Do you have a property in Sumter County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Sumter County Property Appraiser‘s office and the Sumter County Tax Assessors office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Sumter County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Sumter County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Sumter County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Sumter Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Record Search/GIS Maps

From the top menu, hover on Record Search/GIS Maps, and click on Property Record Search. Click on “Yes, I accept the above statement” after reading the statement.

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Sumter County Property Appraiser’s Office Contact

Address:

218 E McCollum Avenue

Bushnell, Florida 33513-6124

Phone

(352) 569-6800

Fax

(352) 569-6780

Other sections of the Property Appraiser Website

Apart from letting you search properties, the Sumter County property appraiser’s website also offers you other information about the office of the Sumter County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

General Info

This page offers the most basic information you need to know, like an overview of exemptions, how their tax works, and many more.

Tax & Exemptions

If you want to know the exemptions available, as well as taxes and tax discounts, then this page has you covered. Its information ranges from Disabled Veterans Homestead Property Tax Discount to Charter School Facilities Exemption.

Download Forms

As the name implies, this section is where you can download Exemption Forms, Agricultural / Classified Use Property Forms, Tangible Personal Property Forms, Value Adjustment Board Forms, and others.

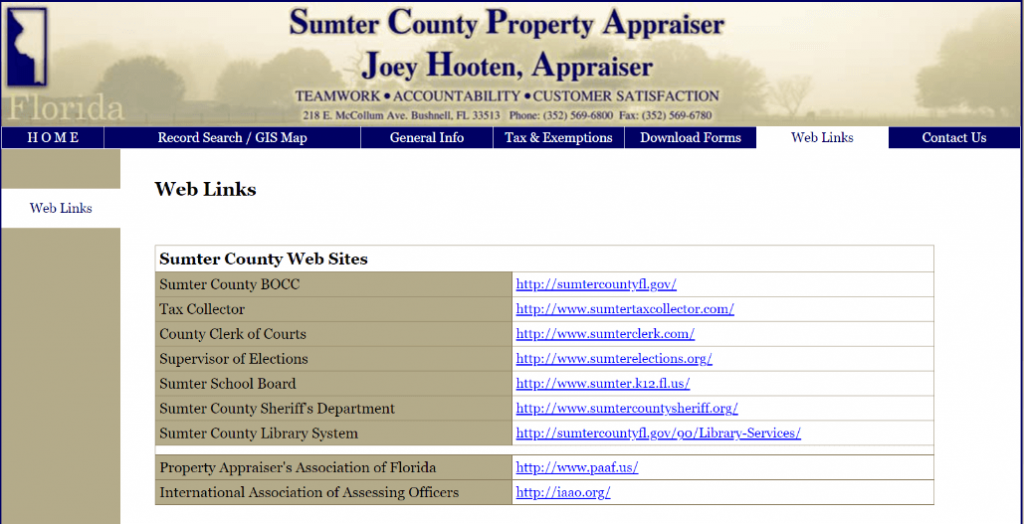

Web Links

This section gives you links to other government offices and other Sumter County offices that you might want to check out, especially for more information.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Sumter County Property Appraiser’s Office, Website, Map, Search Content

The Sumter County Property Appraiser is responsible for placing a reasonable and equitable market price on every parcel of the home, both real estate and tangible in our county. Many people think the Property Appraiser figures out the quantity of taxes a homeowner will pay, but this is not the case. Meanwhile, if you want to find the property appraiser closest to you, go to Property Appraisers.

The taxing authorities include the Board of County Commissioners, School Board, City Board; the Water Management District is responsible for setting all property tax rates. For that reason, the amount of taxes to be examined. Their goal is to serve the individuals of Sumter County with outstanding client service. The information consisted of herein will be routinely kept for your advantage.

There are lots of appraisers near Sumter County. Besides Sumter County Property Appraiser, you may also discover Lake County Property Appraiser, Lee County Property Appraiser, or Leon County Property Appraiser.

All About Sumter County Property Appraiser Taxes

The regional road network serves the whole county, stimulates financial development, produces tasks, and sets the phase for another long term of the low real estate tax in Central Florida. In addition to the facilities assistance, the county provides the foundational services for the cities that include safety assistance for all the schools, fire, and ambulance services as examples that will grow as the client base grows.

What’s the most significant misunderstanding about how this will impact my tax bill? The majority of homeowners got their Reality in Mileage notification from the Sumter County Home Appraiser’s Office. It shows each of the taxing authorities’ suggested boosts or declines, coupled with non-ad Valorem evaluations. In this notification, each taxing body’s actual effect is out, and, together, the general dollar portion effect is lower than some citizens are aware.

