Do you have a property in Santa Rosa County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Santa Rosa County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Santa Rosa County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Santa Rosa County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Santa Rosa County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

Other sections of the Property Appraiser Website

Apart from letting you search properties, the Santa Rosa County property appraiser’s website also offers you other information about the office of the Santa Rosa County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

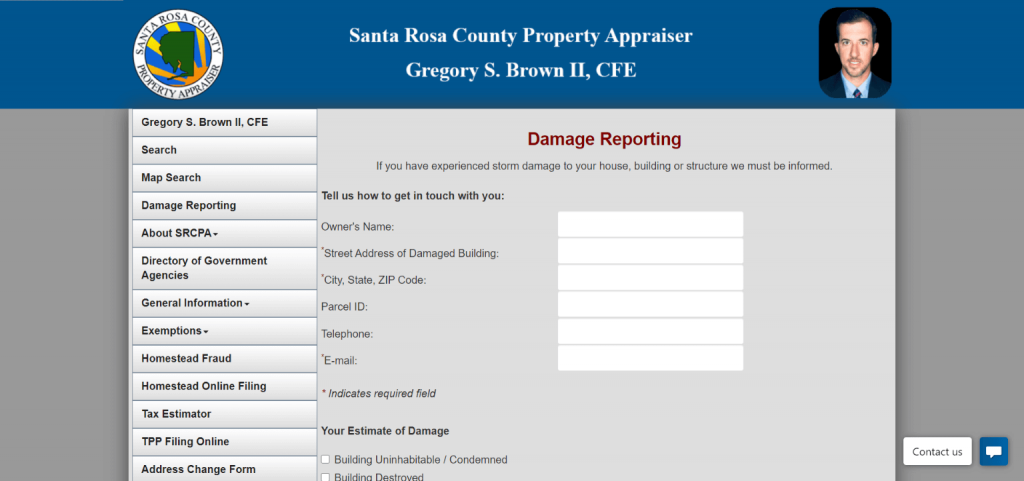

Damage Reporting

You can report online if there is any damage to your house. Fill out the form accordingly.

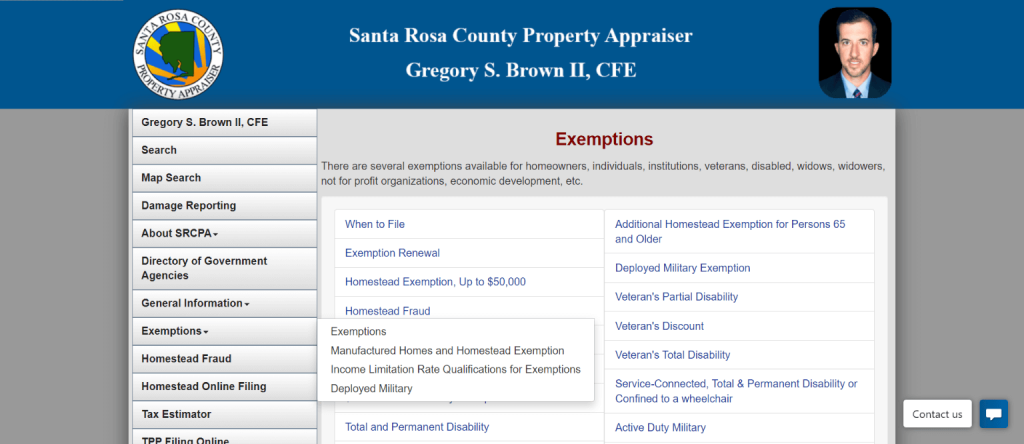

Exemptions

If you want to know the exemptions available in Santa Rosa County, then this section has you covered. It gives you data on exemptions involving the following: Widow/Widower, Homestead Fraud, Homestead, Non-Profit, veterans, Conservation, Seniors, and Portability.

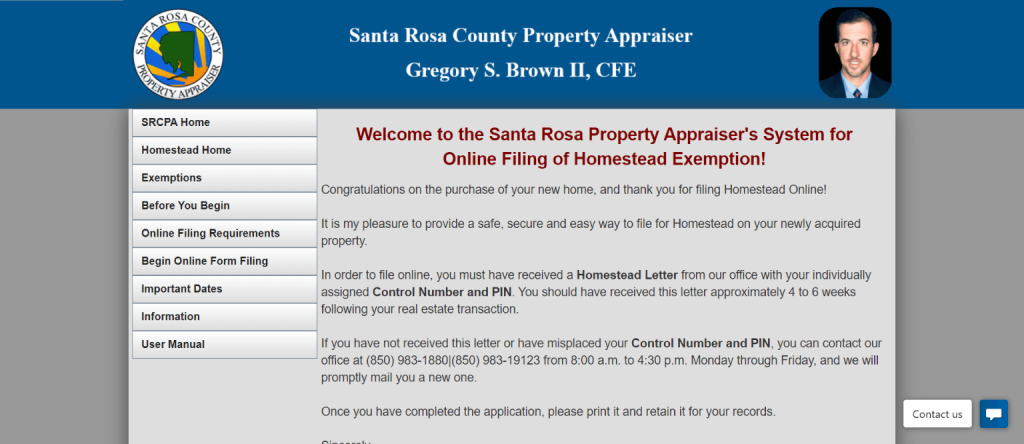

Homestead Online Filing

Apart from allowing you to file for homestead, this page also gives you information like requirements to file. You may also report homestead fraud.

