Do you have a property in Monroe County that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Monroe County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Monroe County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Monroe County Property Appraiser Website

Meanwhile, for a more detailed search about your property, visiting the Monroe County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Monroe Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Property Search

To do a Monroe PA Property Search Property Search go to the left-hand menu and click on Property Search. This option would be first on the list.

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Monroe County Property Appraiser’s Office Contact

Address

500 Whitehead St.

Rear of Building

Key West, FL 33040

Phone

(305) 292-3420

Fax

(305) 292-3501

Other sections of the Property Appraiser Website

Apart from letting you search properties, the Monroe County property appraiser’s website also offers you other information about the office of the Monroe County Property Appraiser offers. Here’s a quick list of what you’ll find on the website. From this page, you can also do internet applications or reports as well as mapping applications. You can also check for Monroe County Real Property Tax Services.

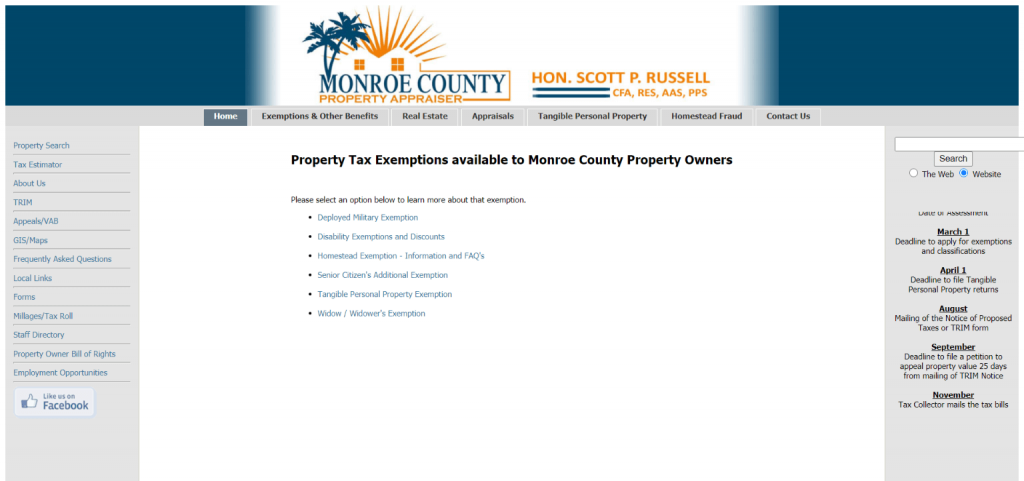

Exemption & Other Benefits

If you want to know the exemptions available in Monroe County, then this section has you covered. It gives you data on exemptions involving the following: Deployed Military, Disability Exemptions and Discounts, Homestead, Senior Citizen’s Additional, Tangible Personal Property, and Widow/Widower’s Exemption.

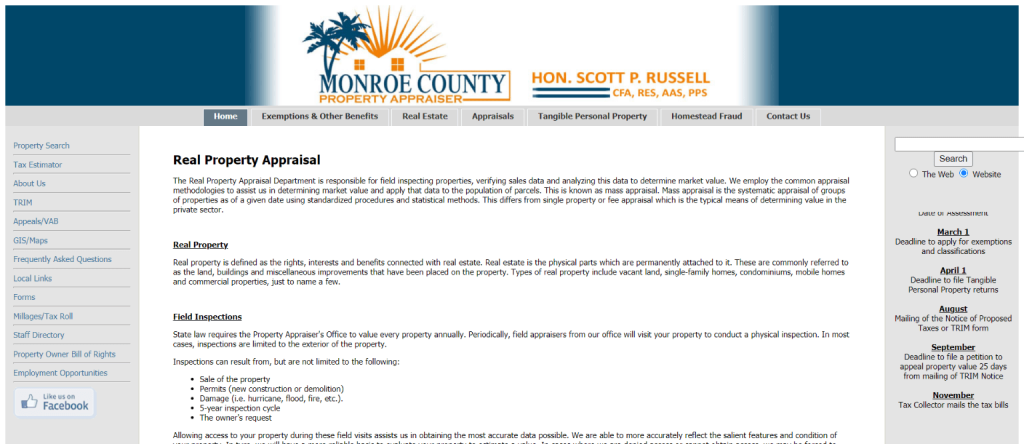

Appraisals

This section answers your questions about appraisals and the appraisal department. It helps you understand the processes of sales verification and field inspection among others.