Real Estate Appraisal and Closing services are readily available in every county in Florida, consisting of We have offered some information you may find helpful below. ASI covers all 67 counties throughout Florida for your real estate appraisal and title needs. Use our online buying and tracking system to track your files.

Review Appraisal system

They utilize their office’s acknowledged appraisal system called Computer Assisted Mass Appraisal (CAMA) system. CAMA helps the Sumter County Florida Residential or commercial property Appraiser gather, store, and examine big data pieces. This data is essential to correctly evaluate each property’s rate under the jurisdiction of Sumter County Florida Home Appraiser.

The Sumter County Florida Residential or commercial property Appraisal staff assists him/her to evaluate and comprehend the property market in the county and, therefore, correctly come up with a reasonable rate for your realty. The Florida State law mandates that Sumter Home Appraisals need to be done at least one time in a three-year time window.

They likewise determine if any modifications or adjustments to a home; And the condition of the property. All this info participates in the CAMA and the after computing; the ideal home worth identified by the Sumter County Fl Property Appraiser.

Review Homestead Exemptions

These exemptions apply to the marketplace worth of the appraised property. The most common exception is Homestead. This exemption offers a $50,000 rebate to the assessed worth of the property. Hence, decreasing the relevant taxes for any year. The Sumter County Residential Or Commercial Property Appraiser has the authority to select the applications. And permit exemption to some of those who have used it.

Cap and exemption are eliminated at the end of the fiscal year if the residential or commercial property sells. Taxes determined on the full Just/Market Value. The residential or commercial property will benefit from the new owner’s Homestead Exemption constraints in the second year.

Do you want to find other appraisers? We also have Gulf County Property Appraiser, Wakulla County Property Appraiser, and Bay County Property Appraiser for your reference.

Review Taxable value exemptions

Determine Taxes on the Full Market Value. The residential or commercial property will benefit from the Save Our Homes Cap’s constraints in the second year of the new owner’s Homestead Exemption.

When identifying Taxable Value, exemptions subtracted from the Evaluated Worth to reach a Taxable Value. The annual Millage Rate then increases the Taxable worth to determine the amount of tax due. Modification in homeownership will effectively “reset” the Capped Value to full market worth. It is essential to understand that real estate tax will increase next year as the examined worth must change to equate to the actual market price.

Remember Sumter County Property Appraiser Branches

Sumter County has five branches serving its community and a Lake-Sumter State College school library that is open to the public. Bushnell Public Library E.C. Rowell Public Library Panasoffkee Community Library Villages Town Library (Gazebo) Towns Public Library (Pinellas Plaza) Lake-Sumter State College Library (Sumterville) The Sumter County Library Providers began servicing the Wahoo, Center Hill, Linden, Croom-A-Coochie locations through the county’s Library on Wheels program in 2008. ^ The Villages Charter Schools.

The other starts at SR 44 in Wildwood, west of Exit 329 on I-75, and crosses the Marion County line towards Ocala. County Roadway 466-A: County Roadway 466: County Roadway 462: County Roadway 476-B: The Sumter County Chamber of Commerce, the cities of Webster and Bushnell, Sumter County government, organizations, community leaders, veterans’ groups, and people worked to have 62 miles of roadway in Sumter County designated by the state of Florida as a Florida Scenic Byway. Sumter County operates Sumter District Schools runs district public and personal schools in Sumter County.

Besides Sumter County Property Appraiser, you may also read about Manatee County Property Appraiser, Charlotte County Property Appraiser, and Flagler County Property Appraiser to assist you with taxable value exemptions.

FAQ

Who is Sumter County, PA?

He is the person responsible for placing a reasonable and equitable market price on every parcel of a home, both in real estate and tangible property in the county.

How much can homestead taxes go up each year?

The proposed Tax increment for 2019-2020 is 24%, which is the highest percentage ever and angering many homeowners.

How to identify taxable value in Sumter County Property Appraiser?

When identifying Taxable Value, exemptions subtracted from the Evaluated Worth to reach a Taxable Value. The annual Millage Rate then increases the Taxable worth to determine the amount of tax due.

Conclusion

The residential or commercial property benefits from the constraints of the Save Our Homes Cap. Which happens in the second year of the new owner’s Homestead Exemption. Suppose additions or enhancements to the residential or commercial property, the worth of those improvements will count. You can write your feedback, questions, or experience on Sumter County PA in the comment box below.