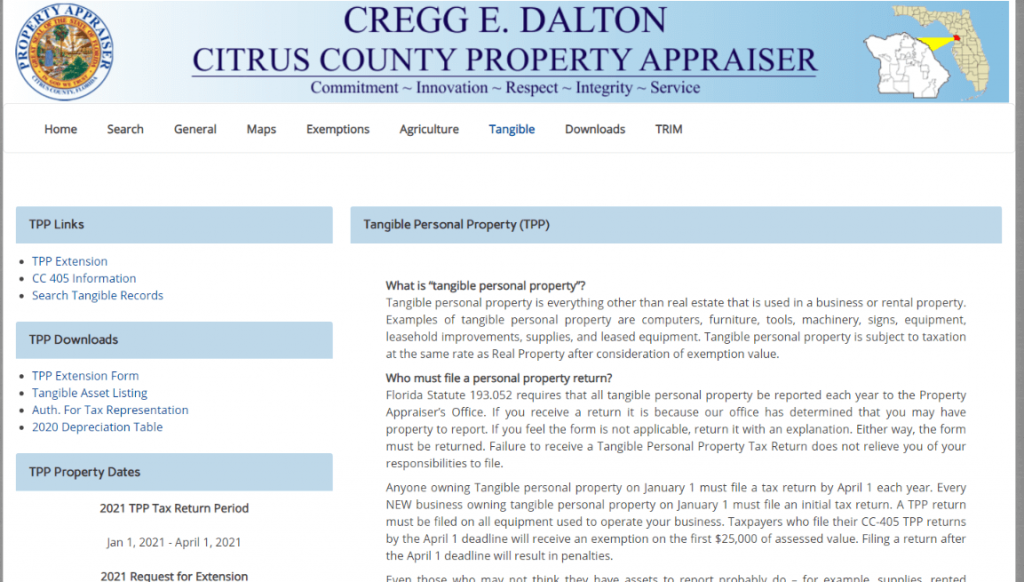

Tangible

This page gives you details about the tangible personal property (TPP). Apart from answering your most basic questions about TPP, you’ll also find important dates and contact information.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Citrus County Property Appraiser’s Office, Website, Map, Search Content

Throughout the year, the staff of Citrus County Property Appraiser collects data on real properties. By July of the year, the market value is determined, and taxing authorities start setting their millage rates. Each property owner is mailed the notice of proposed property tax or also known as Truth in Millage. Meanwhile, visit Property Appraisers to find out more about appraisers.

The notice provides the property owners with the anticipated tax amount. Citrus County PA has the mission to provide an equitable and fair assessment of tac each year based on the market per Florida Constitution, requirements, and law. At the same time, their office delivers efficient and courteous services to the Citrus County citizens.

Do you live near Collier County, Palm Beach County, or Charlotte County? They also have an appraiser who can assist you in assessing the value of your property.

Access Citrus County Property Appraiser Website

The office of Citrus County Property Appraiser (CCPA) values the ADA accessible; web environment for its users to ensure that they reach a broader population who can access and receive the benefit of their services, including the use of their website. The goal of CCPA is to comply with WCAG 2.1 level A and AA by the end of the year 2020. They continuously work to increase the usability and accessibility of their website to adhere to many of the guidelines and standards.

Currently, CCPA is exploring the compliance service opportunities that will identify the unfinished documents that need to be addressed as a priority. ADA does not oblige CCPA to take action that will alter the nature of its services and programs or will impose an undue administrative and financial burden.

Besides Citrus County Property Appraiser, you may also check property appraisers from other counties like Broward County, Miami Dade County, or Volusia County.

Location and Contact Details

CCPA has two offices in the County, and both offices have a full staff to serve you promptly. Through highly trained operators, the calls can be transacted 24/7, 365 days a year.

