Do you have a property in Marion County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Marion County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Marion County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Marion County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Marion County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Marion Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Property Search

Clicking the Property Search menu directs you to the page where you can encode property information.

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Marion County Property Appraiser’s Office Contact

Email

[email protected]

Address

Marion County Property Appraiser,

PO Box 486

Ocala, FL 34478

Phone

352-368-8300

Fax

352-368-8336

Other sections of the Property Appraiser Website

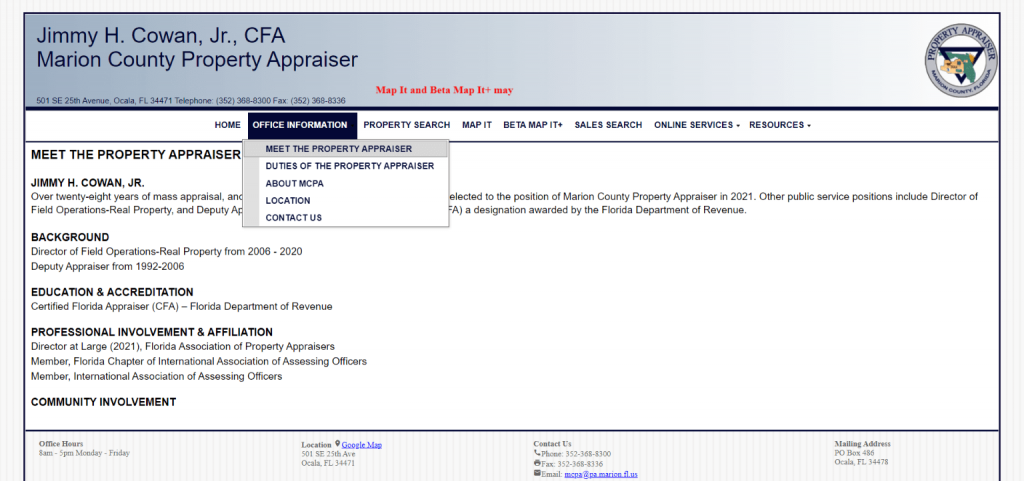

Apart from letting you search properties, the Marion County property appraiser’s website also offers you other information about the office of the Marion County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

Office Information

This drop-down menu offers you a wide range of information about their office and the appraiser. Here you’ll Meet the Property Appraiser, find out the Duties of the Property Appraiser, learn more About MCPA, find their office Location and Contacts.

Property Search

The Property Search Page is where you can search for records of any property using many different methods, like by Name, Address, Parcel – Real Estate, Parcel – Tangible, Property Class, Adverse Possession, and Map ID, among other ways.

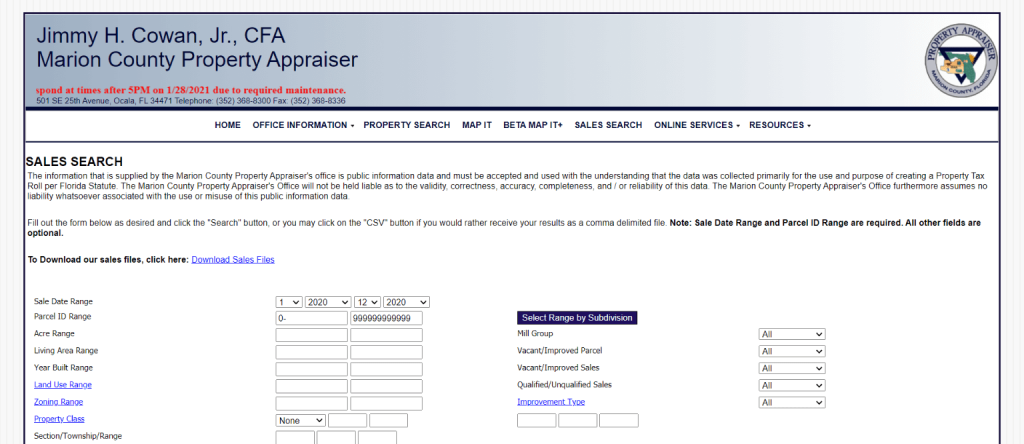

Sales Search

This section gives your information about which properties are on sale during a specific time frame you would wish to buy one, and it gives you the option to choose the Parcel ID Range, the size in acres, the Living Area’s size, the year it was built, and the Section/Township/Range, and the like.

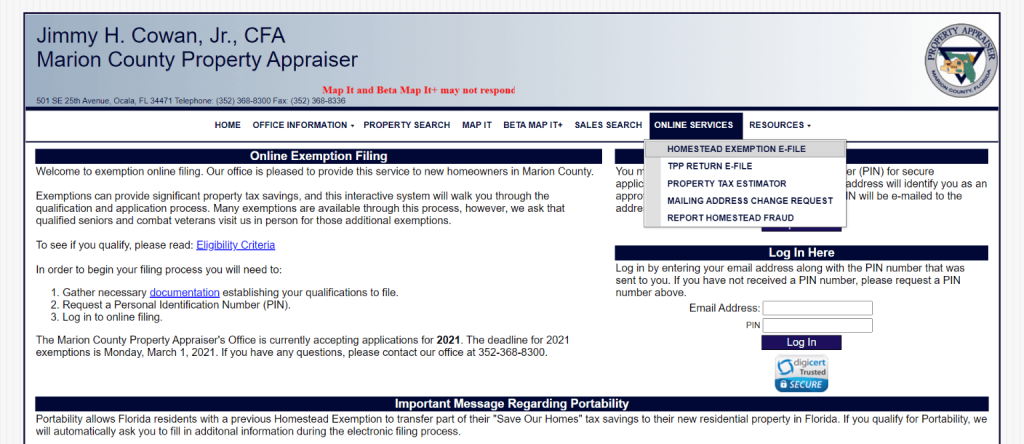

Online Services

From this section, you can find the Homestead Exemption E-File, TPP Return E-File, Property Tax Estimator, Mailing Address Change Request, and Report Homestead Fraud.

