Do you have a property in Osceola County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Osceola County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Osceola County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Osceola County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Osceola County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Osceola Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Search

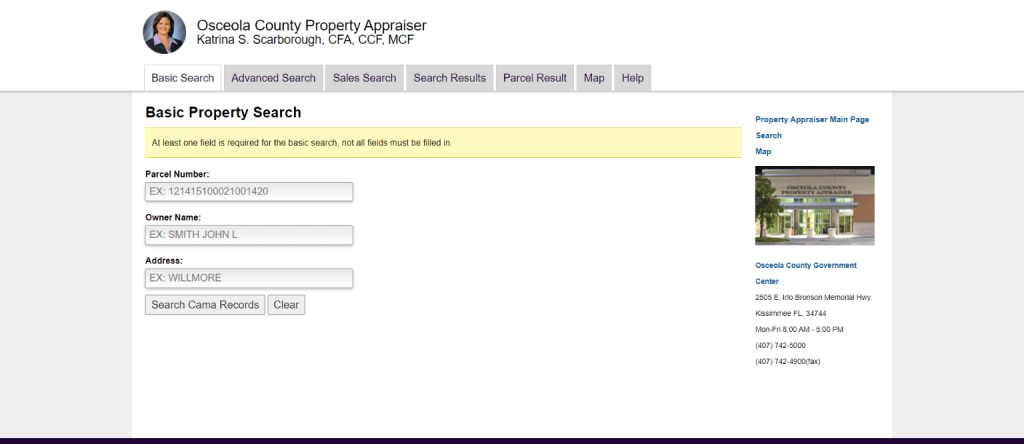

Go to Search, and from the drop-down menu, choose Property Records Search.

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Osceola County Property Appraiser’s Office Contact

Email

[email protected]

Address

Property Appraiser’s Office

2505 E Irlo Bronson Memorial Hwy

Kissimmee, FL 34744

Phone

407-742-5000

Other sections of the Property Appraiser Website

Apart from letting you search properties, the Osceola County property appraiser’s website also offers you other information about the office of the Osceola County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

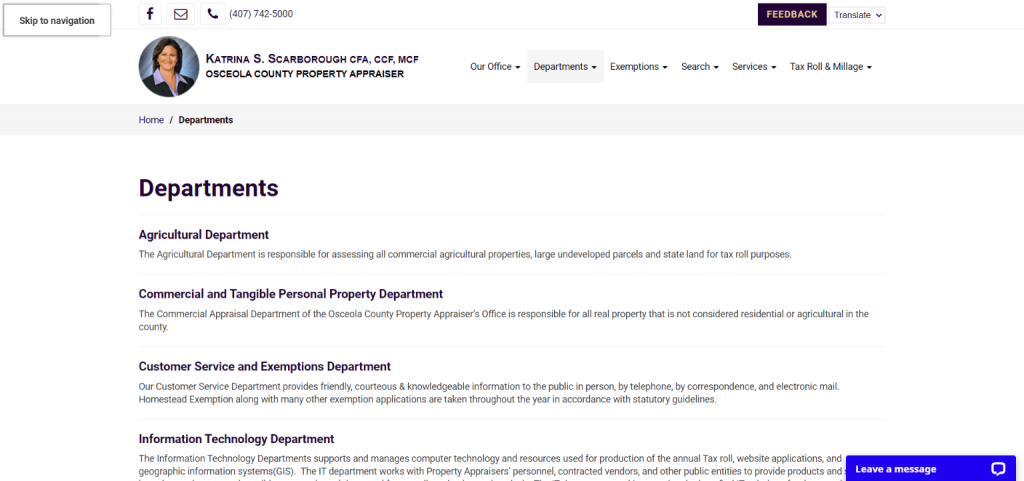

Departments

This page offers you information about the different departments of the property appraiser’s office. Such departments include the Agricultural Department, Commercial and Tangible Personal Property Department, Land Records and GIS Department, Residential Department, and Tax Roll Department.