The service’s convenience will allow Florida residents who need to relay services to communicate and connect with anyone. The calls that the CCPA office received will remain confidential, and no records of the conversation will be maintained. Below are the offices, address, and contact details you can use to communicate or visit at the CCPA office:

- West Citrus Center- Crystal River Office, 1540 N Meadowcrest Blvd., Suite 400 Crystal River, FL 34429 Phone: (352)564-7130, Fax: (352)564-7131

- Inverness Office- 210 N. Apopka Ave., Suite 200 Inverness, FL 34450, Phone: (352)341-6600, Fax: (352)341-6660

Review Homestead Exemption

It is a more convenient way to complete your application for the homestead exemption and sending it through the mail. By this, you can save more time and money. Follow their steps for you to complete the application process:

- Print an application form

- Obtain and review the required documents

- Apply to the main office by the 1st of March.

You are qualified to take some or all of the benefits of ‘Save Our Homes’ to your new home if you received the homestead exemption before two years on a property that you sold or abandoned, and you have purchased a new home by the 1st of January.

You must file a ‘Transfer of Homestead Assessment Difference’ to receive the homestead exemption. DR-501T by the 1st of March with a property appraiser in Citrus County where the new homestead was located to transfer ‘Save Our Home’ benefit to the new homestead.

When the form is submitted, a property appraiser in the new homestead county will certify a transfer from the property appraiser that counts to which the original homestead was located. You should also apply for the Portability portion even if you have applied for the new homestead exemption.

Learn other related articles like Clay County Property Appraiser, St Johns County Property Appraiser, and Flagler County Property Appraiser.

All About Citrus County Property Appraiser Search

There are several categories where you can fill in for the search that you desire. These search options made it easier for you to determine what details you want to get from a particular category. Here is the following search option you can use:

Citrus County Property Appraise

The owner or name search option is to locate the properties with the known owner name. Fill in with the full name or part of the full name to the search box. Then use the * to match any string of characters.

Address Search

use this search option to locate a property using the details or the address such as street number, name, or direction. Leave the street suffix for the best result and use * as a wild card to match any string of the characters when you are unsure of the spelling. This wild card is assumed at the end of the characters.

Advanced Search

you can use this option to search for multiple criteria. Select your desired criteria that you want to search in the drop-down box criteria. After you have decided on what criteria, a field(s) will appear at the bottom based on what you choose. You can enter any of your wording, numbers, dates, etc. Click the add button. Then, the criteria will appear in the box of Current Search Criteria at the right corner.

Map Search

This option is to locate properties with a known location or Parcel ID. You either have a Zoom Search or search through the Alt key. The Zoom Search allows the users to draw a box around the interest area. This is useful for locating the property in a known general location but not the owner’s name, address, or Parcel ID. In search of the alt key, the user can enter an Alt key number to zoom in to the property.

FAQ

What is Citrus County, PA?

Citrus County PA has the mission to provide an equitable and fair assessment of tac each year based on the market per Florida Constitution, requirements, and law. At the same time, their office delivers efficient and courteous services to the Citrus County citizens.

How to contact Citrus County PA?

CCPA has two offices in the County, and both offices have a full staff to serve you promptly. Through highly trained operators, the calls can be transacted 24/7, 365 days a year. The service’s convenience will allow Florida residents who need to relay services to communicate and connect with anyone. The calls that the CCPA office received will remain confidential, and no records of the conversation will be maintained. Below are the offices, address, and contact details you can use to communicate or visit at the CCPA office:

– West Citrus Center- Crystal River Office, 1540 N Meadowcrest Blvd., Suite 400 Crystal River, FL 34429 Phone: (352)564-7130, Fax: (352)564-7131

– Inverness Office- 210 N. Apopka Ave., Suite 200 Inverness, FL 34450, Phone: (352)341-6600, Fax: (352)341-6660

How to search for property in Citrus County, PA?

There are several categories where you can fill in for the search that you desire. These search options made it easier for you to determine what details you want to get from a particular category.

Conclusion

Citrus County PA has the mission to provide an equitable and fair assessment of tac each year based on the market per Florida Constitution, requirements, and law. At the same time, their office delivers efficient and courteous services to the Citrus County citizens. CCPA has two offices in the County, and both offices have a full staff to serve you promptly.

These offices are located at Crystal River Office, 1540 N Meadowcrest Blvd., Suite 400 Crystal River, FL 34429, and at 210 N. Apopka Ave., Suite 200 Inverness, FL 34450. There are several categories where you can fill in for the search that you desire on their website. These search options made it easier for you to determine what details you want to get from a particular category. the citrus county property appraiser