Do you have a property in Hillsborough County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Hillsborough County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Hillsborough County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Hillsborough County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Hillsborough County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Hillsborough Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Property Search

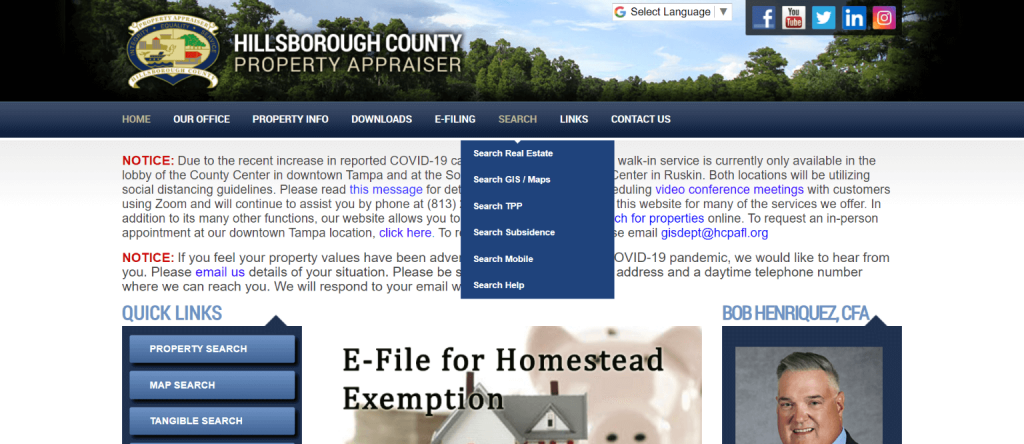

On the Quick Links, choose Property Search, or you can click on “Search.” Then click “Search Real Estate.” Another set of drop-down menu will appear, choose “Basic Search.”

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Hillsborough County Property Appraiser’s Office Contact

Email

[email protected]

Address

15th Floor County Center

601 E. Kennedy Boulevard

Tampa, Florida 33602-4932

Phone

(813) 272-6100

Fax

(813) 272-5519

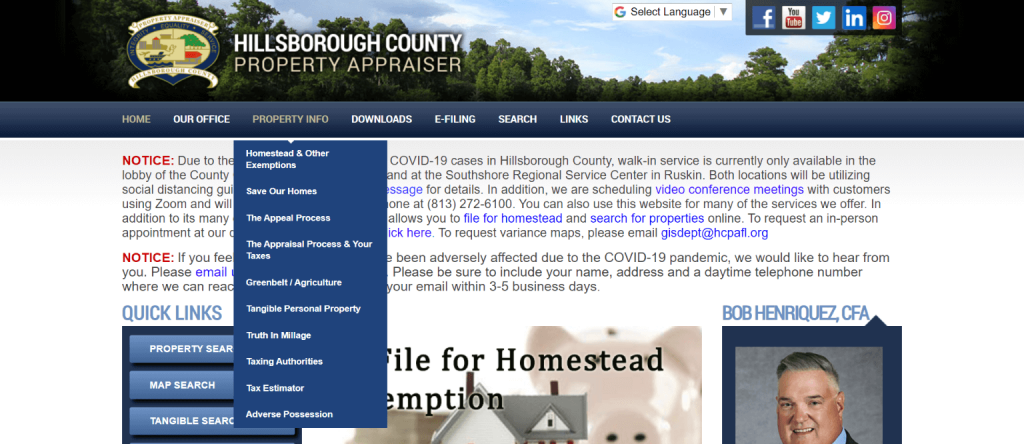

Other sections of the Property Appraiser Website

Apart from letting you search properties, the Hillsborough County property appraiser’s website also offers you other information about the office of the Hillsborough County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

Our Office

Homestead & Other Exemptions, Save Our Homes, The Appeal Process, The Appraisal Process, and Your Taxes, Greenbelt/Agriculture, Tangible Personal Property, Truth in Millage, Taxing Authorities, Tax Estimator, Adverse Possession

Property Info

This section gives your various information about properties, from taxes, millage, to tangible personal properties. There is also a tax estimator, should you want to get an idea of how much your property would be taxed.

