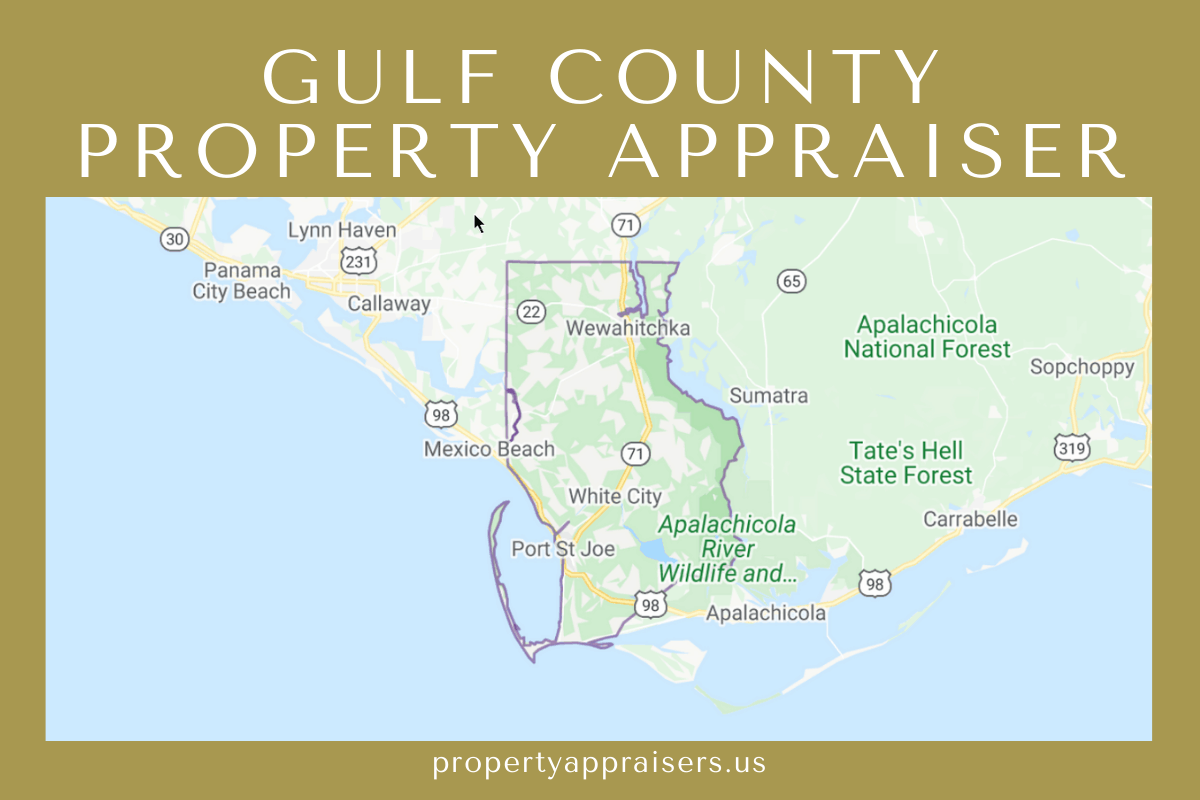

Do you have a property in Gulf County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Gulf County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Gulf County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Gulf County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Gulf County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Gulf Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Property Search

Scroll a little bit down the page and you will find Quick Links on the left-hand side. Click on Property Search, which is first on the list.

- Fill out the form

Fill out the form that appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., or legal information.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Gulf County Property Appraiser’s Office Contact

Email

[email protected]

Address

1000 Cecil G Costin Sr Blvd, Rm 110

Port St. Joe, FL 32456

Phone

(850) 229-6115

Fax

(850) 229-6661

Other sections of the Property Appraiser Website

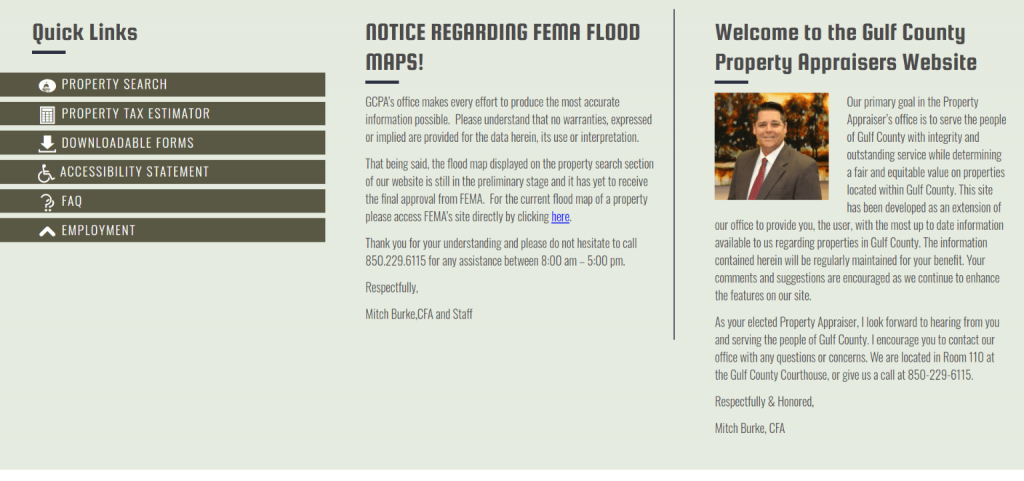

Apart from letting you search properties, the Gulf County property appraiser’s website also offers you other information about the office of the Gulf County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

Quick Links

This part of the homepage gives you easy access to some of the most used features of the site: property search, property tax estimator, downloadable forms, accessibility statement, FAQ, and employment.

