Do you have a property in Bay County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Bay County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Bay County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Bay County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Bay County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Bay Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Search Records

From the top menu, click on Search Records, and on the next page, click on “Yes, I accept the above statement” after reading the statement.

- Fill out the form

Fill out the form that appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Bay County Property Appraiser’s Office Contact

Address

860 W. 11th Street

Panama City,

FL 32401

Phone

(850)248-8401

Fax

(850)248-8447

Other sections of the Property Appraiser Website

Apart from letting you search properties, the Bay County property appraiser’s website also offers you other information about the office of the Bay County Property Appraiser offers. Take note, however, that the Bay Count site claims no warranties, either expressed or implied, are given for the data n their sites, its use, as well as interpretation. Here’s a quick list of what you’ll find on the website.

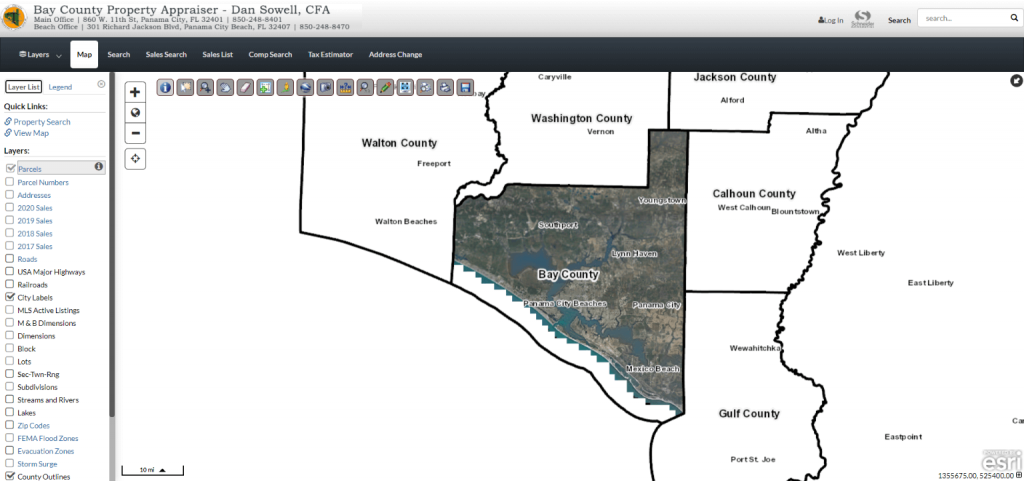

Map Search

After you click Map Search, on the next page, click on “Yes, I accept the above statement” after reading the statement. Doing so will direct you to an interactive map where you can also do a property search.

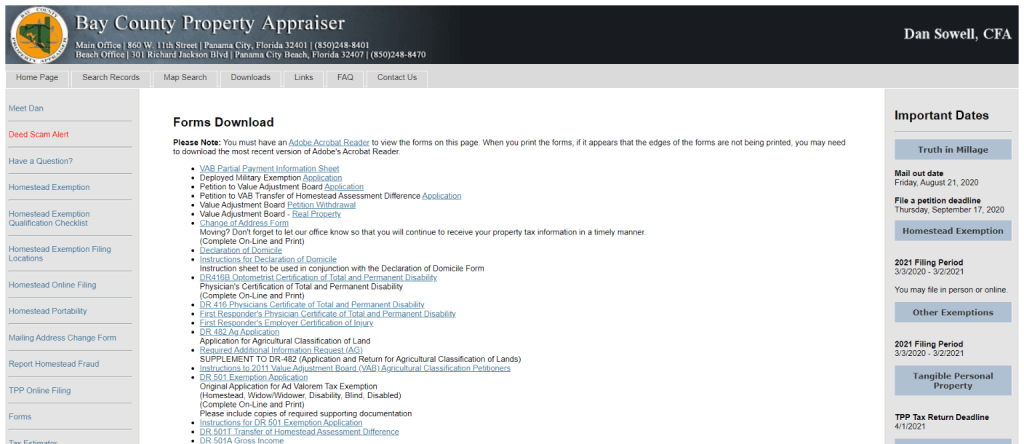

Downloads

This section gives you access to the forms and documents you need in relation to your real property. You can find forms for your homestead filing, value adjustment board information, or even tangible personal property forms.

