Are you a property owner in Columbia County that you wish to appraise? Are you curious about the property values and property taxes in this county? This page gives you details on how to check your property values online and get in touch with the Columbia County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Columbia County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Columbia County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Columbia County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Columbia Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Record Search

On the left-hand menu, click on Record Search, and you will be directed to a page where there are submenus for Real Property, Sales Report, and GIS Maps. Be sure you are on Real Property if you are going to check the value of your property.

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, include the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Columbia County Property Appraiser’s Office Contact

Email

[email protected]

Address:

Columbia County Property Appraiser

135 NE Hernando Ave.

Suite 238

Lake City, Florida 32055

Phone

386-758-1083

Fax

386-758-2131

Other Sections of the Property Appraiser Website

Apart from letting you search properties, the Columbia County property appraiser’s website also offers you other information about the office of the Columbia County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

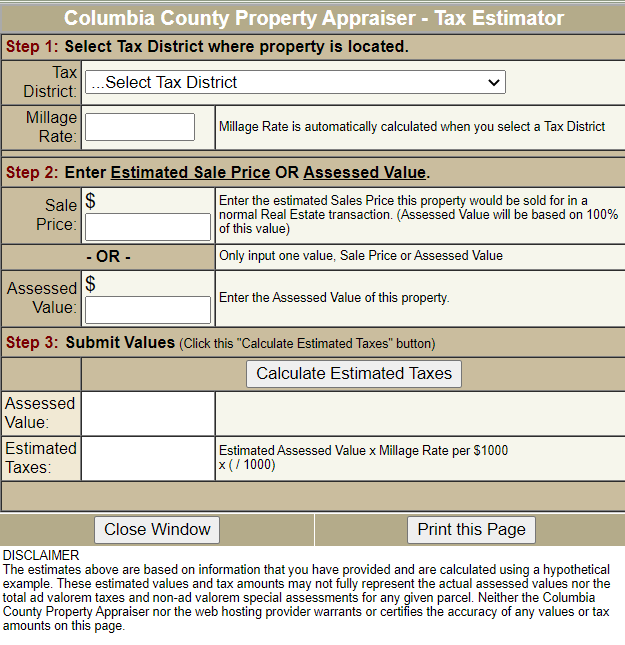

Tax Estimator

Clicking the Tax Estimator section brings out a pop-up of a form where you can encode information about your property to get an estimation of the cost of taxes it could incur.

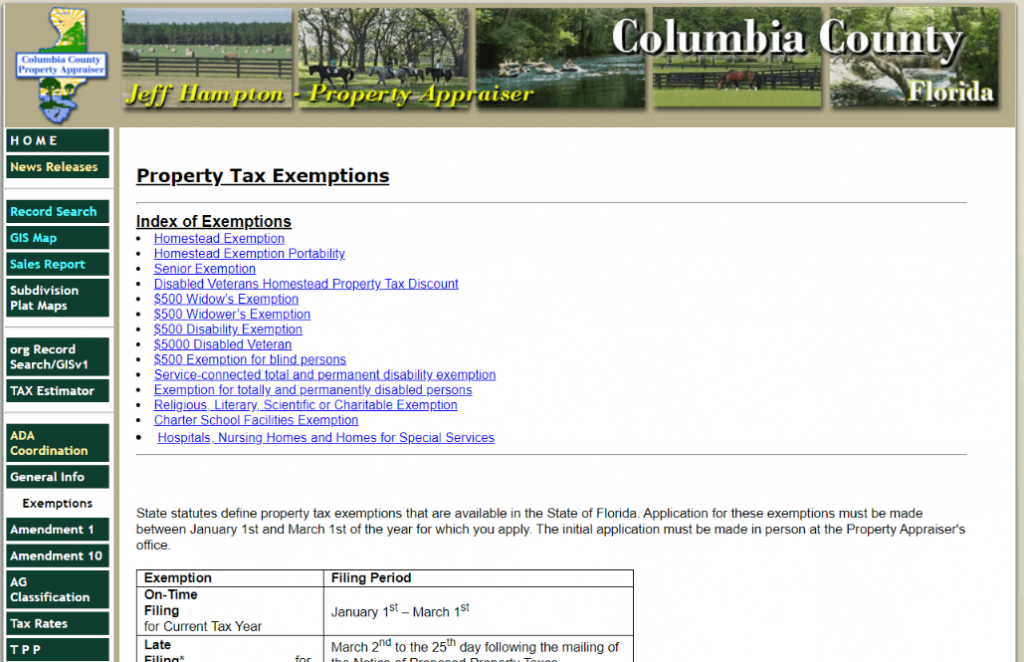

Exemption

This page gives you details about exemptions available in Columbia County. It also gives you an idea about how much to claim and the requirements. You’ll also find the filing periods on this page so that you are guided accordingly. Among the subsections here are Homestead Exemption,

TPP

This section answers all your questions about tangible personal properties, including why and how to file them. It even provides helpful hints and suggestions.

Download Forms

From this section, you can download most of the forms you need for Agriculture, Confidentiality, Review Request, Homestead, Tangible, Split/Combine, Non-Proft, Income & Expense, Brochures, Conservation, Address Change, and Appeals. You also have the option to View All Forms on a single page.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Columbia County Property Appraiser’s Office, Website, Map, Search Content

Property Appraiser for Columbia County, through the Florida Constitution, Jeff Hampton is responsible for setting reasonable and fair estimates for the county. Before discussing any further detail, you can check out Propertyappraisers for more information on other property appraisers.

