Do you have a property in Okaloosa County that you wish to appraise? Are you curious about the property values and exemptions in this county? This page gives you details on how to check your property values online and get in touch with the Okaloosa County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Okaloosa County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Okaloosa County Property Appraiser Website

Meanwhile, for a more detailed search about your property appraisal and exemptions, visiting the Okaloosa County property appraiser would be a good idea, but checking out their website first would be even better especially if you want to find out about taxes and exemptions. Here’s how you can check your property’s worth from the website.

- Go to Okaloosa Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Property Search

On the homepage, scroll down a little and n the Quick Links list, click on Property Search.

- Fill out the form

Fill out the form that appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Okaloosa County Property Appraiser’s Office Contact

Address

1250 Eglin Parkway N., Suite 201 Shalimar, FL 32579

Phone

850-651-7240

Fax

850-651-7244

Other sections of the Property Appraiser Website

Apart from letting you search properties, the Okaloosa County property appraiser’s website also offers you other information about the office of the Okaloosa County Property Appraiser offers. You can get details like homestead exemptions and exemption from taxations, among many others. Here’s a quick list of what you’ll find on the website other than appraisal and exemptions.

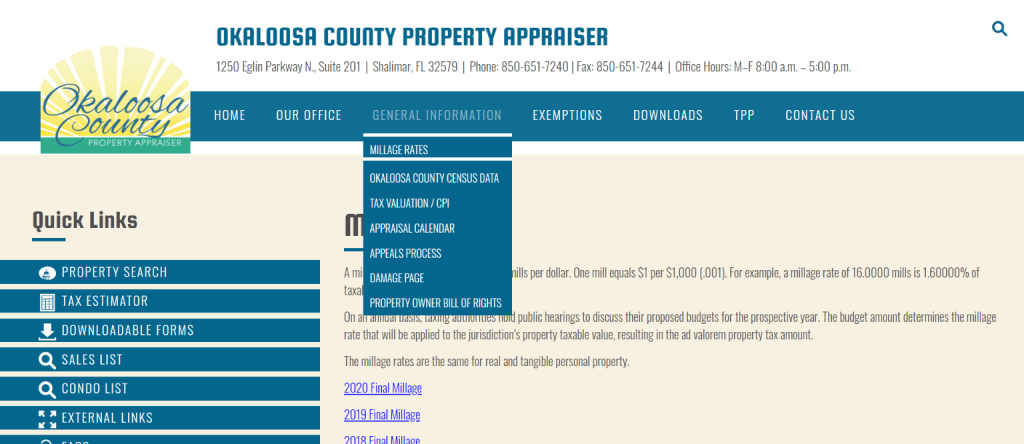

General Information

This section provides you with various information about millage rates, tax evaluation, and appeals process among others.

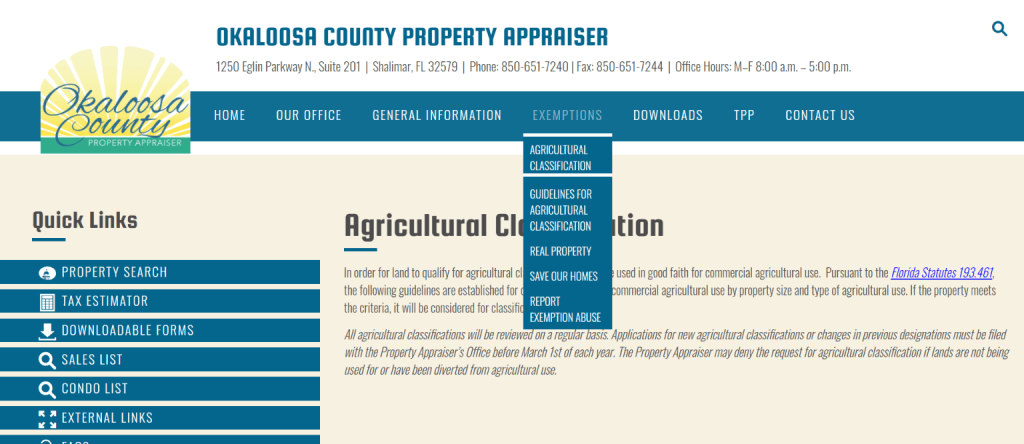

Exemption

If you want to know the exemptions available in Flagler County, then this section has you covered from answers to your questions on exemptions up to exemption applications. It gives you data on exemptions involving the following: Save Our Home exemptions, senior exemptions, among other details on exemptions and the extent of exemptions.