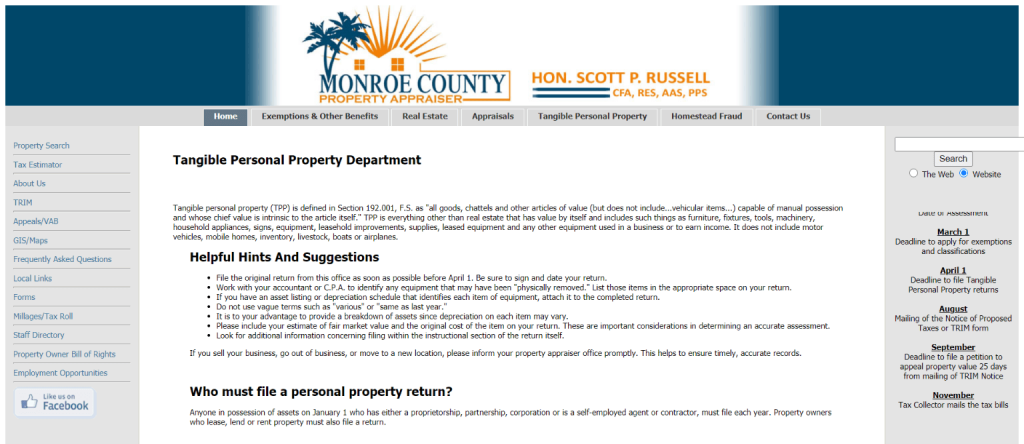

Tangible Personal Property

This page will answer all your questions about tangible personal property. It also provides helpful hints and suggestions.

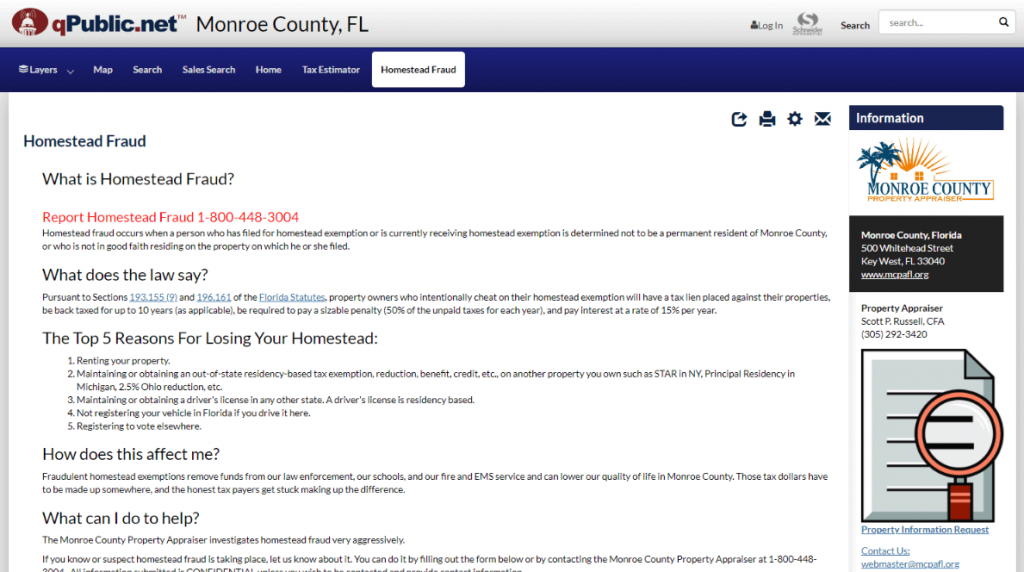

Homestead Fraud

This section explains homestead exemption and homestead fraud. You can also report suspected homestead fraud through this page.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Monroe County Property Appraiser’s Office, Website, Map, Search Content

Property Appraiser for Monroe County welcomes you to our guide. This page gives the taxpayer information to understand residential or commercial property assessments better. Their friendly office personnel is efficient and experienced. You may also read and checkout the Property Appraiser‘s website.

