Do you have a property in Alachua County, Florida that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Alachua County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Alachua County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

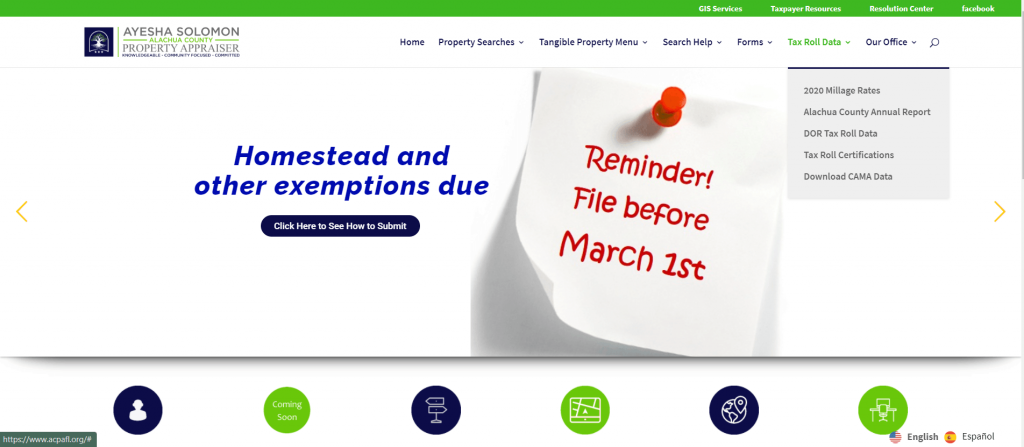

Visit Alachua County Appraiser Website

Meanwhile, if you are after the accuracy, correctness, reliability, validity, and completeness of appraisal information about your property, visiting the Alachua Florida property appraiser would be a good idea. However, checking out their website first would give you a basic understanding of pertinent details involving your property. Here’s how you can check your property’s worth from the website.

- Go to Alachua Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Property Searches

There will be a drop-down menu once you click or hover over this category. From the drop-down menu, choose Property Searches.

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Alachua Property Appraiser’s Office Contact

Email

[email protected]

Address:

515 North Main Street

Suite 200

Gainesville, FL 32601

Phone

(352) 374-5230

Fax

(352) 374-5278

Other Sections of the Property Appraiser Website

Apart from letting you search properties, the Alachua property appraiser’s website also offers you other information like contact information of Alachua County offices in Florida and even the Alachua County Social Services.

Do take note that the Alachua Property Appraiser’s Office assumes no liability in the use or misuse of public information. Meanwhile, here’s a quick list of what you’ll find on the website.

Property Searches

In this, there are three options. The Property Search allows you to check the value of specific properties in Alachua. If you’re interested in the purchase of properties, the Property Sales Search is where you should go. Meanwhile, if you want to compare prices and other property information, go to the Property Comparison Search.

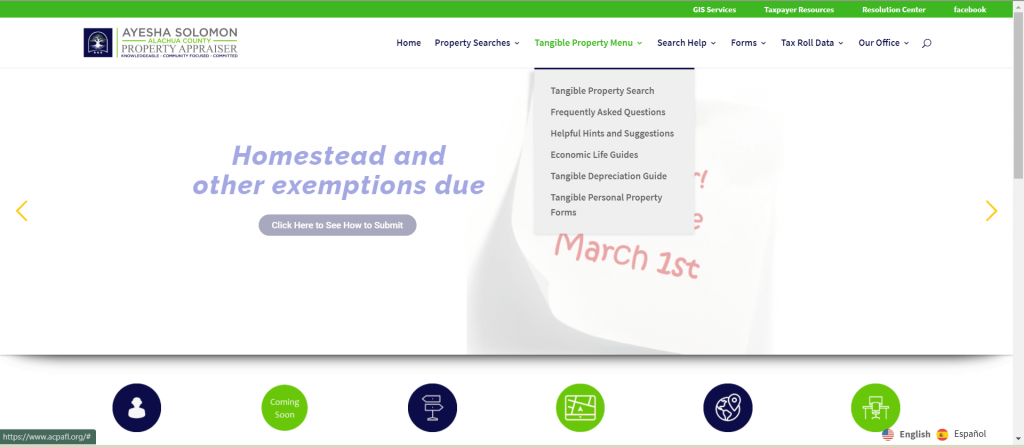

Tangible Property Menu

The Alachua property appraiser’s website also gives you information about tangible properties with sub-sections for Tangible Property Search, Frequently Asked Questions, Helpful Hints and Suggestions, Economic Life Gude, Tangible Depreciation Guide, and Tangible Personal Property Forms.