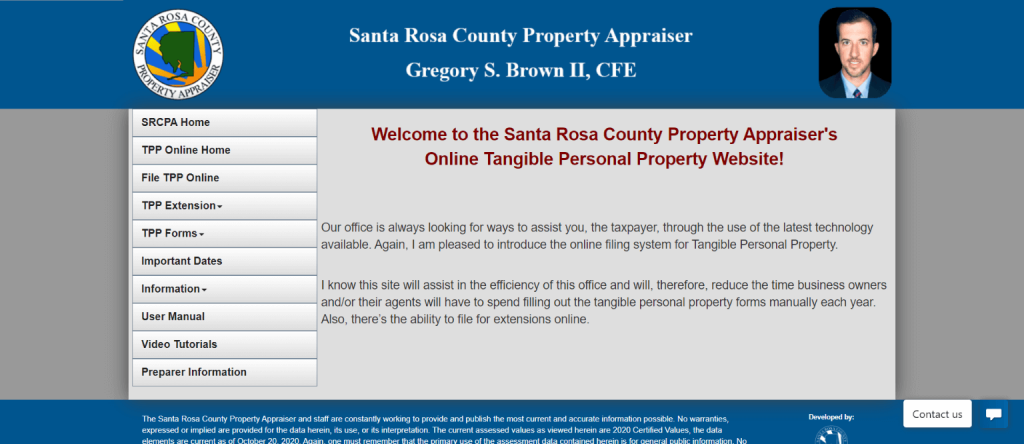

TPP Filing Online

You can file for tangible personal properties on this page. You also have access to other TPP information and downloadable forms.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Santa Rosa County Property Appraiser’s Office, Website, Map, Search Content

Donald C. Spencer, the County Clerk at Santa Rosa, welcomes you to visit the Santa Rosa County Property Appraiser Website, which is the Online Information Center. A service created to give you more information and assist you with your requirements. “We, as public trustees, want input from you to make this advantageous to your requirements.” For more information about other appraisers, visit Property Appraisers.