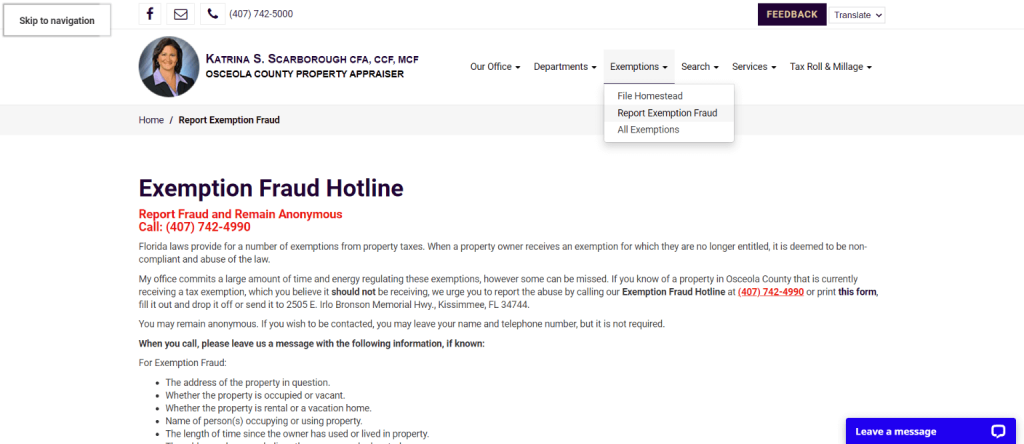

Exemptions

This section allows you to file homestead exemption or report exemption fraud. It gives you also all information you need about exemptions.

Search

This section gives a chance to do various searches. you can do a basic search of the property, advanced search, sales search, parcel result, and map search.

Services

From this section, you can download pdf forms or fill out online forms for your requests on the following: address change, customer payment processing, split-merge request, and tax estimator.

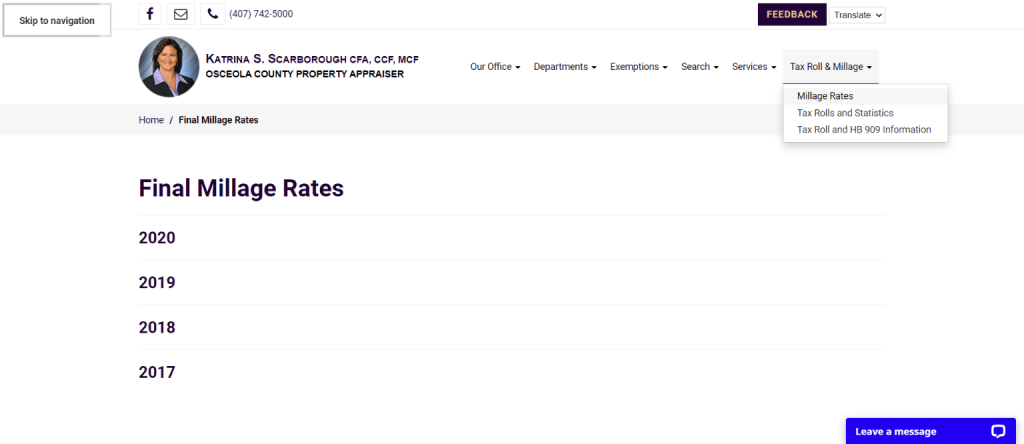

Tax Roll and Millage

This section gives you reports of the final millage rates per year along with tax roll information and statistics.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Osceola County Property Appraiser’s Office, Website, Map, Search Content

Property Appraiser for Osceola County aims for the transparency of their office. An elected County officer is a Property Appraiser established through Article VII of the State of Florida’s Constitution. If you want to find out more about other appraisers, check out Property Appraisers.

Together with Osceola County Property Appraiser website, they expect to research all the properties in the County of Osceola and file for Tax Saving Exemptions. The feedback you will leave to them is highly appreciated as it will help them improve their services.

