Do you have a property in Broward County, Florida that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Broward County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Broward County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Broward County Property Appraiser Website

Meanwhile, if you are among the property owners who want a more detailed search about your property, visiting the Broward County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Broward Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Property Search

Clicking the Property Search menu directs you straight to the page where you must encode property information. There are going to be options for searches based on what information you have about your property.

- Fill out the form

You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, include the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Broward County Property Appraiser’s Office Contact

Electronic Mail

[email protected]

Address:

Broward County Property Appraiser’s Office

Broward County Governmental Center

115 South Andrews Avenue, Room 111

Fort Lauderdale, Florida 33301

Phone

954-357-6830

Other Sections of the Property Appraiser Website

Apart from letting you search properties, the Broward County property appraiser’s website also offers you other information about the office of the Broward County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

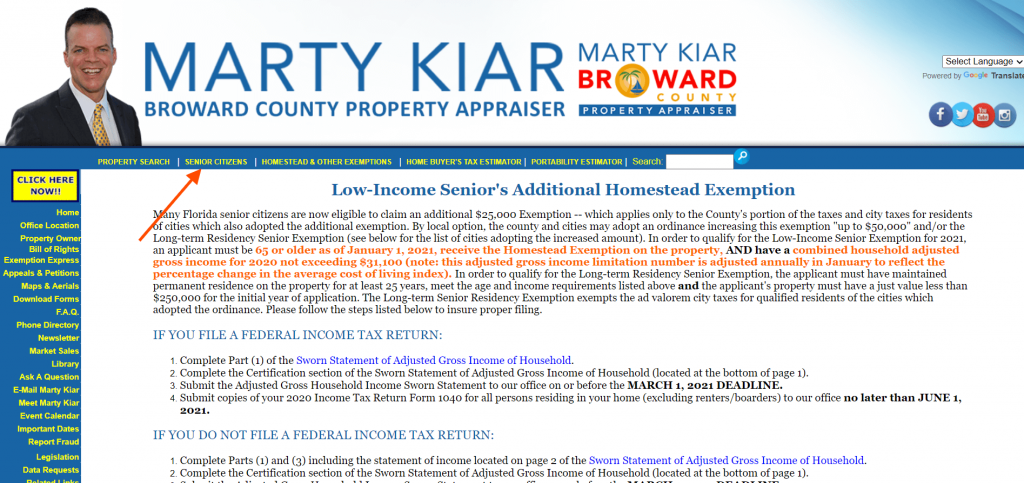

Senior Citizens

This page gives you details about homestead exemptions, including what you need if for filing or not filing a federal income tax return. It also contains a list of cities that have adopted Senior Citizen’s Additional Homestead Exemption.

Homestead & Other Exemptions

This page gives in detail what you need for assessment and applications of a homestead. It also gives information on other exemptions. You’ll also have access to every form you’ll need.

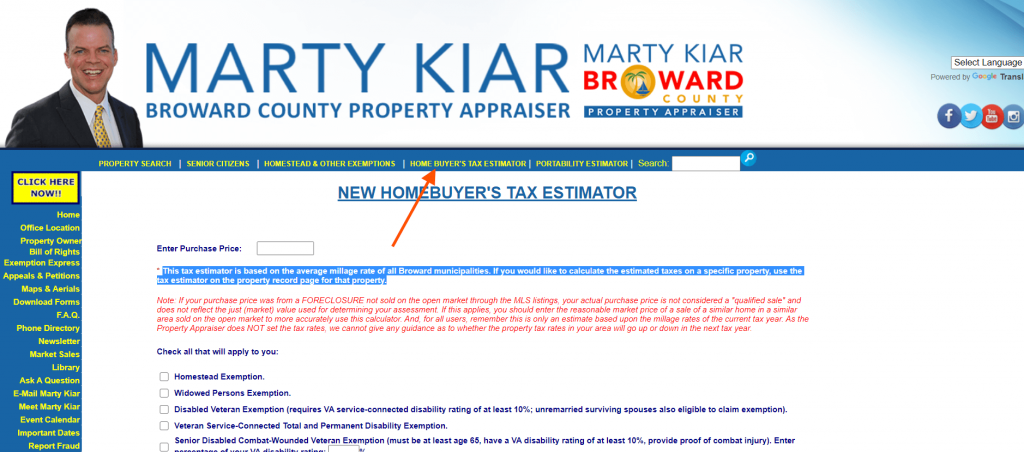

Home Buyer’s Tax Estimator

This page allows estimation of property taxes in Broward County, Florida. You can check the future taxes of a property you plan to buy or sell. It is based on the average millage rate in all Broward municipalities.