The property appraiser is responsible for identifying, finding, and setting a fair value on all properties—both genuine and individual, inside the district for tax purposes. The “market” price of the actual estate depends on the present land showcase. Finding the “market” price of your property involves finding the price many people would pay for the property. Deciding on a reasonable and fair value of properties is the primary task of the office.

The appraiser doesn’t set the value. Individuals make the property value by purchasing and selling land in the commercial center. The appraiser has the legitimate duty to examine those exchanges and evaluate your property.

If you are in Wakulla County, we also have details about its property appraiser. You can also explore other property appraisers like Okaloosa County Property Appraiser, Orange County Property Appraiser, and Osceola County Property Appraiser.

Review Property Appraiser Taxes

To continue the delivery of social services and other functions in Columbia County, nearby governments need income. Your property taxes fund services such as government-funded training, law implementation, fire security, road support, park and entertainment territories, and other government services.

The Property Appraiser’s Office doesn’t decide your taxes. The different taxing specialists set the yearly fee or mileage rate.

Columbia County taxing specialists incorporate the city and area commissions, the educational committee, water the board areas, the modern improvement authority, and the medical clinic authority. When the tax rate is set, it is applied to your property estimation. At that point, your property tax is figured.

Martin County Property Appraiser, Orange County Property Appraiser, or Highlands County Property Appraiser? What do you want to explore? We also have references for them.

Review Property Taxing Procedure

The procedure for taxing genuine property starts with the acquisition of property. Then, a deal closed, the Clerk of Superior courts’ office in Evans, Georgia, records it. The Tax Assessor’s office then appoints value to the property, and an assessment notice is sent to every individual property proprietor in May or June of the following year. The property proprietor will then have a certain period to offer the doled out worth.

Meanwhile, when the intrigue procedure period has finished, a tax digest accumulates. The tax digest is an official posting of all property proprietors in the region, the surveyed estimation of the property they possess, and the property’s taxes. Tax digest is the focal archive of the tax office.

It is a finished posting of property proprietors, their road addresses, legitimate addresses, property areas, exclusions, assessments, and taxes due. After that, the overview was submitted to the State Department of Revenue for endorsement by the Property Tax Division Director.

After approval by the Columbia County Commissioner, bills are arranged and then sent out during the first week of September. The assessor must keep up current examination and assessment records by ensuring that essential field information and factors.

Causing changes in valuations as they happen in land use and upgrades reflected. Therefore, he/she is responsible for the remaining comparison of all exchanges inside the area. As well as keeping an updated record on all properties.

Access Columbia County Florida Records

The Columbia County Courthouse office comes up with the latest records. You have a privilege under Florida’s Public Records Law to investigate these records. Should you need help with these records, please don’t hesitate to stop by their office and ask for assistance.

In October of every year, the office guarantees the County Tax moves to the Tax Collector. The rolls contain information such as the name and mailing address of the proprietor, the parcel identification number, the lawful depiction, the surveyed worth and exclusions for the property, and the measure of taxes due.

These records are utilized to make the charges that are sent out by November 1 every year. Taxing specialists set the Mileage Rate considered with the assessment to ascertain the taxes for the year. Once paid, the Tax Collector distributes the funds to gather to the Taxing Authorities.

From there, the funds are used to provide services for the residents of Columbia County. The Tax Collector’s Office is devoted to providing the County with the most present data accessible. We also endeavor to provide helpful information on the web and in-person.

Access Columbia County Property Search

The province assessor must evaluate and survey all genuine property between the first Monday in January and the first day of July (ACA 26-26-1101). On and after 1 January 1991, taxpayers will yearly evaluate their distinct individual property for promotion Valorem taxes from January 1 through May 31 (ACA 26-26-1408).

The taxable substantial particular property of new residents and new organizations set between January 1 and May 31. Residents gain a distinct individual property from January 1 through May 31. Aside from that, the substantial personal property obtained from May 2 through May 31 will be assessable without misconduct within thirty (30) days following the date of its securing.

FAQ

Does the property appraiser toll or gather taxes?

No. The property appraiser evaluates all property in the area and is neither a taxing authority nor a tax-gatherer.

How is the property assessed?

Once in a while, the property appraiser or a staff appraiser will visit and investigate every property. Notwithstanding, individual property estimations might be balanced between visits considering deal movement or different variables that influence land prices in your neighborhood. Deals of comparable properties are solid pointers of significant worth in the land market.

What is the market price?

Florida Law necessitates that the simple estimation of all property is resolved every year. The Supreme Court of Florida has announced “simply value” to be legitimately synonymous with “full money worth” and “honest evaluation.”

What does a property appraiser do?

The property appraiser is responsible for identifying, finding, and reasonably esteeming all property, both genuine and individual, inside the region for tax purposes.

Conclusion

The records of the province assessor’s office comprise or evaluate the taxable property and people in the district. Along these lines, it is essential that they be precisely recorded and very much kept. You are welcome to visit the county office anytime you need help within working hours. If you have more information about the Columbia County proper appraiser, leave us a message below.