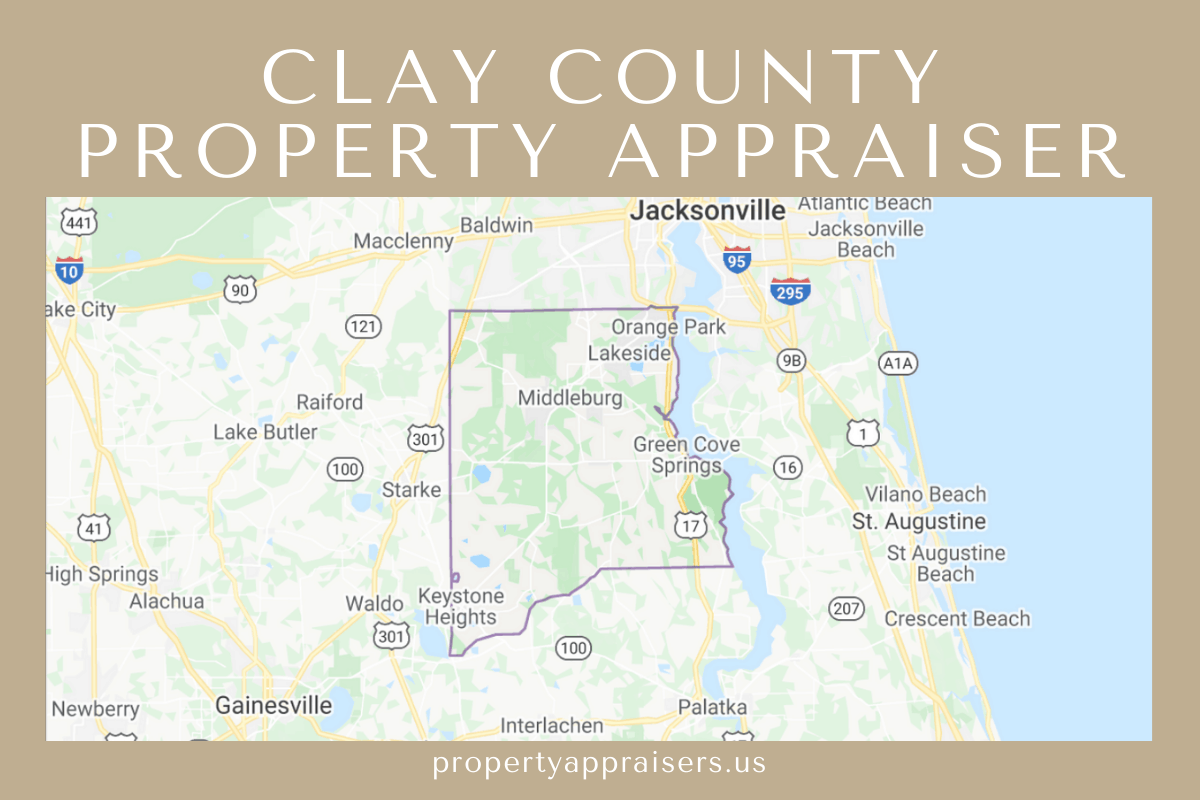

Do you have a property in Clay County that you wish to appraise? Are you curious about the real property values in this county? This page gives you details on how to check your property values online and get in touch with the Clay County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Clay County Property Value with Online Tools