All About Property Search

The parcel and map records of Osceola County Property Appraiser are for property tax purposes only. The information was compiled from the most accurate source of data from the county of Osceola’s public records. The data collected was collected for the purpose and use to create a Property Tax Roll as per Florida law and must be accepted and use with understanding.

Thus, the website’s information must not rely on a substitute for a title search for reference purposes only. Osceola County PA assumes that the office has no responsibility for any misuse of the information contained or lost from there. The site users must consider all the risks and liability when accessing a third-party website linked to their site.

Review Location and contact information

Osceola County PA’s office is available through email, telephone, or you can come and visit their office at 2505 E Irlo Bronson Memorial Hwy, Kissimmee, FL 34744. You can also set an appointment with them through their contact number– 407-742-5000. One of the customer service members will direct you to which department you can inquire about your concerns.

You can come and visit OCPA’s office during office hours 8:00 AM- 5:00 PM, Monday to Friday except on particular County holidays. Their email is [email protected].

You can also read these other related articles: Sumter County Property Appraiser, St Lucie County Property Appraiser, Escambia County Property Appraiser.

Access Homestead Exemption

Each of the homestead and portability situations can be distinctive. To advise on your exemption position, you can contact Osceola County PA at (407) 742-5000.

Under Florida law, every person of legal or equitable title to a real estate maintains it as his permanent residence to receive up to $50,000 of homestead property exemption. A partial exemption may vary if the applicant has a less than 100% of ownership.

As you accumulate your property as your permanent home or your legal/natural dependent’s permanent home, as of the 1st of January, you are entitled to a homestead exemption. According to the law, on the 1st of January of every year, the date to which your permanent residence is determined.

What’s new about property appraisers? You can check out other articles about Sumter County Property Appraiser, Walton County Property Appraiser, Citrus County Property Appraiser, and Orlando County Property Appraiser.

Review Exemptions Department and Customer Service

- Osceola County PA has a responsible Exemption Department to administer all the exemption matters, including the widow, widower, disability, homestead, limited income senior exemption, Veterans exemptions. The staff from this department review and create new applications to confirm the eligibility and assist in the additional exemptions for their taxpayers who qualified. There is also an investigation department to investigate allegations for improper exemptions.

- Customer Service Department provides courteous, knowledgeable, and friendly information to the public through telephone or in-person by electronic mail and correspondence. According to the statutory guidelines, Homestead exemption applications are taken all through the year along with many other exemptions.

FAQ

Who is Osceola County PA?

An elected County officer is a Property Appraiser established through Article VII of the State of Florida’s Constitution. Osceola County PA aims for the transparency of their office. Together with their website, they expect to research all the properties in the County of Osceola and file for Tax Saving Exemptions. The feedback you will leave to them is highly appreciated as it will help them improve their services.

How to contact Osceola County PA

You can set an appointment with Osceola County PA through their contact number– 407-742-5000. One of the customer service members will direct you to which department you can inquire about your concerns.

Where is Osceola County, PA, located?

Osceola County PA’s office is available through email, telephone, or you can come and visit their office at 2505 E Irlo Bronson Memorial Hwy, Kissimmee, FL 34744.

How to search for property in Osceola County, PA

The parcel and map records of Osceola County PA are for property tax purposes only. The information was compiled from the most accurate source of data from the county of Osceola’s public records. The data collected was collected for the purpose and use to create a Property Tax Roll as per Florida law. It must be accepted and use with understanding. Thus, the website’s information must not rely on a substitute for a title search for reference purposes only. Osceola County PA assumes that the office has no responsibility for any misuse of the information contained or loss from there. The site users must consider all the risks and liability when accessing a third-party website linked to their site.

Conclusion

OCPA ensures that the best customer service and the Exemptions Department are provided. Osceola County PA’s office is available through email, telephone, or you can come and visit their office at 2505 E Irlo Bronson Memorial Hwy, Kissimmee, FL 34744. You can also set an appointment with them through their contact number– 407-742-5000. One of the customer service members will direct you to which department you can inquire about your concerns.