They continuously offer and assist the taxpayer with concerns concerning their evaluation. You are welcome anytime to drop by the office at the JP Kennedy Structure Courthouse Annex. Meanwhile, are you looking for a property appraiser near you? Visit Property Appraisers for more appraisers.

The County employees strive to precisely appraise worths as mandated by the State of Tennessee and its General Assembly. Their mission is to accurately recognize, assess, and list all taxable residential or commercial properties, to achieve reasonable and equitable values.

Article II Section 28 of the Tennessee Constitution states: ” all real estate, personal or combined shall undergo taxation” The Property tax dollars are in use to better the city, county, and state governments. The funds build roadways, parks, fire and cops defense, public schools, and many other regional services.

Other than Monroe County Property Appraiser, you can read other property appraiser near your place. Such appraisers are from Gulf County, Charlotte County, or Highlands County.

All About Monroe County PA

The Monroe County PA, Scott P. Russell, supplies Real estate Dates and associated mapping information as a service to residents and facilities. The information is only for awareness functions. The general public information herein furnished as a service by Monroe County Real Property Tax Providers. Home and tax information is readily available for the towns in Monroe County, New York.

Home assessment information might change throughout the year however does not end up being last for taxing functions till the official filing of the Town Final Assessment Roll on or about July 1. The amount of overdue tax represents delinquent County or town taxes, which could include unpaid school or village taxes from previous years and owed to Monroe County, New York.

Review Tax Relief Programs for Seniors and Handicapped

For questions relating to these programs, please contact the Gloucester County Assessors Workplace straight at (856) 307-6445. Annual Residential Or Commercial Property Tax Deduction for Senior People and Disabled Persons. Make these Applications for a Yearly deduction of approximately $250 from home taxes for property owners. Their age should be 65 or older or handicapped who fulfill individual earnings and residency requirements.

Individuals $ 250 Real Residential Or Commercial Property Tax Deduction Supplemental Earnings Type Yearly Reduction for Veterans Application Yearly reduction of approximately $250 from real estate tax for qualified war veterans and their enduring unmarried spouses/surviving civil union partners/surviving domestic partners. The local town administers this advantage.

Read more about other related appraisers: Leon County Property Appraiser, Hernando County Property Appraiser, St Johns County Property Appraiser

Access Geographic Information System

Users of this mapping application must consult the original public information sources for confirmation of the details contained in this application. While efforts are in play to utilize the most current and accurate information, Monroe County, New York, and their mapping and software application consultants assume no legal responsibility for the information contained in this Internet-based Geographic Info System (GIS).

The Monroe County, New York City, and their mapping and software experts supply this GIS information and metadata without any claims regarding the completeness, usefulness, or precision of its material, positional, or otherwise. Using and browsing of info on this website are at your own risk. Provision of this data and application or access to it, Monroe County, New York City, assumes no obligation to help the user in using such data. The advancement, use, or upkeep of any applications you apply or relate to the data or metadata is your responsibility.

FAQ

Who is Monroe County PA?

The Monroe County appraiser, Scott P. Russell, supplies Real estate Date and associated mapping information as a service to residents and facilities.

How much can homestead taxes go up each year?

When examining the brand-new assessed value, it is very important to understand that the previous examined value was based on 25% of your home’s market worth, while the new evaluated value is based upon 100% of your home’s value. For instance, if the marketplace worth of your residential or commercial property was $100,000, the evaluated worth would have been $25,000 (25% of market price).

Where to ask for inquiries about the tax relief for seniors and handicapped program?

For questions relating to these programs, please contact the Gloucester County Assessors Workplace straight at (856) 307-6445.

Conclusion

The parcel information in Monroe County, New York Website should be used for general information purposes only and not to determine property borders. In numerous instances, parcels and other information layers do not align precisely with aerial photography. That is a more accurate data source. Take your time to visit the County office and get more information on the services available for you. Any questions regarding this post are welcome in the comment box below.