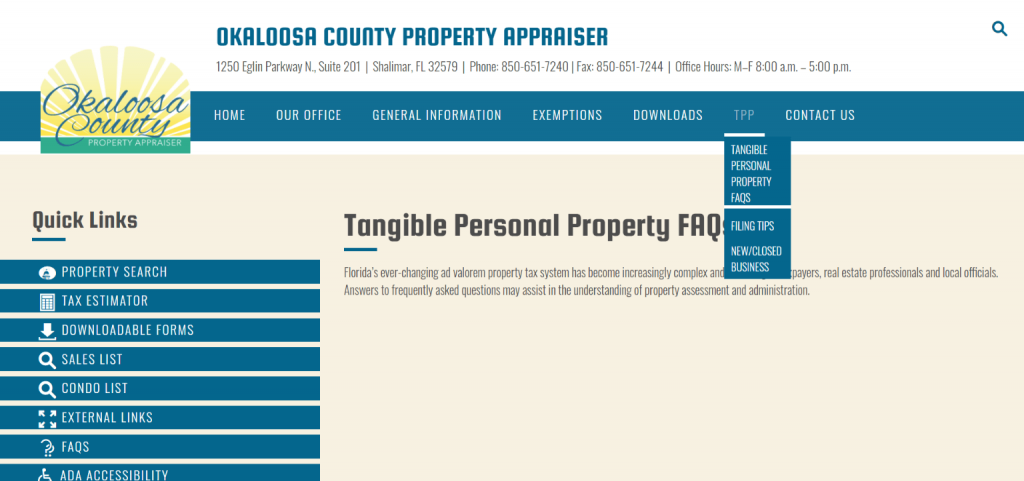

TPP

This section gives you every piece of information needed about the tangible personal property (TPP), including filing tips.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Okaloosa County Property Appraiser’s Office, Website, Map, Search Content

Mack Busbee invites you to visit the Okaloosa County Property Appraiser. It is an online service the county presents as a public service to provide an overview of the county’s intends responsibilities and functions of the Property Appraiser’s office. If you want to know more about property appraisals, visit Property Appraisers.

In Florida, all Counties offer Real Estate Appraisal and closing services. Consisting of Appraisal and title services are now provided in every County in Florida by call and choose ASI. Get your files finished rapidly and accurately. Why do residential or commercial property requirements evaluation?

Florida requires the Okaloosa County Home Appraiser to assess all homes within its jurisdiction. This assessment helps determine the market worth can attach to that home, and there will be no undervaluing or overvaluing throughout purchasing or selling.

Aside from Okaloosa County Property Appraiser, try reading the details of Monroe County Property Appraiser, Miami Dade County Property Appraiser, or Martin County Property Appraiser. They have appraisers that can help you with the tax of your property.

All About Okaloosa County Property Appraiser

The Okaloosa Home Appraiser’s office has the needed standards for this exemption. Okaloosa County Appraiser needs all petitioners of this exemption to furnish information of their home and develop their credentials. For example, disabled persons need to provide the Okaloosa County PA with property files appropriately signed by two physicians of that County who are not associated with the owner.

You can likewise visit our site and go through the often asked questions (Frequently asked questions). If you are unsatisfied, call the Okaloosa Home Appraiser’s office and fix a consultation. Okaloosa County Title Business – Okaloosa County Florida Residential Or Commercial Property Appraiser At our Okaloosa county title business, we use cutting edge software application, which helps us close title cases with double the speed.

What County are you looking for? Polk County, Pinellas County, or Pasco County? We have what you are looking for as a property appraiser to those counties.

Review Home Exemptions

What are the standards for the Appraisal of a home? The Okaloosa County Appraiser is governed and monitored by the state of Florida. The Okaloosa County Home Appraiser’s workplace requires every owner to fill out a form for the category of home.

You can also file for tax exemption and likewise notify the Property Appraiser if there have been many additions, modifications, alterations, or improvements on the said home.