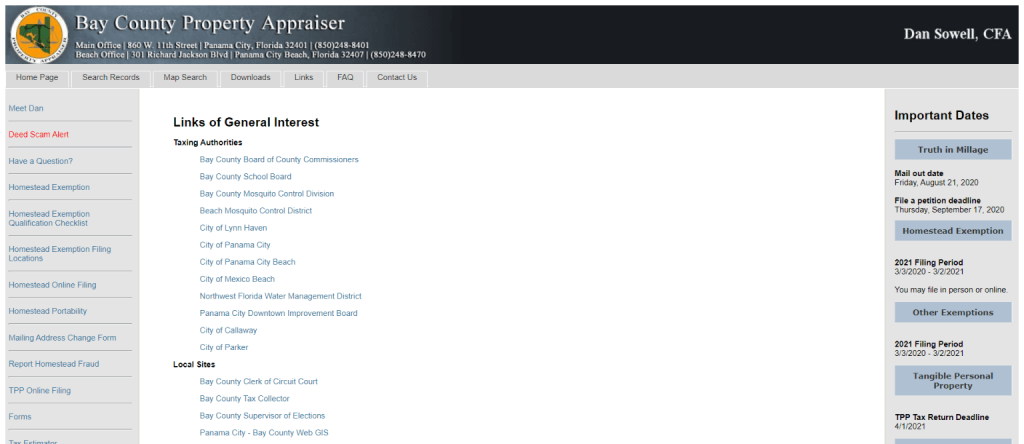

Links

This section gives you links to other government offices or agencies that you might need to reach out to about concerns with your properties.

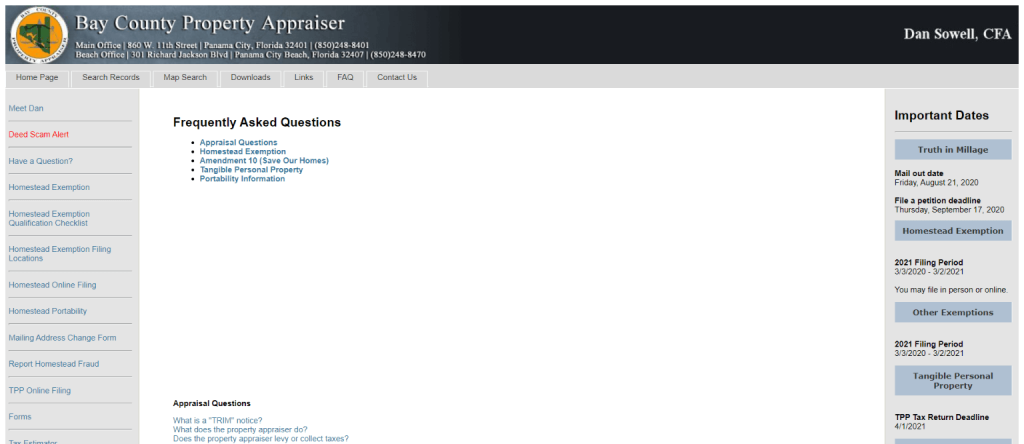

FAQ

As the name implies, this section answers all frequently asked questions related to appraisals, homestead, Save Our Homes, Tangible Personal Property, and some others.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Bay County Property Appraiser’s Office, Website, Map, Search Content

Achieving an outstanding service to the citizens and property owners is the aim of Bay County Property Appraiser or BCPA. By Florida State’s law, each property must be personally viewed in Bay County at least once every five years. Meanwhile, if you want to find the property appraiser closest to you, search in Property Appraisers.

All About Bay County Property Appraiser

The field appraisers are responsible for the inspection, photography, and measuring of the properties’ exterior parts. Their appraisers can easily be recognized with the official shirts with the BCPA photo identification card. The appraisers will never demand to enter your home and also will never enter a locked backyard.

The property appraiser does not determine the taxable property amount the owner will pay. The School Board, Board of the County Commissioners, and Local Taxing Authorities determine the tax based on the millage rate they set. Therefore, the property owner should not fear to appreciate their property’s value if the millage rates are accordingly.

As the value of the property increases, the millage rates must decrease and vice versa. By the law, if the value of the property increases, the millage rate must remain unchanged. You may see an increase in the assessed value even while the market value of your property drops if it is homestead property.

The homestead properties’ assessed value will increase by the amount of the CPI of up to 3%, whichever is less. The millage rates remain the same, though your taxes can still go up.

Read more about other related appraisers: Sumter County Property Appraiser, Walton County Property Appraiser, Nassau County Property Appraiser, Duval County Property Appraiser.

Review What Property Appraisers Do

The Property Appraiser has the responsibility to locate, identify, and fairly value all properties, including personal and real, within the Bay County for the tax purpose. The market value of the real property is based on the current real estate market.

The estimate of your property’s market value means discovering the price that most people would pay for your property according to its current condition. Remember that the property appraiser does not make the value. Buying and selling real estate in the marketplace is what makes the value. The Property Appraiser has the lawful responsibility to study transactions and appraise properties appropriately. Property appraisers also:

- Analyze trends in construction costs, sales prices, and rents to the best-estimated value of all assessable property

- Track changes in ownership

- Maintain maps of the boundaries of parcels

- Keeps property characteristics and descriptions of buildings updated

- Approve and accepts applications from eligible individuals for exemptions and another form of the property tax relief

Where are you located? Are you from Orange County, Pasco County, Alachua County, or Collier County? We also have articles about their property appraisers that you might want to read.