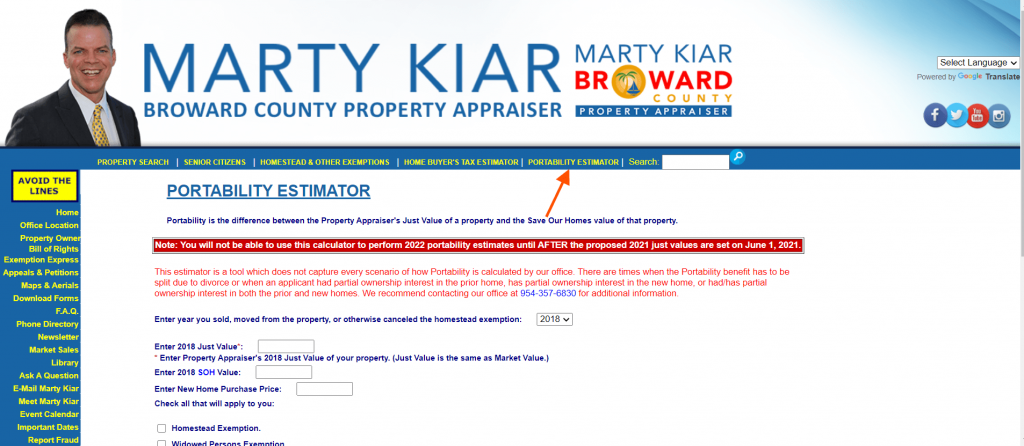

Portability Estimator

Take note that the portability is the difference between the Property Appraiser’s Just Value for a property and the Save Our Home value. This page gives you an estimate of the portability of your chosen property.

Other Sections

This website offers even more Broward County records and data on the side to help with the filing and applications related to your property. It has Exemption Express, Appeals & Petitions, Maps & Aerials, Download Forms, F.A.Q., Market Sales, Data Requests, among many others. This site is pretty detailed and easy to navigate.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Broward County Property Appraiser’s Office, Website, Map, Search Content

Broward County Property Appraiser helps to ensure you get money’s worth. It is crucial to remember that the evaluated value and the residential or commercial property’s market value are two different. Usually, the assessed worth of a home is less than the real market price of a property.

The examined value considers things like square footage and lot size; the actual market price considers much more, including recent updates done to a house, the overall condition of the home, supply and demand in a specific neighborhood, etc. If you have questions relating to your home’s evaluation, you will get in touch with the Property Appraiser’s precise details. If you want to read more about property appraisers, visit Property Appraisers.

All About Broward County PA

You can meet the Broward county property-appraiser (BCPA) to discuss the appraisal. Second, you can file a petition for the Broward County Adjustment Board. Lastly, you can take legal action and file suit in the Circuit Court (appeals options are also available).

Filing online for your homestead application to download the forms, utilize the tool for home buyers tax estimator, get tax cost savings info, and report scams.

Real estate tax rates (millage rates) are determined and computed by taxing authorities. These are a combination of chosen boards (city commission, school board, county commission) and not chosen groups( hospital districts, water districts, children’s services board, etc.). Your real estate tax is computed by taking the Assessed Home Value and subtracting Exemption Quantity( s). This number is the taxable worth of your house.

Review Broward County PA Homestead

Here are details on who can avail of Broward County PA’s services and what the requirements are:

- Florida Drivers License OR Florida I.D. Card

- Broward Citizen Registration OR a Statement of Domicile

- Social Security numbers of ALL owners.

Resident Aliens

- Irreversible Citizen” Permit,” or proof of asylum

- INS I-485 letter showing that application to transform to permanent resident status is complete.

Senior’s extra exemption

- Needs at least one owner to be 65 as of January 1, 2016.