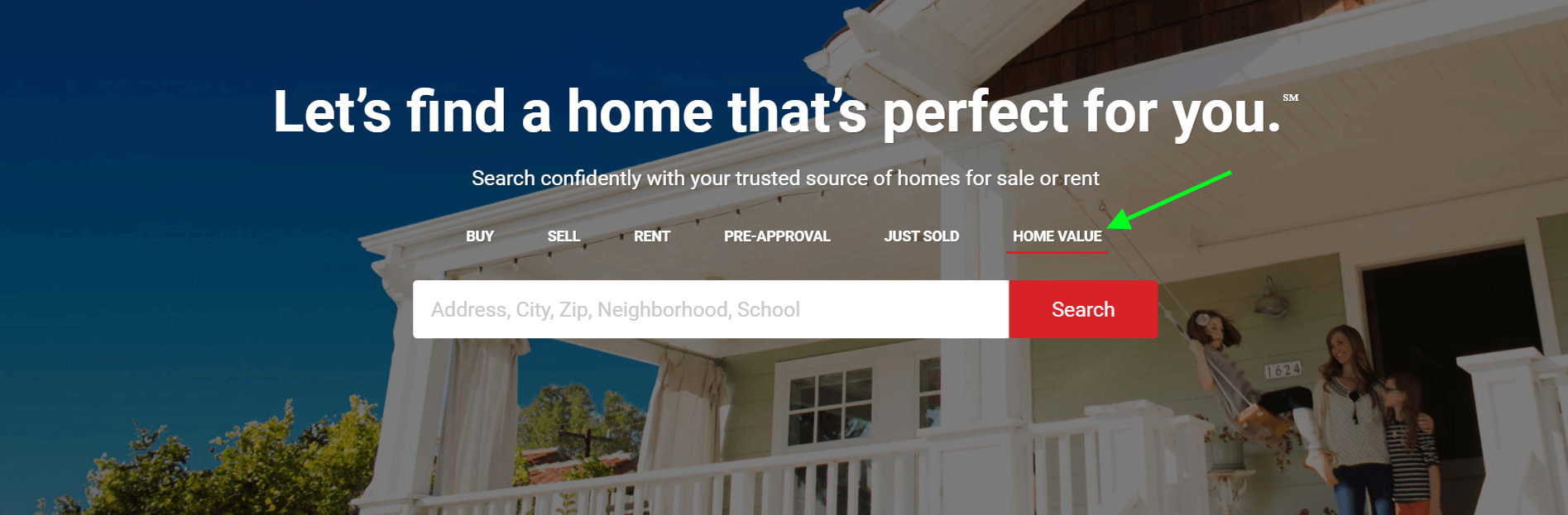

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

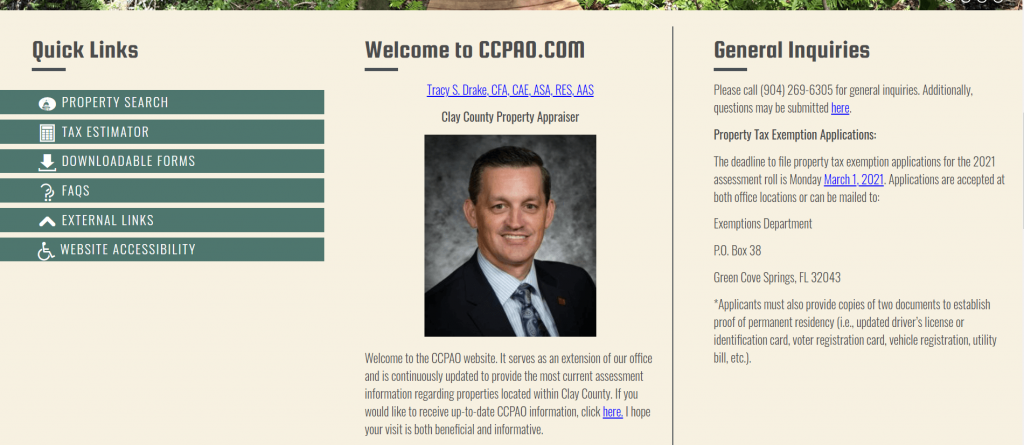

Visit Clay County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Clay County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Clay Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Property Search

Scroll halfway down the page, and you’ll find Property Search on the left-hand side of the screen. Click on it. You’ll be directed to a form.

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, include the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Clay County Property Appraiser’s Office Contact

Address

477 Houston Street, P.O. Box 38

Green Cove Springs,

Florida 32043

Phone

(904) 284/269-6305

Office Hours

M-F 8:00 a.m. – 4:30 p.m.