This appraisal system of the Okaloosa Florida Residential or Commercial Property Appraiser also helps the Tax Authority levy tax on the home. The Okaloosa County Appraiser is accountable for helping owners of real estate to declare tax exemption. The Florida State law provides an exception referred to as Homestead Exemption. Under this exemption, the value to appraise is less by $50,000, the home’s tax.

No use of the property to settle Tax Lien

The Okaloosa County Value Adjustment Board presently has no legal authority to advise the Residential or commercial property Appraiser from tape-recording a tax lien versus the taxpayer’s value the Property Appraiser to eliminate a taped tax lien. A cancellation of (as opposed to a denial of the current year) homestead exemption and the imposition of a tax lien by the Residential or commercial property Appraiser is not based on the Value Modification Board evaluation present.

Invite to Okaloosa County, where many check out, and we are lucky enough to call house! From diverse Fort Walton Beach and the beaches of Destin to rivers, lakes, and forests in the Crestview area, there are numerous choices among the nine municipalities of Okaloosa County in which to live. Our community is house to military members and families consisting of the United States Air Force, Army, Navy, Militaries, and Coast Guard.

Okaloosa Family destinations

We have various distinctions for our soft, white, sandy beaches that include “Finest Beach, Finest Family Destination, and Finest Location to Boat,” to call a few. Acclamations are from media outlets such as the U.S.A. Today, Southern Living, Travelocity, the Travel Channel, and most recently, Okaloosa County made the top ten list for “Finest Places for Service & Careers” by the Forbes Service Institute.

One such example will be the brand-new Marine Life Center on Okaloosa Island, which will increase the local seafood industry through stock enhancement, provide aquaculture education, and develop jobs. Okaloosa County’s three airports have another significant effect on the regional economy.

Destin-Fort Walton Beach Airport (VPS) is a joint-use facility established on Eglin Flying force Base in 1957. The five chosen Okaloosa County Commissioners are devoted to linking our neighborhoods and offering essential services, public safety, and quality of life for future generations.

Okaloosa County Office Functions

The Okaloosa County home appraiser is accountable for finding, locating, and fairly valuing all property within Okaloosa County. The function of assessing the taxable value is done at market worth, which someone will spend for your property’s existing state.

To get questions addressed about your Appraisal, discover a residential or commercial property appraiser, or appeal a choice made by a property appraiser in Okaloosa County. We take pleasure in providing information for the Okaloosa County home appraiser is accurate. However, you can contact us, and we’ll do our best to update it.

Find Real Estate Appraisal and Closing services in every County in Florida, consisting of Appraisal and title services, are in every County in Florida. Make one call by choosing ASI and get your files finished rapidly and accurately. Why do residential or commercial property requirements for evaluation?

Therefore, Florida requires the Okaloosa County Home Appraiser to assess all homes within its jurisdiction so that a market worth can attach to that home. And there will be no undervaluing or overvaluing throughout purchasing or selling.

Okaloosa is a great county like Osceola County, Orange County, and Nassau County. They also have a property appraiser that can help you with your properties.

FAQ

How to contact Okaloosa County Property

You can contact them at the following address:

County Name: Okaloosa County Property Appraiser

Postal Address: 73 Eglin Parkway NE

On Suite 202, Fort Walton Beach,

Florida 32548

Phone: (850) 651-7240

Fax: (850) 651-7244

Time Zone: Central

Website: 181,460

Location: 936 sq

What is Okaloosa County, PA?

The Okaloosa County Home Appraiser is responsible for assessing all homes within Florida’s jurisdiction so that a market worth can be attached to the home. This assessment protects properties from undervaluing or overvaluing throughout purchasing or selling.

Conclusion

Likewise, you can visit our site and go through the often asked questions (Frequently asked questions). If you are not satisfied, call the Okaloosa Home Appraiser’s office and fix a consultation. Okaloosa County Title Business – Okaloosa County Florida Residential Or Commercial Property Appraiser.

We use cutting-edge software applications at our Okaloosa County title business, which help us close title cases with double the speed. The County strives to improve the services they offer to the public. The County appraiser is open to anyone’s comments that can assist in improving their operations. “Serving you is a pleasure,” Says Busbee. Any observations regarding this post are welcome in the comment box below.