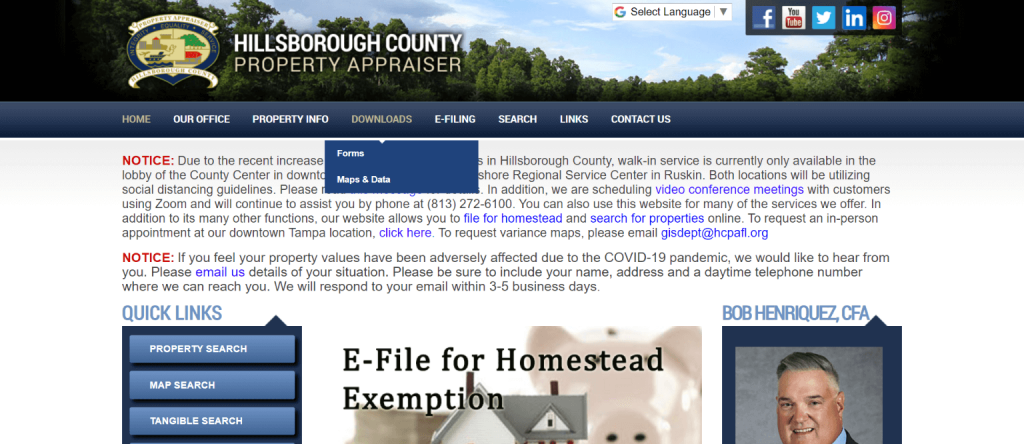

Downloads

This section contains every form you would need to fill out relating to your property. You may also download maps and some other pertinent data.

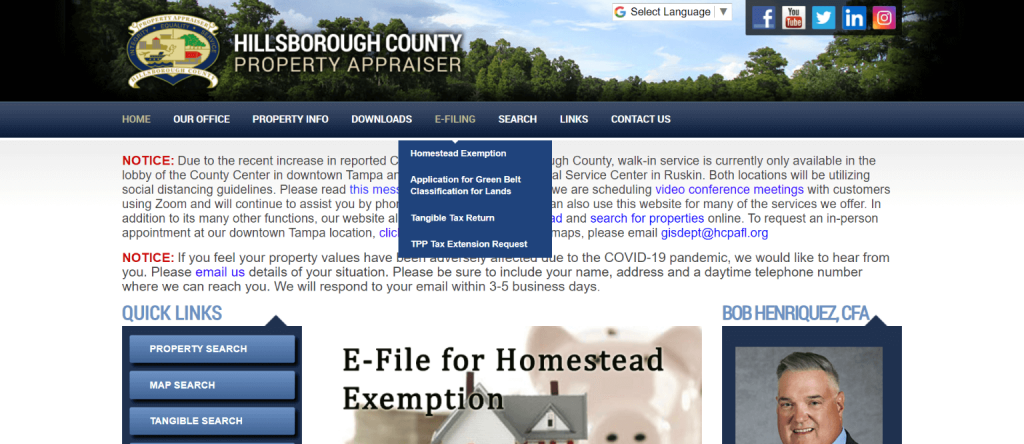

E-Filing

You may file Homestead Exemption, apply for Green Belt Classification and Lands, file Tangible Tax Return, request TPP Tax Extension online through this link.

Search

Should you want to search for a property value, a property for sale, or even maps, this section is where you can go. Its subsection includes Search Real Estate, Search GIS/Maps, Search TPP, Search Subsidence, Search Mobile, Search Help

Links

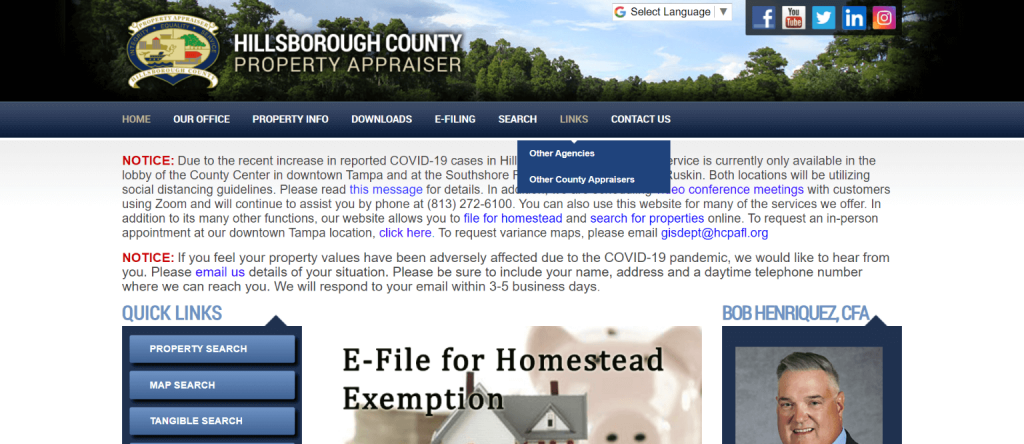

This section lets you reach out to other government agencies and offices within Hillsborough and in other counties.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Hillsborough County Property Appraiser’s Office, Website, Map, Search Content

Property Appraiser for Hillsborough County, what is it, and what do they do? Many individuals believe the residential or commercial property appraiser identifies the amount of taxes each residential or commercial property owner pays; in truth, the title “Property Appraiser” explains everything. In this article, you will get to know more about Property Appraisers. Meanwhile, for more information about other appraisers, visit Property Appraisers.