- The total household adjusted gross earnings, not exceed$ 28,448.( call for info on required files)

NOTE: Husband or another half may file on behalf of both. Attend the Broward County Residential Or Commercial Property Tax Workshop Event for Realtors. Free event -seating is restricted. RSVP is required. This event is for realtors who offer the property in Broward County.

Looking for new appraisers? You can try Seminole County Property Appraiser, Polk County Property Appraiser, Pinellas County Property Appraiser, Palm Beach County Property Appraiser, or Orange County Property Appraiser.

If you own your house, live there permanently, and are a Florida resident since January 1, you might get approved for Homestead exemption. Homestead can lower your taxable value on your home by as much as $50,000, saving you around$ 750 annually. More importantly, your evaluated value, which is utilized to determine your home taxes, cannot increase by more than 3% annually after receiving the exemption. Not using by March 1 constitutes a waiver of the immunity for that year, and you need to apply for the next year instead. You need to meet the list below requirements as of January 1:

Have a legal or advantageous title to the residential or commercial property, tape-recorded in the Authority’s records on the property. Be an irreversible citizen of the state of Florida. Be a United States citizen or have an irreversible house card (green card).

The deadline is March 1 each year. Failure to file for an exemption by March 1 constitutes a waiver of the exemption privilege for the year under Florida law. Our office sends by mail all-new house owners an exemption package around 6-8 weeks after their deed is tape-recorded in the county records.

This package consists of guidelines on how to use it in person for homestead. Please read all directions carefully before sending the application online; log-on with your user ID and password. By mail, make sure to submit the form completely, indicate, and enclose copies of the needed paperwork and mail to their exemption department. When personally processing your application in their office, bring copies of all required paperwork to their office at the given address above, and they will fill the app for you.

Access Contact Information

If you have further inquiries and you want to talk to someone, here is some information on how you can visit or reach Broward County, PA.

Broward County PA address

See Us. Location: Their MAIN OFFICE is located at the Broward Governmental Center at 115 South Andrews Avenue, Space 111, in downtown Fort Lauderdale (just south of Broward Boulevard).

Broward County PA phone number

You can contact their office on this number– 954.357.6830. [email protected] or call 954.357.6830. Email addresses are public records under Florida law. If you do not desire your email address released in reaction to a public records demand, do not send out an email to this entity. Here is a quick phone list to direct you in the ideal instructions :

- Customer support, Exemptions & General Details – 954.357.6830

- House Values – 954.357.6831

- Apartment & Co-Op Property Values – 954.357.6832

- Business Home Values – 954.357.6835

- Agricultural Characteristics – 954.357.6822 or 954.357.7471

- Tangible/Commercial Personal Effects – 954.357.6836

- Report Homestead Fraud – 954.357.6900

- Residential Or Commercial Property Appraiser Marty Kiar – 954.357.6904

- Main Office – Fax: 954.357.8474

Find out more appraisers. Check out Volusia County Property Appraiser, Seminole County Property Appraiser, Pasco County Property Appraiser, Polk County Property Appraiser, and Brevard County Property Appraiser.

FAQ

Who is the Broward county property-appraiser?

You can meet the BCPA appraiser to discuss the appraisal. Second, you can file a petition for the Broward County Adjustment Board. Lastly, you can take legal action and file suit in the Circuit Court( appeals options are also available).

When to declare Broward county homestead property appraiser?

The deadline is March 1 each year. File for an exemption by March 1 constitutes a waiver of the exemption privilege for the year under Florida law. Our office sends by mail all-new house owners an exemption package around 6-8 weeks after their deed is tape-recorded in the county records.

How long does Broward county property-appraiser take to show a new owner from a purchase?

Tax payments are processed within 24 hours of invoice (as much as three service days throughout peak periods). Overdue Property bills are charged a 3% interest and advertising expenses. Overdue Concrete Personal effects bills are charged a 1.5% interest monthly and marketing expenses. Payor verifies your payment online from their public website, Broward. County-taxes.

Conclusion

Like any other company, a property appraiser engages in contracts with different vendors for various services like aerial oblique photography and Pictometry, printing, specialized software, computer equipment, etc. The State’s approved bid list is used instead of seeking new proposals or bids. By-and-by the company conducts its own appropriate RLI/RFP/competitive bid process.

Do you have questions related to this article? Let us help you by messaging us through the comment box down there.