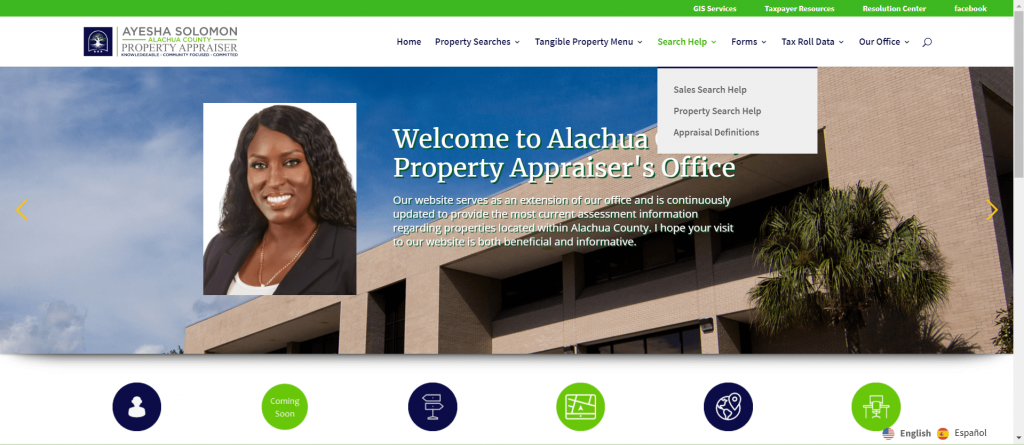

Search Help

This section mostly defines terms that you must be familiar with to do searches. If, for instance, there is certain information required for a search that you can’t understand, then you can resort to this section. The same goes if you see terms from search results that you don’t understand. This section s further divided into three: Sales Search Help, Property Search Help, and Appraisal Definition.

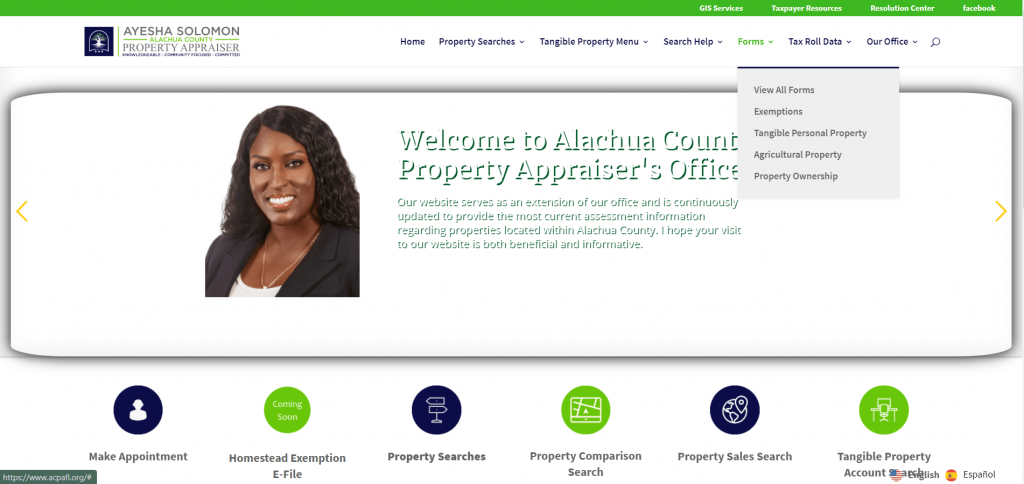

Form

From this section, you can download most of the forms you need for Exemptions, Tangible Personal Property, Agricultural Property, and Property Ownership. You also have the option to View All Forms on a single page.