Location

BCPA has two offices you can choose to visit to ask for assistance to know your property’s market value or to inquire about the exemption services. The main office is located at 860 W. 11th Street, Panama City, FL 32401, and the Beach office you can find inside Panhandle Educators Federal Credit Union, 301 Richard Jackson Blvd, Panama City Beach, FL 32407

Contact Details

You can contact (850)248-8401 for inquiries in the main office of BCPA. Sending mail through fax at (850)248-844 will make your submission of documents much more comfortable. You can call the Beach Office at (850)248-8470 with their fax number (850)233-5057.

Website

BCPA gives value to the work they provide to the people and maintains their website for the users’ benefit. The features of the site are continuously enhanced.

Access Bay County Property Appraiser Record

The BCPA Office makes every effort to produce the most accurate information as much as possible. No warranties implied are provided for the data herein, its interpretation, or use. The Property Appraiser’s office does not assign addresses, nor is it responsible for the address’s accuracy on the BCPA website. Senior Exemptions do not apply to all taxing authorities.

The Property appraiser established the market value for the ad Valorem tax purposes. It does not represent the anticipated selling price. Information on the BCPA site should not be relied upon for insurance-related matters. The current year assessments areas of the 1st of January and are based on the previous year’s sales activity.

Review Homestead Exemption

The Homestead exemption decreases the taxable value of a property you made as your permanent residence by the amount up to $50,000. This exemption presents substantial savings on the taxes imposed against your property through various taxing authorities.Every person who has equitable or legal title to real property in Florida is qualified. Whoever has recorded the title instrument in the Bay County public records where the application is made, the candidates for exemption must reside on the property as of the 1st of January. They must be in good faith — making it their permanent residence to be eligible. For instance, if you are residing in your permanent home on the 1st of January 2019, you qualify for the homestead exemption of 2019.

Exemption applications must be made between the 1st of January and the 1st of March for the eligible tax year. Like if you were living in your property as your permanent home on the 1st of January, 2019. Then, you have until the close business of the 4th of March, 2019, to file your homestead exemption for that year. Failure to apply by the 4th of March of the tax year shall constitute a waiver of the exemption privilege for that particular year.

Additional Information:

Homestead exemption applications may be filed after the 4th of March, but the exemption will be applied in the next tax year. Like if you moved into your permanent home on the 1st of April, 2018, you can file for your exemption for 2019 anytime. From the 2nd of April, 2018, through the 4th of March, 2019.

At the “Forms” section of the BCPA website, you can print and complete the homestead exemption application. You can either mail in the app with all the supporting documentation or bring your information to the office of Bay County, PA. One signature is required for joint owners who are already married with the same last name, but all documentation listed below must be provided. The signatures are necessary if owners who occupy the home have different last names.

There are lots of appraisers that have a good implementation of their homestead exemption. You can also explore such appraisers like Miami Dade County Property Appraiser, Palm Beach County Property Appraiser, and Osceola County Property Appraiser.

FAQ

Who is Bay County, PA?

The field appraisers are responsible for the inspection, photography, and measuring of the properties’ exterior parts. Their appraisers can easily be recognized with the official shirts with the BCPA photo identification card. The appraisers will never demand to enter your home and also will never enter a locked backyard.

How to contact Bay County PA?

You can contact (850)248-8401 for inquiries in the main office of BCPA. Sending mail through fax at (850)248-844 will make your submission of documents much easier. You can call the Beach Office at (850)248-8470 with their fax number (850)233-5057.

How to search for property in Bay County, PA?

The BCPA Office makes every effort to produce the most accurate information as much as possible. No warranties implied are provided for the data herein, its interpretation, or use. The office of Property Appraiser does not assign addresses, nor is it responsible for the address’s accuracy on the BCPA website. Senior Exemptions do not apply to all taxing authorities. The Property appraiser established the market value for the ad Valorem tax purposes. It does not represent the anticipated selling price. Information on the BCPA site should not be relied upon for insurance-related matters. The current year assessments areas of the 1st of January and are based on the previous year’s sales activity.

Conclusion

Achieving an outstanding service to the citizens and property owners is the aim of Bay County Property Appraiser or BCPA. The Property Appraiser has the lawful responsibility to study transactions and appraise properties appropriately.

Bay County Property Appraiser has two offices you can visit to ask for assistance to know your property’s market value or inquire about the exemption services. The main office, which is located at 860 W. 11th Street, Panama City, FL 32401, and the Beach office you can find inside Panhandle Educators Federal Credit Union, 301 Richard Jackson Blvd, Panama City Beach, FL 32407.the bay county property appraiser