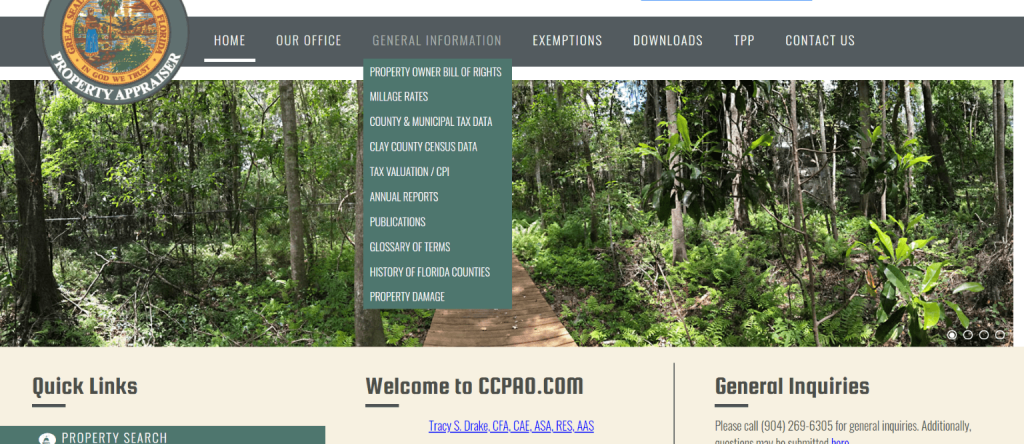

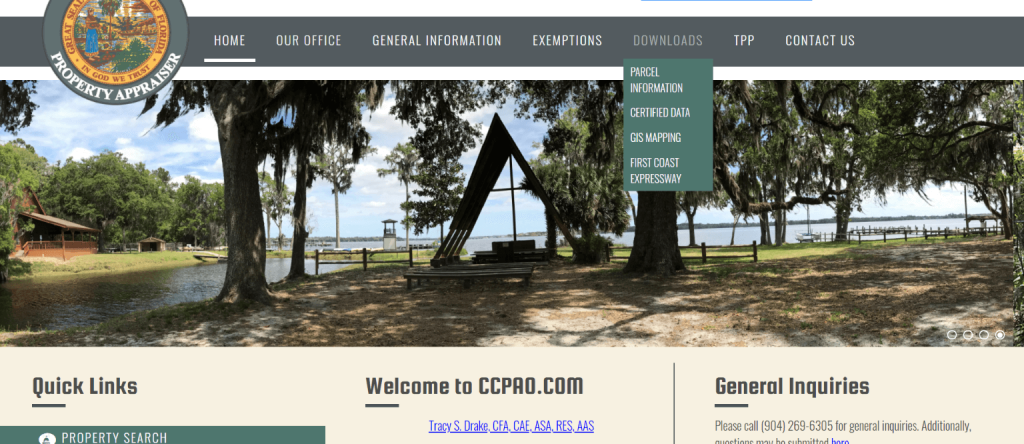

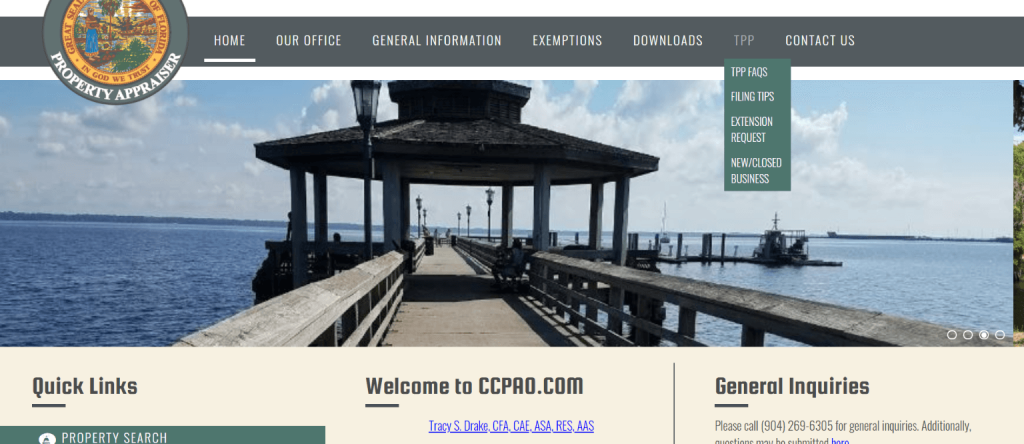

Other Sections of the Property Appraiser Website

Apart from letting you search properties, the Clay County property appraiser’s website also offers you other information about the office of the Clay County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

Our Office

This section gives you every detail you need to know about the Clay County Property Appraiser’s Office, but on top of that, this section gives you details as to where you can request public records and information about the certification of the tax roll.

General Information

If you want to check millage rates, property taxes valuation, annual reports, and other property records fr Clay County properties, this section has you covered.