Tax Roll

Apart from details about tax roll, this section provides you tax information related to properties in Alachua. You can get 2020 Millage Rates, Alachua Annual Report, DOR Tax Roll Data, Tax Roll Certifications, and even Download CAMA data.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Alachua County Property Appraiser’s Office, Website, Map, Search Content

If you have a property in Alachua County that you wish to appraise or curious about this county’s property values, visit the Alachua County property appraiser. The gives you details on how to get in touch with the Alachua County Property Appraiser’s office. However, if you’re interested in appraisers from other counties, visit Property Appraiser’s website.

All About Property Appraiser Website

If you want to find out more about the appraiser’s office before going there in person, it is best to visit the Alachua County Property Appraiser’s Office website. This site aims to provide proper service to the community, taxpayer, and the public abroad. It frees users from the difficulty of obtaining documents or attachments, including property ownership assessment data, information, sales data, building sketches, parcel ownership maps, aerials, property taxes, and many other data about the county’s properties. If you wish to read more about other property appraisers, visit the Property Appraiser’s website.

The site’s mission is to provide an excellent quality service to the customers proudly and ensure fair and equitable administration of property taxation laws at their best practices. It wants to deliver excellent administration and appraisal of property tax by their teamwork quality service with completeness, validity, and reliability.

If you are looking for the details of other property appraisers, we also have it. Please read articles about Citrus County Property Appraiser, Manatee County Property Appraiser, and Sarasota County Property Appraiser.

Access Website

The info supplied by the Property Appraiser website is public information data and should be accepted and utilized to understand that the information was gathered primarily for the usage and function of developing a Property Tax Roll per Florida Statute. The Alachua County Appraiser’s site will not be held liable regarding the credibility, correctness, accuracy, efficiency, and dependability of this information.

Are you near Leon County, Brevard County, or Gulf County? We also have articles for the details of their property appraiser that you might want to read.

Property Search

The search provides a list of all matched properties through the property search. You can select any property from the list to view your chosen property’s details after the list is returned. Use the drop-down boxes or enter the from: or to: values at the right corner.

Enter the selection data in the form: box to select the values. You can page forward by pressing the button located at the bottom part of the page. Once the search page’s result is returned, you have a chance to select an option to download the information of the requested parcel to your device.

Due to the available bandwidth restrictions for the website, 400 matched parcels limit the search to appear. Reaching above the number of parcels found in the matched selection criteria will hinder you from downloading the file.

The information gathered and supplied by the office of Alachua County PA is public information data and must be used and accepted to understand that the data was collected primarily for the purpose and use of creating a property tax roll according to Florida’s law. Their office assumes that they have no liability or whatsoever associated with the misuse or use of those public information data.

Location and contact details

In case you need the address, the contact details, or the fax number of the Alachua County appraiser’s office, we have provided the details for you. You may now visit, call, or send files through the given details below:

- Office: 515 North Main Street, Suite 200, Phone: (352) 374-5230, Fax: (352) 374-5278

- Custodian of Public Records: Jim Durrance, Phone: (352) 374-5230, Email: [email protected], Workplace Fax: (352) 374-5278

- Public Information Coordinator: Jeff Boyd, Email: [email protected]. , Phone: (352) 374-5230

Meanwhile, if circumstances, like today’s global health crisis, are preventing you from visiting the Alachua County appraiser’s office or meeting with an appraiser in person, you can check your property’s value on Realtor.com. If it’s a commercial property that you want to check, then visit Commercial Property Appraisal.

Review Homestead Exemption

Qualified residents can receive an exemption that will reduce the property’s taxable value up to $50,000 under Florida’s Constitution. To know better about Homestead Exemption, we listed common questions that we answered for you to learn and discover.

Q. As per the Property Appraiser’s, who is qualified for the homestead exemption?

A. The residents of Florida who have equitable or legal title to the property occupy the home and have the intention to make the property their permanent residency, as of January 1, are entitled to the homestead exemption.

Q. When can I apply for the exemption?

A. It is recommended that you apply as soon as possible once you occupy and own the property. First-time applicants should file before the deadline of March 1 for the tax year they desire to qualify.

