Do you have a property in Wakulla County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Wakulla County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Wakulla County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Wakulla County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Wakulla County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Wakulla Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Search Records

From the top menu, click on Search Records, and on the next page, click on “Yes, I accept the above statement” after reading the statement.

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Wakulla County Property Appraiser’s Office Contact

Email

[email protected]

Address

3115-A Crawfordville Hwy.

Crawfordville, Florida 32327

Phone

(850) 926-0500

Fax

(850) 926-6367

Other sections of the Property Appraiser Website

Apart from letting you search properties, the Wakulla County property appraiser’s website also offers you other information about the office of the Wakulla County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

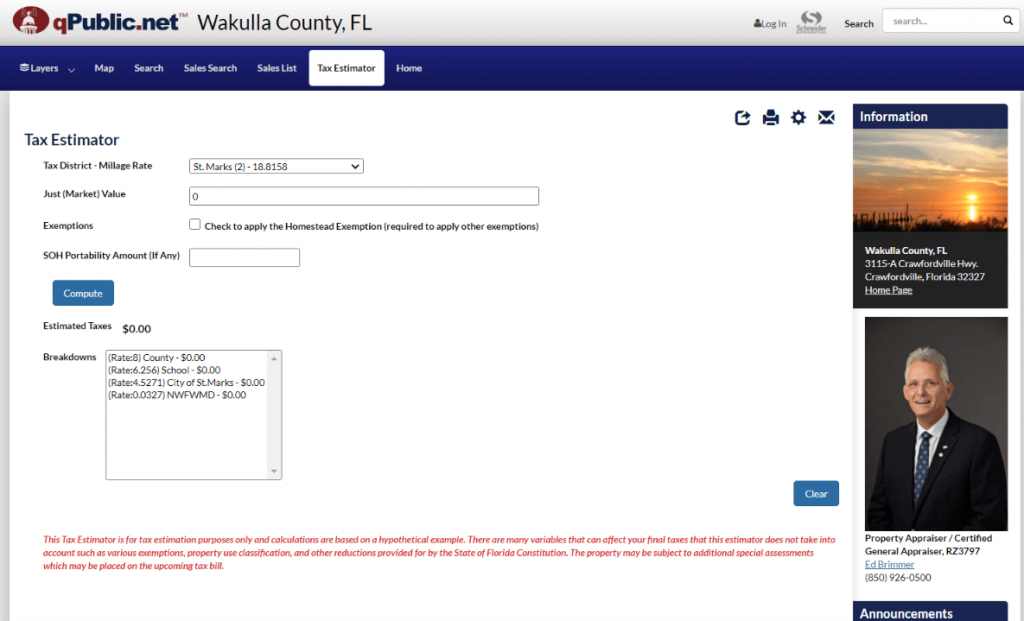

Tax Estimator

On this page, you can check or estimate the tax of your property. It will give you a breakdown f the amount depending as well on the information you encode.

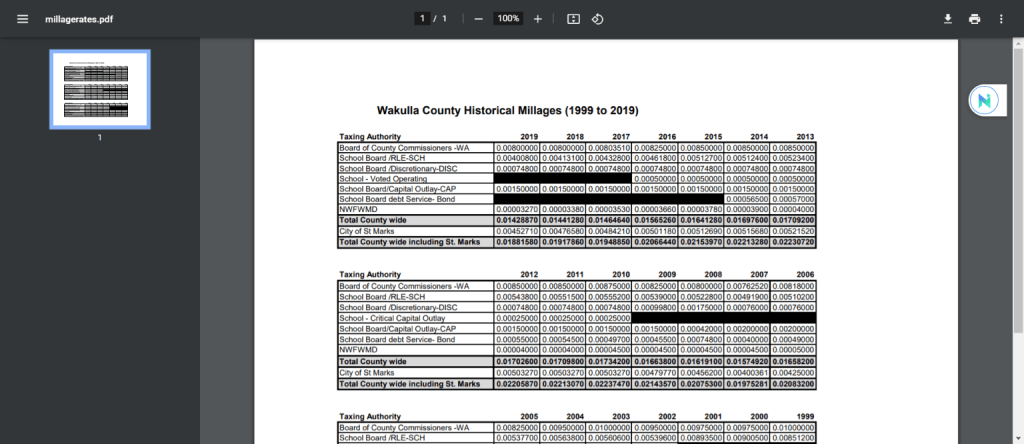

Millage rates

This page shows you a pdf of the millage rates from 1999 to 2019. You may also download the file should you need it.