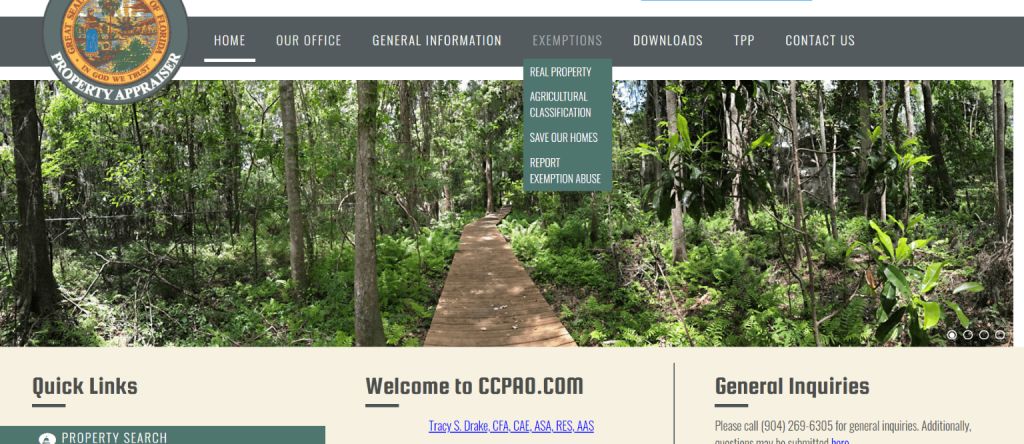

Exemptions

This section gives you details about exemptions on real properties, including agricultural properties. You may also report exemption abuse in this section.

Downloads

This section lets you download information about parcels, that you need for parcels, certified data, and even GIS mapping.

TPP

If you want details about tangible personal property, you may go to this section. YOu can get filing tips here and even make extension requests.

Other sections

Other useful sections on this website would include a page on tax estimation and one where you can download all forms you need. There is also a page for external links leading to vital Clay County government offices and agencies.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Clay County Property Appraiser’s Office, Website, Map, Search Content

A property appraiser is tasked to value all property, whether taxable or exempted from the valuation. The Clay County Property Appraiser covers over 96,000 properties, either real or tangible personal properties. If you want to find out the nearest appraiser to you, visit Property Appraisers.

All About Clay County PA

Clay County PA uses mass appraisal techniques as the primary valuation method to ensure all properties are assessed accurately, equitably, and efficiently. These include the cost approach, sales comparison approach, and income capitalization approach. Depending on the character of the property, the Clay County Property Appraiser’s Office may consider the following approaches:

Market (Just) Value – This is commonly defined as the most probable price for a property in a competitive, open market involving a willing buyer and a seller. The market value may increase or decrease as the market dictates.

Assessed Value – This is the property’s value after any assessment reductions, limitations, or caps have been applied, which are created by the legislature and are not directly related to market value.

Taxable Value – The assessed value minus exemptions is the taxable value, but it is not directly related to market value. Also, taxable value and tax levied are the formulae used to determine ad valorem property taxes.

You can also read other related articles like Hernando County Property Appraiser, Lee County Property Appraiser, and Leon County Property Appraiser.

Access Clay County PA Contact

If you want to talk to search more about Clay County PA or talk to an agent, here are some ways to reach them.

Clay County PA website

Visit the official website of Clay County PA and see all the details you need to know about real estate and properties in Clay County. You may also read to see what’s in store for you on this website. Since the office is open to the public from 8:00 AM till 4:30 PM, Monday through Friday, you may check the website to see the information you need.

You will find information about the Clay County PA Office, real property exemptions, TPP, general information, and other details on the homepage. This also includes information about Roger A. Suggs, Clay County’s property appraiser. Suggs, a Native Floridian, took office on January 6, 2009, after working in the Assessment/Appraisal field for more than 37 years.

Clay County PA property search

If you are looking for a particular property, you may click on the first tab to load another page. Here, you may search using the basic site address, multipart address, owner, parcel, sales, and or subdivision. Once the search results show, you may choose to export the search results in Excel for easier recording.

Clay County PA phone number

The Clay County PA office can be contacted through these phone numbers: (904) 284/269-6305. However, please be reminded that it is only open from Monday to Friday from 8:00 a.m. to 4:30 p.m.

Clay County PA Location

The Clay County PA handles evaluates all properties in Clay County. It is located at the following address:

477 Houston Street, P.O. Box 38

Green Cove Springs, Florida 32043

FAQ

Who is the Clay County, PA?

The duty of the Clay County PA is to help determine the value of a property through examination and research. The property appraiser has to come up with a detailed report about the property that indicates its value and the reason(s) why it was given such value.

Where to contact the Clay County PA office?

The Clay County PA office can be contacted through these phone numbers: (904) 284/269-6305.

Where is Clay County located?

The Clay County PA handles evaluates all properties in Clay County. It is located at 477 Houston Street, P.O. Box 38, Green Cove Springs, Florida 32043

Conclusion

These are necessary details about Clay County, PA. If you have any questions, please leave a comment below. We will try to provide answers to your queries.