Do you have a property in Gulf County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Indian River County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Indian River County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Indian River County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Indian River County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Indian River Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Property Search

From the top menu, click on Search Records. You will be directed to a new page.

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

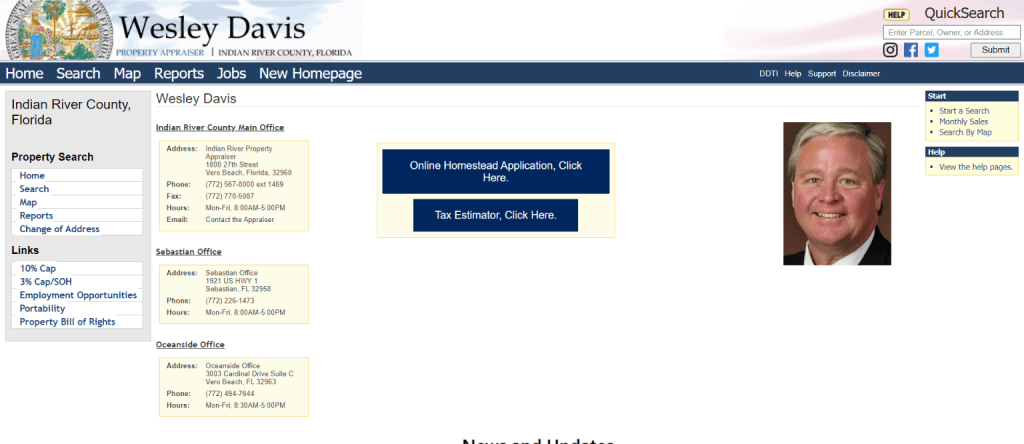

Indian River County Property Appraiser’s Office Contact

Address

Indian River Property Appraiser

1800 27th Street

Vero Beach, Florida, 32960

Phone

(772) 567-8000 ext. 1469

Fax

(772) 770-5087

Other sections of the Property Appraiser Website

Apart from letting you search properties, the Indian River County property appraiser’s website also offers you other information about the office of the Indian River County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

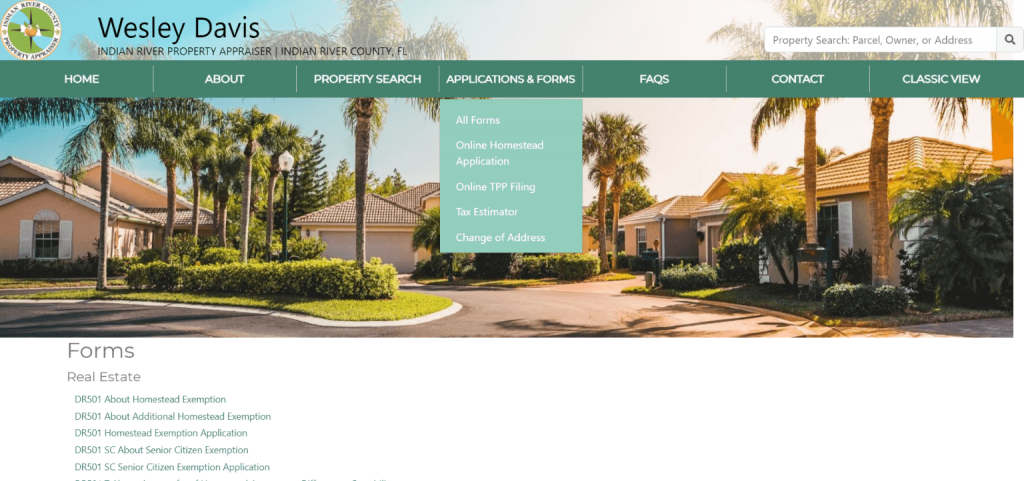

Application & Forms

This page allows you to download various forms from those that you need for homestead application to those for change of address and tangible personal property. You also have access to the tax estimator on this page.