Note that a residential or commercial Hillsborough County PA and its staff are charged with putting a reasonable and just worth on each private home in Hillsborough County. The role of setting the quantity of taxes to be paid as an outcome of the assessed worth of a residential or commercial property is that of the various taxing authorities, including the County Commission, School Board, local municipalities, and Tampa Port Authority.

Besides Hillborough County, you can also check out other property appraisers from Indian River County, Escambia County, Levy County, and Flagler County.

All About Hillsborough County PA

The worth of property fluctuates due to numerous elements. Elements influencing value include home use, the size and condition of enhancements on the site, and the regional real estate market. The Florida Constitution needs our workplace to examine homes based upon their market price. A straightforward meaning of market value is the typical price a willing purchaser would pay to a ready seller.

It is vital to remember that the Residential or commercial property Appraiser does not produce worth. Individuals create worth by purchasing and offering property outdoors market location. The Home Appraiser has the legal duty to study those deals and assess your property accordingly. For many property types, our estimate of the market price is based on sales of comparable properties.

The expense approach is based on how much it would cost today to develop a parcel replacement structure. If your property is not brand-new, the appraiser also needs to estimate just how much value the building has lost with time (depreciation). The appraiser must likewise determine the worth of the land – without buildings or any improvements.

Review Homestead Exemption

Invite to the Hillsborough County PA’s online homestead exemption application. They are providing this application to make declare homestead exemption and other personal exemptions a little more practical for you, the property owner. If your name is not noted as the record owner, they provide a ‘New Owner’ section to complete.

The HCPA workplace should show the property ownership in your name to process your application. If you have recently closed your property, permit the Hillsborough County PA workplace 60 days from their closing to prepare the deed and ownership change. When the March 1st deadline is near, come into their office to file face to face.

To print your invoice, you need to have Adobe Reader. If additional info is required to finish your application, a kind will also print at the end of the application process, noting any extra items needed. At the end of your request, if you give your e-mail address, a courtesy e-mail will be sent out as confirmation that you completed and submitted the application.

If you do not want to utilize the online application, you may finish the printable form. Fax (813-276-8946) mail or bring the form to any of their five offices on or before March 1. If you have any concerns about declaring real estate tax exemptions, contact their office at 813-272-6100.

If a residential or commercial property owner fails to inform the Property Appraiser and identifies that the owner was not entitled to get Homestead Exemption, the property shall be subject to a lien for the excused taxes within the prior ten years, plus 50% penalties and 15% interest.

Read more about other related appraisers: Orlando Property Appraiser, Indian River County Property Appraiser, Columbia County Property Appraiser.

Locations and Contact number

- Downtown Tampa– 15th Floor County Center, 601 E. Kennedy Boulevard Tampa, Florida 33602-4932 Phone: (813) 272-6100 Fax: (813) 272-5519

- Brandon– 311 Pauls Drive, Brandon, Florida 33511 (Across from the Post Office) Phone: (813) 272-6100 Fax: (813) 635-8036

- Plant city– 307 N. Michigan Avenue, 2nd Floor – Suite 230 Plant City, Florida 33563-3400 Phone: (813) 272-6100 Fax: (813) 757-3877

- South county– Southshore Regional Service Center, 410 30th St SE Ruskin, Florida 33570 Phone: (813) 272-6100 Fax: (813) 672-7835

- Northwest county– Westgate Plaza Shopping Center, 12082 Anderson Road Tampa, Florida 33625-5682 Phone: (813) 272-6100 Fax: (813) 264-2946

FAQ

How to download mailing labels from HCPA property search?

At the website of HCPA, you will see options at the top part of the page. Click ‘Download’> Forms. As you choose the form you need to download, you will proceed to the form you need to fill up, and the mailing labels have already been attached to the forms.

Which number is the tax id number on the HCPA website?

Visit or call the Hillsborough County PA office through the given address and contact numbers on their website. Give the clerk the exact address of the property as needed then, ask for the tax parcel number.

When does HCPA update records?

Hillsborough County PA records are updated as soon as new information is received. Assessed values viewed on their site and at their office are a work in progress as always. The true assessed value in any given tax year is reflected on the final certified tax roll only.

Conclusion

The Home Appraiser has the legal duty to study those deals and assess your property accordingly. The HCPA workplace should show the property ownership in your name to process your application. If you have any concerns about declaring real estate tax exemptions, contact their office at 813-272-6100.

How do you find this article about Hillsborough County, PA? We encourage you to share your opinion by leaving a comment below.