General Information

This page gives you details about the Property Owner Bill of Rights and its amendments.

Tax Roll/Budget

This page gives you information about millage rates, tax roll certification, HB 909, and the budget.

Exemption

If you want to know the exemptions available in Gulf County, then this section has you covered. It gives you data on exemptions involving the following: Widow/Widower, Homestead, Seniors, and Portability, among others.

Personal Property (TPP)

This section gives your information about tangible properties as well as forms that you will need. It offers helpful hints and suggestions too.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Gulf County Property Appraiser’s Office, Website, Map, Search Content

The Gulf County Property Appraiser office’s primary responsibility is to serve citizens with trustworthiness and exceptional help while deciding on a reasonable and fair price on properties. There is a website made as an augmentation of the office to provide clients with the latest data. Before we discuss further, you can read more about other US property appraisers here in Propertyappraisers!

Access Gulf County Property Appraiser Search

The regional office of the Tax Collector was established under the 1885 state constitution. It felt that neighborhood assessments could be gathered by a nearby official, who might be progressively receptive to the network’s requirements that chose the person in question. A Tax Collector serves for a multi-year term and is selected by the President of the United States.

The Tax Collector is liable for the assortment of promotion Valorem charges and different duties set at the nearby level, including those by extraordinary exacting areas, state organizations, and province commissions. They are likewise going about as a specialist of a few state offices, including the Department of Revenue, the Department of Highway Safety and Motor Vehicles, and the Fresh Water Fish Commission.

In the Department of Revenue, the Tax Collector bills and gathers positive and individual property charges. The measure of the duty depends on the surveyed estimation of the property and the millage rate.

Different saddling specialists set these measures. As an operator of the Department of Highway Safety and Motor Vehicles, the Tax Collector issues state engine vehicle licenses and procedures for titles on autos, trucks, manufactured homes, and vessels. The Tax Collector likewise sells Hunting and Fishing licenses for the State.

In many areas, the Tax Collector is a charge office, and the Department of Revenue endorses the workplace spending plan. The workplace works on the expenses forced for administrations rendered and any overabundance monies dispatched to the Board of County Commissioners toward the finish of September consistently.

Are you looking for other property appraisers near your place? Is it Columbia County Property Appraiser, Orlando County Property Appraiser, Wakulla County Property Appraiser, or Indian River County Property Appraiser? Luckily, we have all those; check it out here!

Access Gulf County Assessor’s Office Site Services

The Gulf County Tax Assessor is answerable for evaluating the assessable estimation of all properties inside Gulf County. They may set up the measure of expense due on that property dependent on the honest assessment examination. Below is a list of services undertaken by the County as per their site:

- Property Tax Appraisals – The Tax Assessor evaluates and assesses every property’s estimation in his purview on a yearly premise. These assessments are in light of the highlights of the property. And the honest evaluation of similar features found in the same neighborhood.

- Property Renovations and Re-Appraisals – If you redesign your property, the Gulf County Assessor will re-evaluate your home to mirror the estimation of your new increments. Redesigns accounted for the Assessor’s Office by the zoning board, contractual workers, or property holders themselves.

- Making good on Your Property Tax – The Tax Assessor can give you a duplicate of your property charge appraisal. Show you your property charge, assist you with making good on your property imposes, or organize an installment plan. Installments made to the province charge authority or treasurer rather than the Assessor.

- Property Exemptions – The Tax Assessor can furnish you with an application structure for the County estate exclusion, which can give a modest property tax reduction for properties. These are utilized as the principal living place of their proprietors. Additional exceptions may be accessible for farmland, green space, veterans, or others. Call the Assessor’s Office and request subtleties.

- Property Tax Appeals – Once you accept your home is unjustifiably over-evaluated, the Gulf County Tax Assessor can give you a duty offer frame. And illuminate you regarding the expense claim process. Once your allure is acknowledged, your property valuation will be balanced as needed.

FAQ

What are property tax appraisals?

The Tax Assessor evaluates the assessable estimation of every property in his purview on a yearly premise. These assessments are in light of the property’s highlights and the honest evaluation of similar features found in the same neighborhood.

What is the duty of the Gulf County Tax assessor?

The Gulf County Tax Assessor is answerable for evaluating the assessable estimation of all properties inside Gulf County. They may set up the measure of expense due on that property dependent on the honest assessment examination.

What is the objective of the Gulf County Property Appraiser?

The essential objective in the Gulf County Property Appraiser’s office is to serve the individuals with trustworthiness and remarkable help while deciding a reasonable and even-handed incentive on properties.

Conclusion

Any email address provided in light of a public records demand is public property under Florida law. If, for whatever reasons, you don’t want electronic mail to the address, make it clear. Instead, contact this office by telephone or record it as a hard copy. You can physically go to the Gulf County civil government in the County Courthouse in Port Saint Joe. For any questions or more information on Gulf County Property Appraiser, please share with us below.