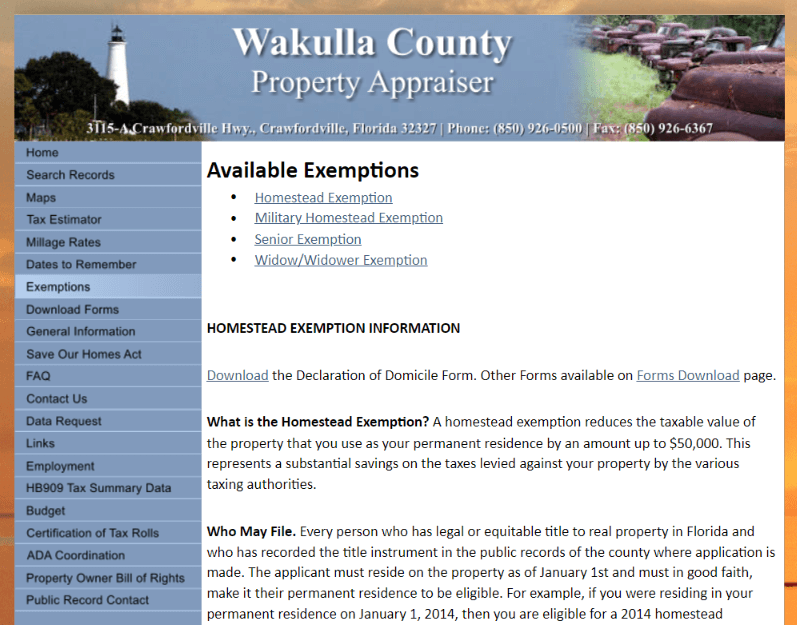

Exemption

If you want to know the exemptions available in Wakulla County, then this section has you covered. It gives you answers to most of your frequently asked questions.

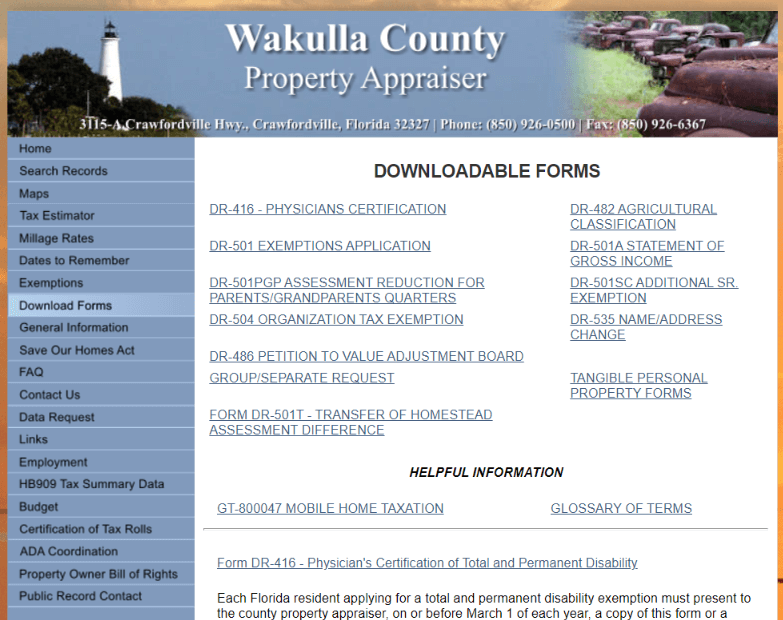

Download Forms

This section gives you access to the forms and documents you need in relation to your real property.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Wakulla County Property Appraiser’s Office, Website, Map, Search Content

The Wakulla County Property Appraiser is deemed responsible for identifying and determining the property’s fair value, both personal and real, within the county for tax purposes. Before we discuss further details, we invite you to check out other articles on Property Appraisers.

