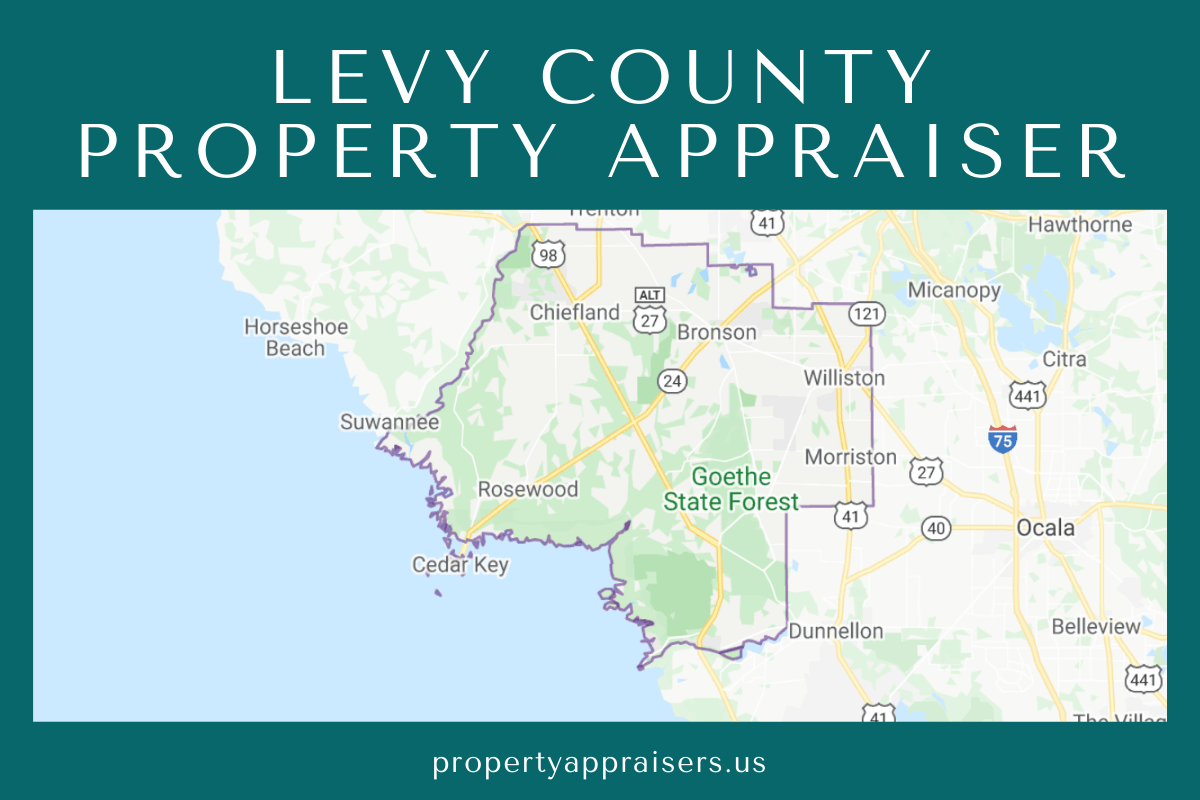

Do you have a property in Levy County, Florida that you wish to appraise and check the sale price? This page gives you details on how to check your property values online and get in touch with the Levy County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Levy County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

