Do you have a property in Sarasota County, Florida that you wish to appraise? Are you curious about the property values in this county? This page gives you details on how to check your property values online and get in touch with the Sarasota County Property Appraiser‘s office. Meanwhile, if you’re interested in appraisers from other counties as well, visit Property Appraiser.

Check Sarasota County Property Value with Online Tools

Several online tools could help you check your property’s value easily and even allow you to track changes in your property’s value. Realtor.com would be one such tool.

Here’s how you can check your property’s value and get updates.

- Go to the website

Visit Realtor.com to check your property’s value or if you want to find other properties.

- Click Home Value

The site allows you to do various searches, so to make sure you are getting details about your property’s value, click on the Home Value option before encoding your property details.

- Type the address

Type in the address of your property in the search bar and hit Search. You’ll get an immediate estimate of the value of your property.

- Sign Up to Get Updates

Once the estimated value of your property appears, you will be given the option to sign up. If you want to get regular updates about your property and track changes in its value, it would be best to sign up.

Meanwhile, if it’s a commercial property that you want to check, you may visit Commercial Property Appraisal. They would gladly help with your property appraisal.

Important – If you need legal advice regarding your property, go to Nolo. It’s always a good idea to get a legal opinion (or even help) about your property, this won’t break your bank and can save a lot of time and money in the future.

Visit Sarasota County Property Appraiser Website

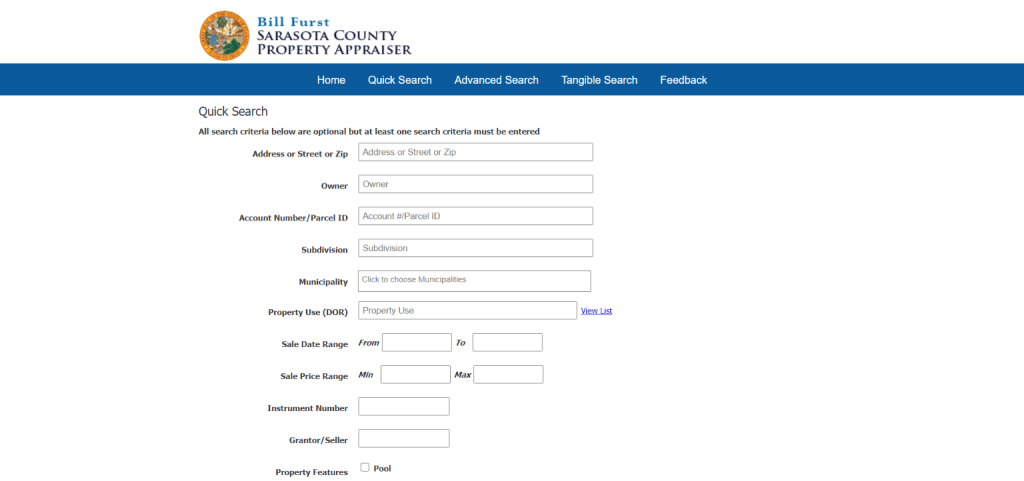

Meanwhile, for a more detailed search about your property, visiting the Sarasota County property appraiser would be a good idea, but checking out their website first would be even better. Here’s how you can check your property’s worth from the website.

- Go to Sarasota Property Appraiser’s Website

This website gives you an option to check your property’s value and find out other properties for sale.

- Go to Search

There will be a drop-down menu once you click or hover over this category. From the drop-down menu, choose Real Property Search.

- Fill out the form

Fill out the form the appears on the next page. You may search using any of the following information: owner’s name, location address, property I.D., neighborhood code. After encoding the necessary information, hit the search button.

- Choose what to do with the search result

The search result will contain a wide array of information, including the owner’s name, parcel I.D., property I.D., and of course, the value, among others. You have options to share, print, or download the content.

Sarasota County Property Appraiser’s Office Contact

Email

[email protected]

Address

2001 Adams Lane

Sarasota, FL 34237

Phone

941-861-8200

Fax

941-861-8260

Other sections of the Property Appraiser Website

Apart from letting you search properties, the Sarasota County, Florida property appraiser’s website also offers you other information about the office of the Sarasota County Property Appraiser offers. Here’s a quick list of what you’ll find on the website.