Q. Is it a need to be a US citizen to qualify for the exemption?

A. Yes, except residents permanently residing in the United States under color of law (PRUCOL) and resident aliens.

Q. What if I fail to appeal to the deadline?

A. If you fail to comply with the March 1 deadline, renounce your privilege of homestead exemption until the following year. But, missing the period due to “extenuating circumstances,” should contact the Alachua County PA office for further advice.

Q. Do I have to appeal for the homestead exemption every year?

A. If there is no change in the situation like your occupation with the residence and still has the intention to make the property your permanent home, your application for the homestead exemption renews automatically. Early in January, your receipt will be sent through the mail. You are responsible for notifying the property appraiser if there are changes with your qualification to receive the homestead exemption.

If you are near Lake County, Citrus County, Osceola County, Miami Dade County, or Duval County, you can also read about their appraiser.

Q. Can homestead exemption be transferred?

A. Homestead exemption is non-transferrable. Every time you establish a new residence, you are required to make a new application. Residency and title as of January 1 will determine if you are qualified for the homestead exemption.

Q. Can I get an exemption if I reside in a mobile home?

A. Yes, you can still get an exemption. This is if you have a beneficial or legal title to the land that you may qualify. You must bring the title or registration of the mobile home if you own both the mobile home and the land. It is required that you must declare the mobile home as your real property by purchasing an RP decal. If you own the land but not the mobile home, you must purchase a decal yearly, and the mobile home will no longer be assessed to the property.

Remember Important Dates to Remember

There are regular dates that you must remember to not lapse with the responsibilities you have. However, we made a list, so it will be easier for you to remember those dates.

- January 1 – Your property’s condition and statute on January 1 will determine the property’s value for the tax year. January 1 is also the date that will determine the ownership or residency requirements to qualify for the exemption.

- March 1 – All exemption requests filing due, including the homestead and all classified use, including agricultural classification.

- April 1 – Deadline for filing a tangible personal property tax return.

- Mid August – Truth in Millage or notice of proposed property taxes, notices are mailed to property owners. This notice will begin the appeal process and contains deadline notifications.

- November 1 – Mailing of tax bills.

In case you have issues paying your taxes, please call the tax operations department at (352) 264-6968 to discuss payment options.

Explore other appraisers such as Sarasota County Property Appraiser, Marion County Property Appraiser, Lee County Property Appraiser, Collier County Property Appraiser, and Hernando County Property Appraiser.

FAQ

Who is Alachua County, PA?

Alachua County PA honorable Edward A. Crapo says that the website they made aims to provide proper service to the community, taxpayer, and the public abroad. To also obtain property ownership assessment data, information, sales data, building sketches, parcel ownership maps, aerials, and many other data about the county’s properties.

How do I contact Alachua County PA?

– Office: 515 North Main Street, Suite 200, Phone: (352) 374-5230, Fax: (352) 374-5278

– Custodian of Public Records: Jim Durrance, Phone: (352) 374-5230, Workplace, Email: [email protected], Fax: (352) 374-5278,

– Public Information Coordinator: Jeff Boyd, Email: [email protected], Phone: (352) 374-5230

How do I search for property in Alachua County, PA?

The search provides a list of all matched properties through the property search. You can select any property from the list to view your chosen property’s details after the list is returned. Use the drop-down boxes or enter the from: or to: values at the right corner.

Where is the Alachua County property appraiser’s office located?

– Office: 515 North Main Street, Suite 200, Phone: (352) 374-5230, Fax: (352) 374-5278

– Custodian of Public Records: Jim Durrance, Phone: (352) 374-5230, Workplace, Email: [email protected], Fax: (352) 374-5278,

– Public Information Coordinator: Jeff Boyd, Email: [email protected], Phone: (352) 374-5230

Conclusion

Alachua County PA, understanding your need for convenience when having your property appraised, aids you not only in checking the value of your property but even when meeting with tax collectors or when checking your property taxes. The office ensures the and equitable administration of laws on property taxes at their best practices.

Comment any suggestions or questions you have below.