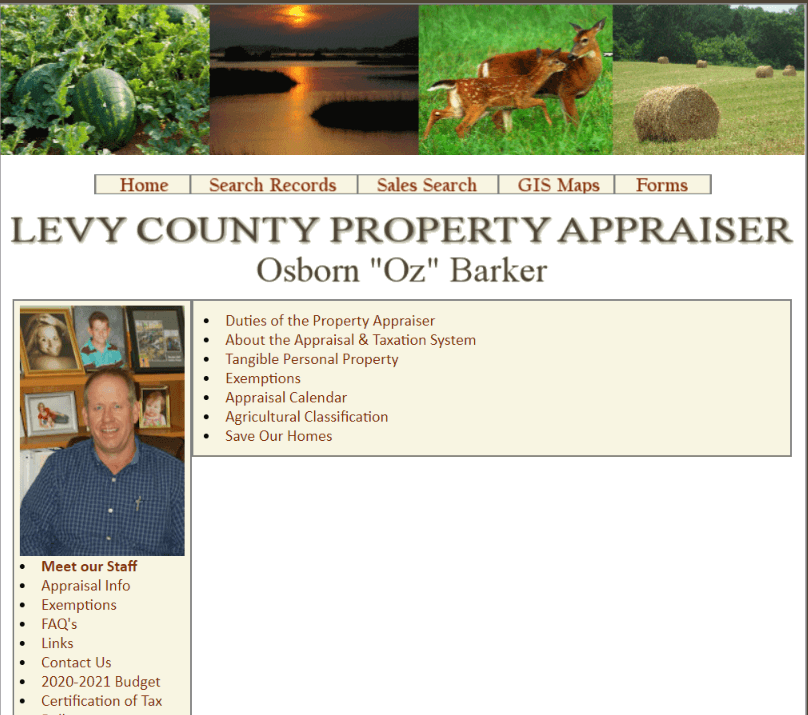

Visit Levy County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Levy County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Levy Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Search Records

From the top menu, click on Search Records, and on the next page, click on “Yes, I accept the above statement” after reading the statement.

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Alachua County Property Appraiser’s Office Contact

Email

[email protected]

Address

310 School Street

P.O. Box Drawer 100

Bronson, FL 32621

Phone

(352) 486-5222

Fax

(352) 486-5187

Other sections of the Property Appraiser Website

Apart from letting you search properties, the Levy County property appraiser’s website also offers you other information about the office of the Levy County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

Appraisal Info

This page offers details related to the appraisal of your property as well as about the duties of the property appraiser. There are also details on taxes, tangible personal property, and exemptions, among many other details that a property owner needs.

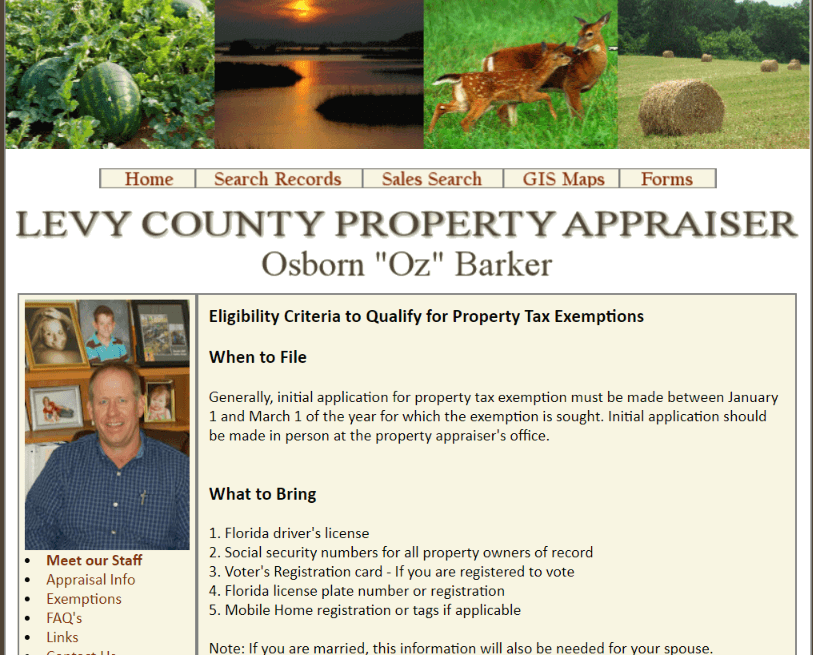

Exemption

If you want to know the exemptions available in Flagler County, then this section has you covered. It gives you data on exemptions involving the following: Widow/Widower, Homestead, Veterans, among others.

FAQs

As the name implies, this section answers all frequently asked questions related to appraisals, homestead, Save Our Homes, Tangible Personal Property, and some others.

Links

This section gives you links to other government offices or agencies that you might need to reach out to about concerns with your properties.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.