Search

Apart from searching for your appraised real property, you can also do a tangible property search and a map search. You can set an advanced search as well.

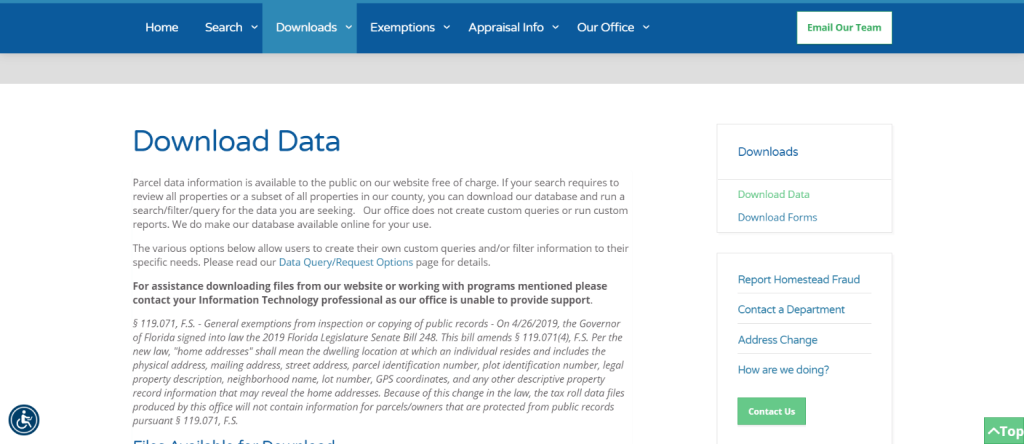

Downloads

From this section, you can download most of the forms you need like these for filing exemptions and other data like those of tax roll or millage rates.

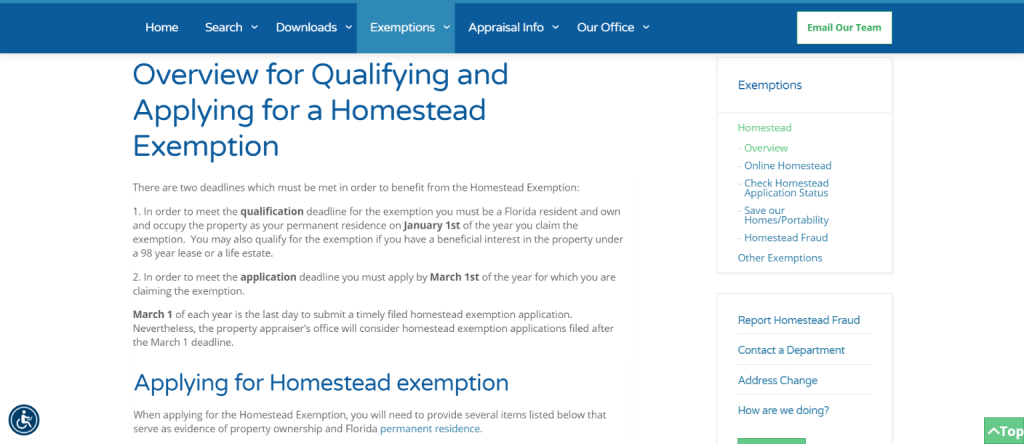

Exemptions

If you want to know the exemptions available in Seminole County, then this section has you covered. It gives you data on exemptions involving the following: Widow/Widower, Homestead Fraud, Homestead, Non-Profit, veterans, Conservation, Seniors, and Portability.

Appraisal Info

This page contains information about Sarasota County properties. You can access data about tangible personal property and even a tax estimator.

F.A.Qs

A tax roll is an official document or record of a property subject to property tax in a given jurisdiction.

The millage rate would be the amount of tax assessed for each $1,000 of property value. For example, a rate of 10 mills would mean that $10 in tax is levied for every $1,000 assessed value.

A homestead would refer to a house and the surrounding land owned by a family. Typically, the homestead would be a farmhouse, and the land around it devoted to crops or animals.