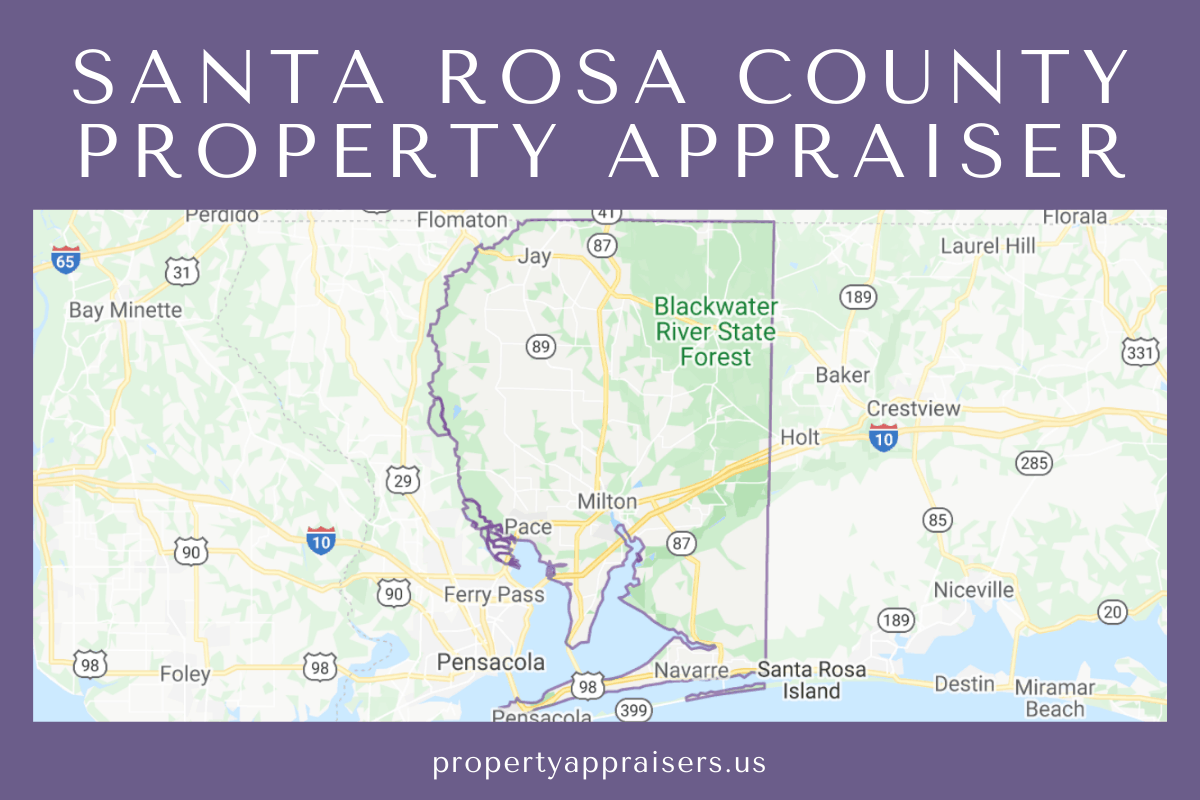

Santa Rosa County is in three unique sections: South Santa Rosa, Central Santa Rosa, and North Santa Rosa. The articles focus on the central east/west roadways that go through the County.

South Santa Rosa County comprises the area from Holley and Ellyson Field. The central area developed along “The Old Spanish Trail.” That ranged from Interstate 10 likewise travels through this section of the County.

The Santa Rosa County Home Appraiser’s Office continues to look for brand-new methods to serve you. They have a website to give you a summary of their functions in the workplace. You will also get information on how different taxing authorities engage with the homeowner.

The County takes pleasure in supplying these useful facts on the evaluation and tax process; Besides, they explain various benefits readily available through tax exemptions in Florida.

All About Santa Rosa County Property Appraiser Office

The Santa Rosa County Tax Collector makes every effort to produce and release the most existing and precise details. “No warranties revealed or indicated are attended to the information herein, its use, or its analysis.” The usage of the search facility indicates understanding and approval of this statement by the user.

The Mission for the Workplace of the Clerk of Court and Comptroller of Santa Rosa County serves our People, the Courts, and the Board of County Commissioners. With the highest requirements of responsibility, integrity, ethics, honesty, and professionalism. They will achieve this by putting quality and client service first and keeping total and accurate records for their County.

There are lots of property appraisers in Florida. Some of them are from St. Lucie County, Putnam County, and Volusia County.

Review Tax Exemptions

To file online, property owners ought to have received a homestead letter with an appointed number and PIN within six weeks of application. Also, candidates with proper documents might be eligible for other exemptions, including those for seniors, widows and widowers, persons with disabilities, active-duty armed forces, veterans, enduring spouses of first responders, farming classifications, historic properties, “granny flats,” and more.

The deadline to look for residential or commercial property tax exemption is March 1. Santa Rosa County Home Appraiser Greg Brown says. New house owners, or homeowners who have never filed, can receive a real estate tax exemption of up to $50,000.

These Homestead exemptions are not transferable from the previous owner to the new owner. “Any property owner should utilize it as their primary residence from January 1. Applying for homestead exemption results in significant cost savings on your home taxes,” Brown stated.

Access Tax Assessor

The regional official in Santa Rosa County, Santa Rosa County Tax Assessor who is accountable for examining the taxable worth of all residential or commercial properties within the County. They develop the amount of tax due to residential or commercial property based upon the reasonable market price appraisal.

The assessor’s workplace can offer you a copy of your home’s latest appraisal on demand. Property Renovations and Re-Appraisals if you refurbish your home (such as adding living area, bedrooms, or bathrooms). The Santa Rosa County Assessor will re-appraise your house to show the value of your brand-new additions.

For your convenience, we also have information about another property appraiser. You may also read St Johns County Property Appraiser, Seminole County Property Appraiser, and Sarasota County Property appraiser.

FAQ

What is Santa Rosa County Property Appraiser?

The Santa Rosa County Property Appraiser makes every effort to produce and release the most existing and precise details possible on Taxes. The Santa Rosa county office summarizes many functions in his workplace; and the different taxing authorities that engage the homeowner. The SRCPA takes pleasure in supplying useful facts on the evaluation and tax process and explaining various benefits readily available through tax exemptions in the State of Florida.

How to contact Santa Rosa County PA

Contact United States Mailing Address PO Box 580 Bristol, FL 32321 Santa Rosa County Home Appraiser 6495 Caroline St Suite K Milton, FL 32570-4592 Workplace Phone: (850) 983-1880 in between 8 a.m. and 4:30 p.m. Monday through Friday. Workplace Fax: (850) 623-1284 Email: mailto: [email protected].

Is homestead exemption in Santa Rosa County Property Appraiser transferable?

These Homestead exemptions are not transferable from the previous owner to the new owner. “Any property owner should utilize it as their primary residence from January 1. Applying for homestead exemption results in significant cost savings on your home taxes,” Brown stated.

Conclusion

For support in figuring out exemption eligibility, questions about what documentation is required. Or, to get a replacement copy of a homestead exemption letter, visit www.srcpa.org. Applicants may file for an exemption at the property appraiser’s workplace at 6495 Caroline Street, Suite K in Milton, or 5841 Gulf Breeze Parkway, Suite A in Gulf Breeze. You are welcome to write any comment or observation in the comment box below regarding this post.