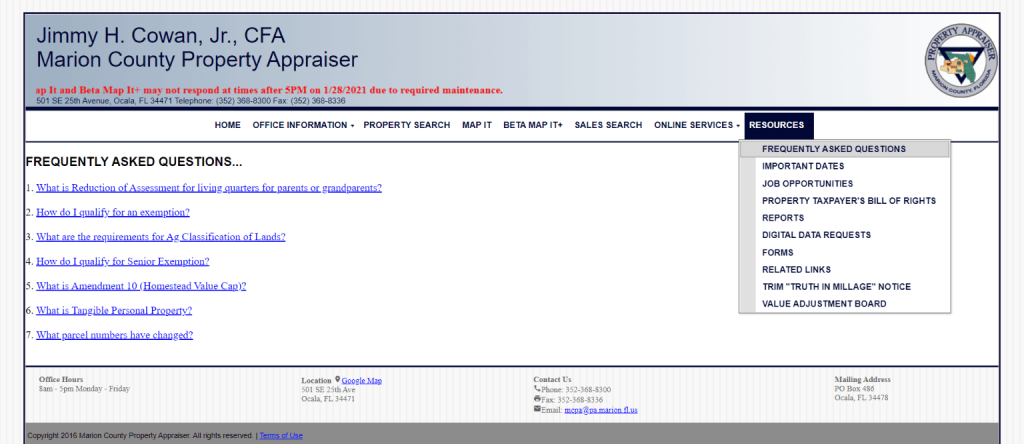

Resources

All other information about Marion County properties are in this section: the Frequently Asked Questions, Important Dates, Job Opportunities, Property Taxpayer’s Bill of Rights, Reports, Digital Data Requests, Forms, Related Links, TRIM ‘Truth In Millage” Notice, and Value Adjustment Board.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Marion County Property Appraiser’s Office, Website, Map, Search Content

Property Appraiser for Marion County has the duty of placing a fair and equitable value on all these real and tangible personal property. Real property includes all buildings and land, structures, and improvements to the land. The tangible personal property includes equipment and machinery, furniture, fixtures, and other items leased and owned for business purposes. If you want to know appraisers close to your property, visit Property Appraisers.

They also administer all the personal and property exemptions apply by the law of Florida. The property appraiser also maintains a current record of property card, name and address of the owner, ownership maps, or fiduciary, responsible for the payment of taxes. Maintaining the description accurately describes properties in the County.

Marion County PA has the mission to generate courteous service, accessible government, and accurate information. They would like to serve as the foundation in achieving the duties mandated by the Constitution and Florida’s laws to ensure transparency in the government.

All About Marion County PA Core Values

- Commitment- The property appraiser makes sure that the responsibility between their staff and the citizens is well served to use the resources effectively. And to have continuous innovation and improvement. The commitment they have enables them to provide access to data and e-services to the public at the taxpayer’s least cost.

- Public Service-First– Marion County PA office and website provide a prompt, courteous, and professional service to internal and external clients.

- Professionalism– Their office makes sure that they generate professional work ethics such as integrity, respect, and honesty for everyone.

- Accountability- Assessed value and personal exemptions are served accurately, equitably, and fairly. The employees of Marion County PA has the liability to the public and their colleague. To have a harmonious working relationship and an excellent service.

Access Website

The information on Marion County PA’s website is prepared as a public service for you. Providing access to public data to make a professional or personal decision is the primary goal of why the information is designated on their site. The property appraiser keeps on innovating additional features to enhance the site. But it does not hinder the visitors as they are always welcome to give their comments and suggestions.

Location and Contact Details

Marion County PA’s office is located at 501 SE 25th Ave. Ocala FL 34471. With its telephone number: (352) 368-8300, you can communicate with their staff to ask for assistance regarding your concerns. Your documents can be sent through their fax number: (352) 368-8336.

Read more about other appraisers such as Duval County Property Appraiser, Clay County Property Appraiser, and Nassau County Property Appraiser.

FAQ

Who is Marion County, PA?

Marion County PA has the duty of placing a fair and equitable value on all these real and tangible personal property. They also administer all the personal and property exemptions apply by the law of Florida. The property appraiser also maintains a current record of property card, name and address of the owner, ownership maps, or fiduciary, responsible for the payment of taxes. Maintaining the description accurately describes properties in the County.

How to contact Marion County PA

With the telephone number: (352) 368-8300, you can communicate with MCPA’s staff to ask for assistance regarding your concerns.

Where is Marion County, PA located?

Marion County PA’s office is located at 501 SE 25th Ave. Ocala FL 34471.

Conclusion

Marion County PA has the mission to generate courteous service, accessible government, and accurate information. They have to place a fair and equitable value on all real and tangible personal property.

Their office is located at 501 SE 25th Ave. Ocala FL 34471. Providing the accessibility of public data to use in making a professional or personal decision. This is the primary goal of why the information where designated on their site.

i’m trying to find the Homestead application but i can’t.