Sarasota County Property Appraiser’s Office, Website, Map, Search Content

Sarasota County PA was elected as a constitutional officer and is charged with determining the market value of all the tangible personal and real property in the County for the tax roll assessment purposes. They have a mission to prepare the accurate assessment roll and meet all legal requirements while advocating for equity and fairness in developing personal and real property values within Sarasota County. They also administer exemptions at their best services and ability. Meanwhile, you can read more about other property appraisers from Property Appraisers.

All About Sarasota County PA Website

It is your responsibility to inform the website if you move to another house. You must forward the bill to the new owner or return it to our workplace if you got a real estate tax expense for a residential or commercial property you no longer own. If you received an actual personal, tangible tax expense for the property you no longer own, however, you did own on January 1st of the year on the tax expense, you are still accountable for paying the tax.

The Sarasota County PA website is not accountable for the material of external sites. Creating discussions is not supported in Web Explorer versions 6, 7. We advise upgrading to the most recent Web Explorer, Google Chrome, or Firefox. If you are utilizing IE 8 or later on, ensure you switch off “Compatibility View.”

Are you located in Wakulla County? How about in Escambia County? We also have details about their property appraisers.

Review Homestead Exemption

A resident who receives the homestead exemption can likewise be eligible for the senior exemption, offering at least one property owner is 65 years of age or older. They satisfy the yearly household changed gross earnings limit. This exemption can be determined by calling the Sarasota County PA at (941) 861-8200.

In Florida, home taxes assess and gather on all real and concrete personal property within Sarasota County. They are responsible for values, assessments, and exemptions. The genuine estate tax costs are a combined notice of advertisement Valorem taxes and non-ad Valorem assessments. The concrete tax costs are solely an ad valorem tax.

Check out these other related articles: Pasco County Property Appraiser, Volusia County Property Appraiser, Brevard County Property Appraiser.

If the property owner pays through an escrow account, the home mortgage business demands are sent the tax bill; the owner will receive a copy of the notification. Homestead exemption is needed to pay within the 4% discount duration. The following discounts request early payment: 4% discount rate if paid in November. 3% discount rate if paid in December. 2% discount rate if paid in January. A 1% discount if paid in February. The due of the gross amount is by the 31st of March. Overdue taxes to end up being overdue on April 1st of the following year.

Review Paying Homestead Exemption

Failure to pay the real estate tax can result in the loss of residential or commercial property. You need to receive a different tax cost for each residential or commercial property you own and confirm the legal description is for all of your property. According to Florida law, the property owner must see that the bill received and taxes are paid.

Real Estate Tax Deduction for earnings taxes may be deductible on the federal tax return. If you detail your deductions, you may include the advertisement Valorem part of your costs; however, the non-ad Valorem assessments might not be deductible. You need to seek advice from your tax return preparer before the non-ad Valorem evaluations in your deductions.

Location and Contact Detail

There are two offices you can visit to submit your application in Sarasota County, PA. The main office is located at 2001 Adams Ln Sarasota, Florida 34237, the US, and the other one is at 4000 Tamiami Trail S Venice, Florida 34293, US. You can also contact them at (941) 861-8200.

FAQ

Who is Sarasota County, PA?

Constitutional officers such as the elected Sarasota County PA are responsible for determining the market value of all tangible personal and real property in the County for tax roll assessment purposes. They have a mission to prepare the accurate assessment roll and meet all legal requirements while advocating for equity and fairness in developing personal and real property values within Sarasota County. They also administer exemptions at their best services and ability.

How to contact Sarasota County PA?

There are two offices you can visit to submit your application in Sarasota County, PA. The main office is located at 2001 Adams Ln Sarasota, Florida 34237, the US, and the other one is at 4000 Tamiami Trail S Venice, Florida 34293, US. You can also contact them at (941) 861-8200.

I’ve been advised to contact Sarasota County Property Appraiser’s office and file for the continuation of the homestead exemption without reassessment. The homestead order is what you would show as proof of ownership (in lieu of a deed). What other documents does one need to provide in support of the application?