The “market” value of the real property is based on the present real estate markets. Estimating the “market” value of the property means discovering the price most people would pay for your property in its current conditions.

It is important to remember that the property appraiser does not create value. People establish value by selling and buying real estate in the market setup. The property appraiser has a legal responsibility to study the transactions and appraise your property accordingly. The property appraiser also does these other functions.

If you are looking for property appraisers in other counties, we also have articles on other counties like Orlando, Indian River, Gulf, Columbia, and Duval. Start exploring them here!

All About Wakulla County Property Appraiser

- Tracks the ownership changes

- Maintains the maps of parcel boundaries

- Keeps descriptions of the buildings and property characteristics up to date

- Accepts and approves applications from the individuals eligible for exemptions and other forms of property tax relief

- Analyzes the trends in sales prices, construction costs, and rents to best estimate the value of all assessable property

Review Wakulla County Assessor Responsibilities

The Wakulla County Assessor is responsible for appraising the real estate and assessing a property tax on Wakulla County, Florida properties. You can contact the Wakulla County Assessor for:

- Paying your property tax

- Information on your property’s tax assessments

- Appealing your property tax appraisals

- Reporting upgrades or improvements

- Your property tax bills

- Checking the Wakulla County property tax due date

There are three main roles involved in administering property taxes. They include Tax Assessors, Property Appraisers, and Tax Collectors. Take note that in some counties, an individual or the office may hold one or more of the roles. For example, the Wakulla County Tax Assessor may also serve as the Wakulla County Tax Appraiser.

Main Roles in Administering Property Taxes

- Setting the property tax rates and collecting owed property tax on real estate properties located in Wakulla County.

- Determining each piece of the real estate’s taxable value, which the Tax Assessors will use to determine the owed property tax.

- Collecting property tax from the property owners. They issue annual tax bills to all property owners in Wakulla County and work with the county’s sheriff’s office to foreclose on properties with delinquent taxes.

A property tax is a tax on any owned property, levied on the property owned by a state, local, or national government. In the past, property taxes were often collected on many types of wealth. Today, however, the property tax’s most common form levied on the land and fixed improvements, like buildings.

The common method of calculating property tax depends on two essential measurements. The property’s assessment value is the base taxable value of the property that needs taxing. The property tax rate and millage rate is the actual tax rate levied on the property’s assessed value. For more details, see calculating property tax.

FAQ

Who decides how much property tax to be paid?

As opposed to the income taxes, the property taxes are not self-assessed. The local tax assessor determines your property’s taxable value and sends you a yearly tax bill based on their appraisal. The overall property tax bill breaks down into individual line items. Standard components of a property tax include:

1. School District Taxes

2. Municipal Garbage Disposal Fees

3. Municipal Utility Fees

4. Library Fees

5. General County Fund Taxes

How to pay property taxes?

The tax assessors will send you property tax statements several months before the property tax is due. The property tax bill usually includes an itemization of various taxes that make up your total property tax. Your entire property tax liability for the year listing in a prominent place on your statement. Payments are usually due to your county treasurer and can be made in person, through the mail, or online.

What happens if you do not pay your property taxes?

Property tax bills are sent at the beginning of each new year. Once you submit the invoice, property taxes are automatically attached to the title deeds of the properties which are due. If the taxes are left unpaid beyond the deadline, delinquent property taxes can turn into a lien against the property. If you do not remove the claim by paying the tax due, the property can be foreclosed on and auctioned in a tax delinquency sale.

Conclusion

Property Appraiser has a legal responsibility to study transactions and appraise property accordingly. They also track ownership changes, maintain maps of parcel boundaries, keep descriptions of buildings and property characteristics. Do you have any questions or suggestions? Please leave us a message in the comment section below.