Do you have a property in Putnam County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Putnam County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Putnam County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Putnam Property Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Putnam County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Putnam Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Fill out the form

Fill out the form that appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Other information from the Property Appraiser

Apart from letting you search properties, the Putnam County property appraiser’s website also offers you other information about the office of the Putnam County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

Exemption

If you want to know the exemptions available in Putnam County, then the property appraiser office has a guideline for this. You can get data on exemptions involving the following: Widow/Widower, Homestead Fraud, Homestead, Non-Profit, veterans, Conservation, Seniors, and Portability.

Tangible Personal Property

You can gather information and apply the process of tangible personal property-related papers at the appraiser’s office as well.

Tax Roll

Apart from details about tax roll, the office could also provide you tax information related to properties in this county. You can get Millage Rates, Alachua Annual Report, DOR Tax Roll Data, Tax Roll Certifications, and even Download CAMA data.

Homestead

All can file for homestead exceptions and even report any homestead fraud.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Putnam County Property Appraiser’s Office, Website, Map, Search Content

Did you know? The development of Putnam County was in 1807 from a portion of Baldwin County. The Putnam County Property Appraiser Timothy E. Parker is duly elected to office. To develop the value of property commercial or residential property according to market value. The information here shows the values in the most current publish of tax digest. Meanwhile, if you want to read more about property appraisers, go to Property Appraisers.

The County’s goal is to be reasonable and accurate using available resources. And thinking about those forces which affect residential or commercial property worth in your area. Their office does not control residential or commercial property values; they rise and fall with the genuine estate market. After meeting an appraiser and examining the pertinent information, you deserve to comply with the Putnam County Board of Equalization.

Finding the best appraiser for your property? You can also read about Escambia County Property Appraiser, Santa Rosa County Property Appraiser, or Volusia County Property Appraiser.

All About Putnam County Property Appraiser

The County’s goal is to make these details readily available as quickly as possible for your use only. However, be mindful that online Files go through changes, and at the time you access them, the information might be different. The County gives no warrant or makes any representations regarding the quality, content, accuracy, or efficiency of the information, text, graphics, links, and other products contained on its web pages.

Residential brokers can inform their customers by providing user-friendly residential or commercial property reports that include property characteristics, current sales, home tax records, and beneficial property maps. You can depend on the present and accurate residential or commercial property data when doing your research, and all the tools are easy-to-use!

Access Public Information Database

The database provides information that is public record and offered through general information demands. Considering that the details appear to be precise according to each county’s report, some formatting and other errors might be present.

The basis of Real estate taxes is upon the marketplace value of your home. In some cases, local real estate tax assessors overstate that “worth,” which means that you pay more than your fair share in property tax! Print, sign and return our Residential or commercial property Tax Decrease application & authorization form, and we’ll start right away!

Review Homestead Exemption Fraud

All this information is a strategic planning process with the assistance of technology and tools to gather further and disperse information. For the Putnam County Property Appraisers, the Website is so far vital. Having a structured technique guarantee that works completes on time, and the mistake rate is dramatic.

Technology helps the Putnam Home Appraisers pay more attention and focus on the grievances of Putnam County’s locals. Discover the Homestead Scams from Putnam County Residential Or Commercial Property Appraisers. Any frauds associated with homestead exemptions in Putnam County are harmful to the overall well-being of the society. Homestead fraud can occur in 2 instances.

- If the individual who is receiving homestead exemption or has applied for one is not a permanent resident of the Putnam County

- If the person getting homestead exemption is not living on the home for which he/she is seeking this exemption.

FAQ

Who is Putnam County, PA?

The Putnam County PA presents information that reflects the worth developed in the most recent tax digest publish. Remember, the Appraiser’s Office establishes property worth only.

How to contact Putnam County PA?

You can contact the Putnam County PA on,

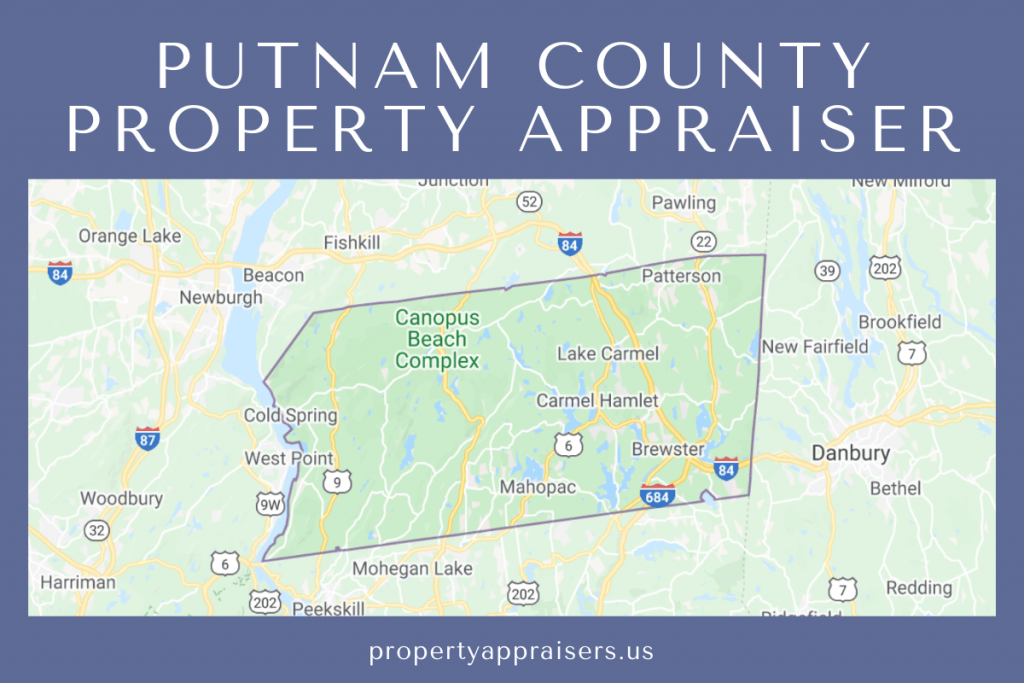

Address: 40 Gleneida Avenue Carmel

Hamlet, NY 10512, United States.

Phone: + 1 845-808-1111

Who is Putnam County Property Appraiser?

The Putnam County Property Appraiser Timothy E. Parker is duly elected to office to develop property commercial or residential property value according to market value.

Conclusion

We offer Putnam county title insurance coverage to secure your home financial investment. Contact us to discover more. Title Escrow and Closing services are likewise readily available within this County, with title commitments supplied within 24 hours. Just complete our order type. Your opinion or more information about Putnam County is welcome in the comment box below.