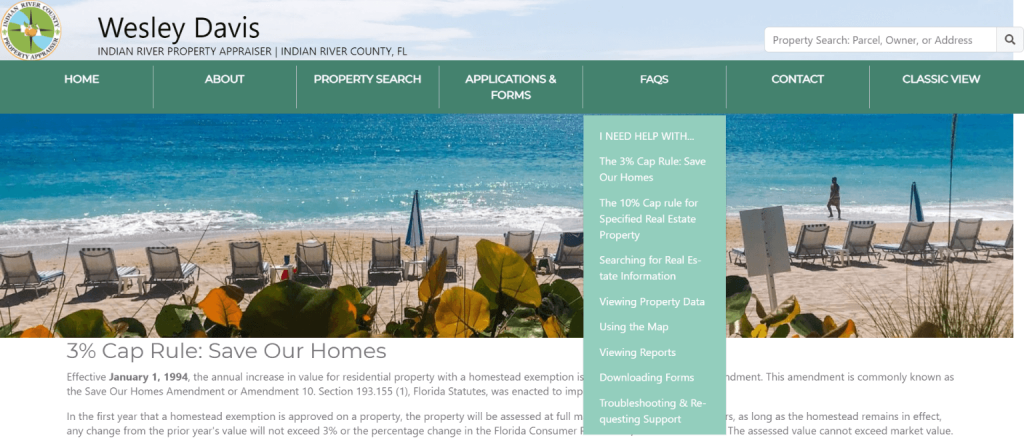

FAQs

As the name implies, this section answers all frequently asked questions related to appraisals, homestead, Save Our Homes, and some others.

Classic View

If you click the Classic View, you will find the contact information of the property appraiser and links to various online filing and downloadable forms.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Indian River County Property Appraiser’s Office, Website, Map, Search Content

The Indian River County Property Appraiser is mainly responsible for finding, locating, and fairly valuing all property within the Indian River County to assess the taxable value. It is generally done at the market value. This value is what someone would pay for the current state of the property appraised. For more about property appraisers near you, check out Property Appraisers.

Property inspection usually takes place at least once every five years. The property appraisers will visit several properties and inspect and value them accordingly. However, a property appraisal is not limited to just once a year. An assessment may become imperative if you want to sell the property due to other factors affecting the general real estate industry at that particular time.

A property appraisal is done strictly by qualified and certified appraisers. They inspect the property and determine its actual value, regardless of what the seller could be asking for. While determining the property’s real value, the appraiser will take a look at the interior and exterior components of the property and the condition of the neighboring property.

You can try the latest property appraisers for your property. Please read our article about Wakulla County Property Appraiser, Charlotte, County Property Appraiser, and Sumter County Property Appraiser.

The actual process of appraising a property, however, takes different approaches based on various factors. They include:

Access Arm’s Length Transaction

The first approach is for the property appraisers to identify types of properties sold in the neighborhood, complete with the prices, terms, and conditions under which they are selling. In this regard, the appraiser will study the transaction in detail to ascertain if it.

The transaction involves a willing seller and a willing buyer. There are no incentives to influence the sale. The appraiser will also establish if the property did not stay for a longer or shorter period in the market. Such a transaction is called an arm’s length transaction. Once the appraiser completes the evaluation of the properties sold in the neighborhood, they can then determine the property’s value relative to the sold properties in the community.

Review The Cost Approach

With the cost approach, the appraiser bases the appraisal on the actual cost to compare with an almost identical property in the same place. This approach is suitable when the evaluation of new properties that have just been constructed. But in the case of older properties, it will be necessary for the appraiser to establish the building’s diminishing value over the years.

It means that older buildings of identical property are likely to be appraised with a lower value than the new buildings of the same type if you use this approach. It will also be necessary for the appraisers to establish the value of the land. Without it, the property and any other improvements present therein.

Remember Income Approach

The income approach is primarily for appraising commercial properties. It focuses mainly on how much the property is likely to fetch should you choose to rent it out for commercials purposes such as a store, an apartment, an office, etc.

While doing such an appraisal, the appraiser will consider several factors such as the maintenance costs, taxes and insurances, operation expenses, and profits or returns that would usually come from such types of properties. Sometimes, the future projections in the increase or decrease of such factors can incorporate when using the income approach to appraise a property.

Would you like to add to your list of options the property appraisers near you? Is it Bay County, Gulf County, or Palm Beach County? We have their reference here for you.

FAQ

What is the role of the property appraiser?

The property appraiser’s primary function is to identify, locate, and justly value all property, both personal and real, for tax purposes. The services of the appraisers are especially crucial when one wants to sell or buy some property. They help you determine the price that most people would be willing to pay for that particular property.

What other roles can the property appraiser do?

Apart from valuation, the property appraiser also does the following:

1. Track ownership changes to the various properties

2. Maintain current maps of the property boundaries

3. Keep the legal descriptions of the multiple properties up to date

4. Receive applications and approve individuals who are eligible for the property tax exemptions.

What is the meaning of value property appraisal?

Market value refers to the amount at which your property could sell on the open market. The property appraiser must analyze the market transactions every year to determine the best market value of properties at the beginning of every year.

What are property tax exemptions?

Property tax exemptions refer to a relief given to certain property types, where they may not be charged any tax, or they can pay slightly lower rates compared to other types of properties.

Conclusion

The property appraiser’s primary role is to identify, locate, and justly value all property, both personal and real, for tax purposes. Should you want to determine the value of your property, you can use their services. Should you have any questions or suggestions, please leave us a message in the comment section below.